2025 Medtech Regulatory Affairs Benchmark

Navigating Efficiency, Data Quality, and Digital Transformation

Executive Summary

The 2025 Medtech Regulatory Affairs Benchmark reveals that many medtech companies lack confidence in their data’s completeness or accuracy and still rely heavily on manual processes to maintain compliance. This is largely underpinned by pervasive siloed processes, which make preparing regulatory submissions a resource-intensive endeavor.

The most critical challenges identified by regulatory professionals include the burden of heavy administrative tasks, gaps in digital tool proficiency, and the inherent complexity of adapting to continuous regulatory changes while consolidating disparate data platforms. These challenges collectively present clear opportunities for strategic investment in technology and comprehensive process optimization.

The 2025 survey findings also underscore a clear industry shift towards embracing unified regulatory information management (RIM) systems, data, and AI tools while developing robust integrations between existing solutions, which marks a big step forward from the 2023 survey results. This strategic move is driven by an organizational imperative to enhance data quality and cultivate a more robust, proactive regulatory function. To achieve this, organizations must prioritize automation, strengthen data governance, invest in programs that enhance skills for regulatory teams, and adopt advanced technologies. Such measures are essential for transforming regulatory operations from a reactive function into a highly efficient and data-driven strategic asset that enables the overall business.

Current State of Regulatory Operations: Efficiency and Confidence

An examination of current operational efficiency and confidence levels within regulatory affairs reveals a nuanced picture, characterized by reactive retrieval capabilities for specific information alongside lingering uncertainties regarding overall data completeness and organization.

