Building a Business Case for Medtech Transformation

Part 1: The “R” in ROI

Good investments produce a good return.

If you buy a house as an investment property, you expect its value to increase. You expect to receive income from renting it. To understand the return, you also have to understand the costs. How much will you pay for the house? How much will you spend up front to make it a desirable rental? What are the maintenance costs? Mortgage interest? Taxes?

The return is made up of the benefits—rent, future profit on eventually reselling the house—minus the costs. You also need to account for the time value of money. Future benefits and costs are worth less than immediate ones. That’s why, if you borrow money to make this investment, you have to pay interest to the banker on the loan.

Putting all this together gives you the return on investment or ROI.

It’s helpful to think of digital transformation investments in the same way. There’s a cost to “build” the asset and a cost to run and maintain it. There are tangible benefits you anticipate. You make the investment because you want to improve some things. You want to increase revenues, or profits. You want to improve speed to market. You want to reduce costs. Or eliminate risks.

But you can’t always directly look up the current costs of doing business or precisely forecast revenue gains or risk reduction. That’s because the things you want to improve are often complex and there are usually some unknowns involved.

So, understanding the ROI of a transformation requires a bit of measurement and a bit of analysis. It’s worth the effort to do this, because having a good business case is important to making sure your strategy—the things you’re trying to improve—is a good strategy.

Building a medtech business case

How should you go about building the business case?

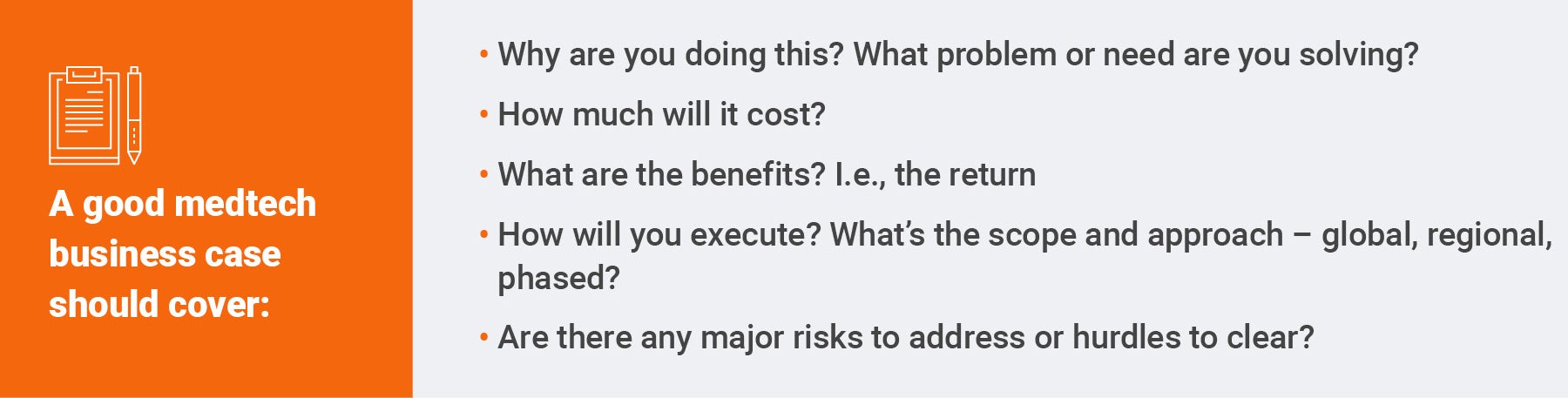

Medtech investments usually require senior management approval, so it’s important to articulate the why, what, and how in a clear and simple way.

This can all fit on one page. And it should. It’s good to have more detail on each of these points—for example a timeline graphic, or who the partners and team will be—but these details should follow the crisp summary.

The business case will help explain to senior leadership why this investment is the right one versus alternatives. There’s always competition for budgets and resources. Your strategy must stand out and be clearly articulated to get funded. It’s often helpful to explain what options you looked at and what the decision criteria were. The decision criteria usually are heavily weighted to financial benefit.

Even though there’s some analysis required, building the business case doesn’t need to be overly complex. By understanding the current state—for example the cycle time of a key process, or hours taken to complete key steps, or excess external contractor costs incurred due to inefficiencies—you can easily estimate current costs in resources or dollars.

Having metrics or key performance indicators (KPIs) is important. These baselines tell you how you’re doing today, so that when you work on a digital transformation, you can verify the improvements. That’s a business benefit.

If you’re coming from very manual environments—not uncommon in medtech—you might not have KPIs or baselines. In this case, it’s often possible to estimate them using a sampling or interviewing approach. Sometimes even this isn’t feasible. In that case, using industry benchmarks as future targets is a good approach.

The same goes for revenue growth. It’s okay to use good estimates to ground the business case. For example, you can use the anticipated revenue for a new product launch to estimate the revenue benefit of getting it to market weeks or months faster.

The advantages of cloud-native software

Traditionally, on-premise software is replaced every five to seven years. That’s like buying a house you can never maintain and have to rebuild all the time.

There’s a big investment advantage to cloud-native software as a service (SaaS) in this respect. There’s only one physical version of the software. There are multiple yearly releases that add features. New features create new benefits—like having periodic kitchen upgrades without extra cost. That’s a significant benefit.

Cloud-native SaaS also reduces risk, because it doesn’t promote the accumulation of technical debt and process debt. As well, older on-premise software always has hidden costs, like infrastructure hosting and excess customization. The Veeva Vault Platform, in particular, also has built-in compliance. This is critical for medtech, and it reduces both risk and cost.

In this context, it’s important to understand the difference between cloud-hosted and cloud-native, multi-tenant SaaS. Partners who are not cloud-native may represent these as the same, but they’re not. Cloud-hosted software is a lot like on-premise software, except that you are renting the hosting and infrastructure rather than maintaining your own data centers. This is helpful because it’s complex and expensive for industry to run data centers, but cloud-hosted software generally still has multiple versions. So, it doesn’t solve the problem of technical debt accumulation and version management.

Good cloud-native SaaS adapts as the business evolves. Because there’s only one version of the software, all the changes are available with each periodic release. That helps ensure the things you wanted to fix—your business case—continue getting better. That’s also why cloud native SaaS is a better way of powering digital transformations. It has a predictable cost structure with accelerating capabilities.

With standard packaging configuration and minimal customization, it’s faster and easier to implement industry standard best practices. Standard configurations also minimize the common problem of time and cost overruns that result from excess complexity.

All together these advantages make up a sound investment that produces a good return.