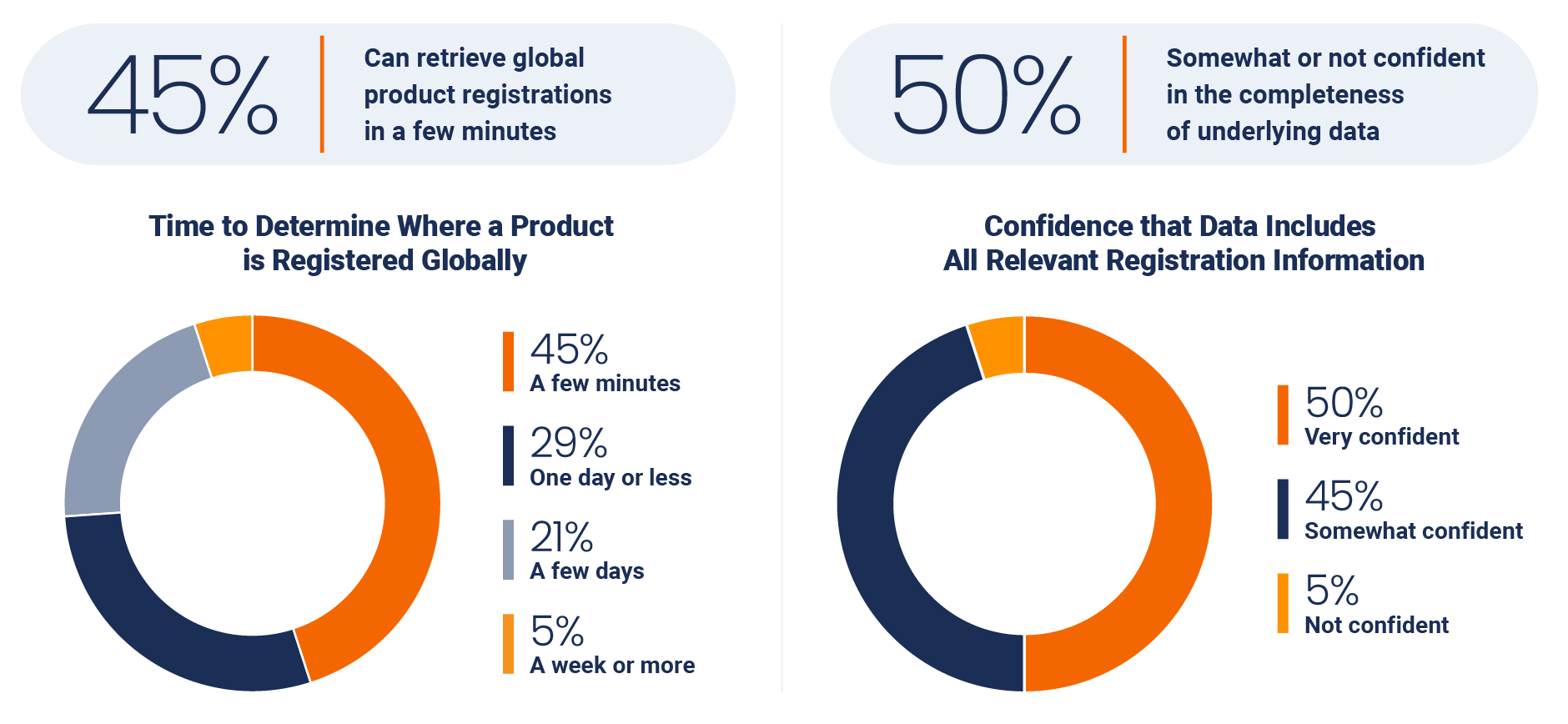

Identifying Global Product Registrations

One of the most daunting tasks for a regulatory team is identifying exactly where products are approved to be sold globally. About half of the respondents (45%) report that it takes just a few minutes to determine where products are registered globally, but only 50% are very confident in the completeness of their underlying data.

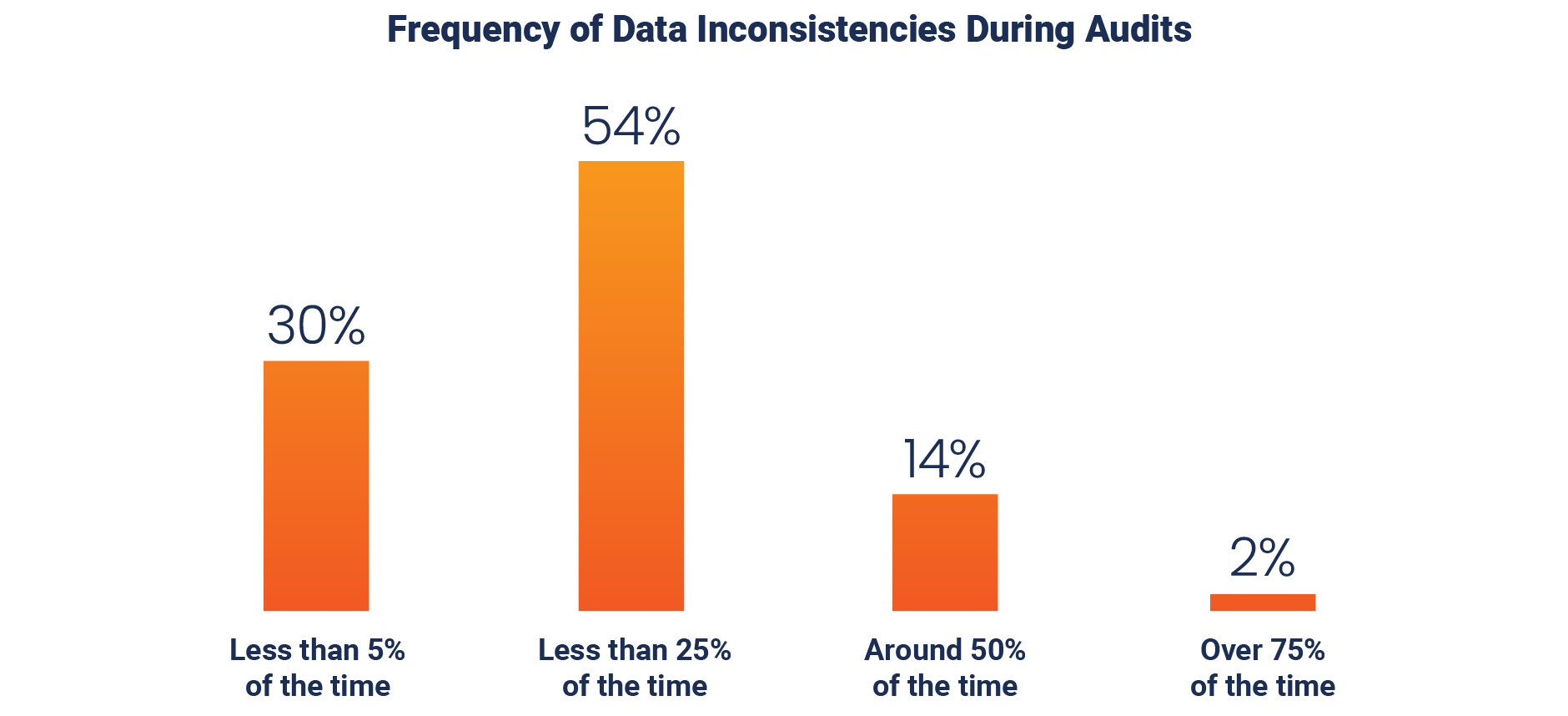

Similarly, during an audit, 68% of respondents indicate they could provide an auditor with a requested document within an hour, but only half (51%) are very confident that they could produce every relevant certificate.

Respondents also say that data inconsistencies can arise during audits, with seven out of ten respondents sharing that they happen more than 5% of the time.

This highlights potential problems with document organization and reveals that medtechs are largely still relying on manual lookup procedures for individual items. This can lead to serious compliance issues including audit findings and products being shipped where they shouldn’t. The lack of visibility also makes it difficult for regulatory teams to plan for future needs, especially when managing complex portfolios across multiple affiliates.

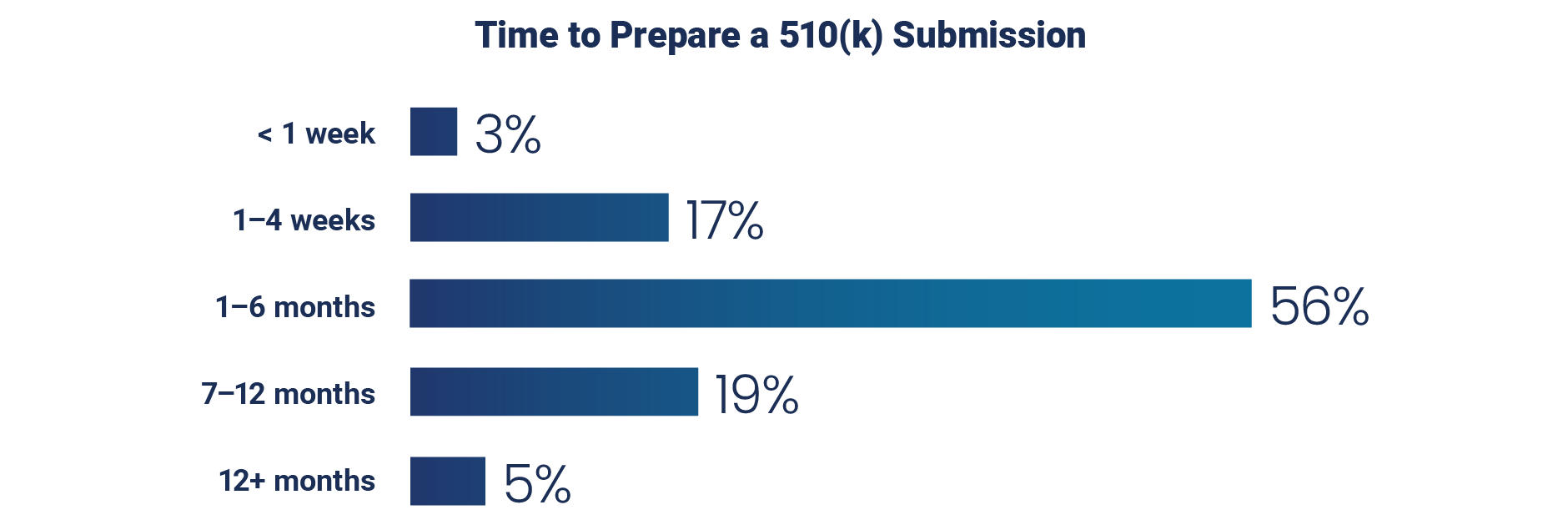

Preparing Submissions

Preparing a submission like a 510(k), from data gathering to internal approval, is a substantial undertaking for most organizations. The survey reveals that 80% of respondents take one month or longer to prepare a 510(k) submission and 24% take more than six months.

When it comes to organizing MDR data for submissions, the process can take twice as long as a 510(k). According to a 2024 survey by MedTech Europe, companies spend more than €3 million and up to 24 months on each MDR certification. Cutting down MDR and 510(k) submission timelines by a few weeks or months could generate significant cost and resource savings.1

While medtech organizations are fairly efficient in retrieving specific regulatory information when prompted, they aren’t confident in the overall completeness or proactive organization of their underlying data. This suggests that current systems are largely optimized for reactive lookups that enable quick responses to specific inquiries rather than for comprehensive, proactive data management.

Medtechs also struggle with fragmented data sources, a lack of standardized data entry protocols, or inadequate data governance. These data integrity issues impede strategic initiatives that demand a complete and accurate data landscape, such as the implementation of advanced analytics or AI solutions. Furthermore, these manual solutions aren’t sustainable and rely heavily on individuals, which could lead to burnout and make it difficult for companies to attract and maintain talent.

Operational Challenges and Gaps

The 2025 survey also confirms the prevalence of manual processes and a lack of visibility into performance across various regulatory functions.

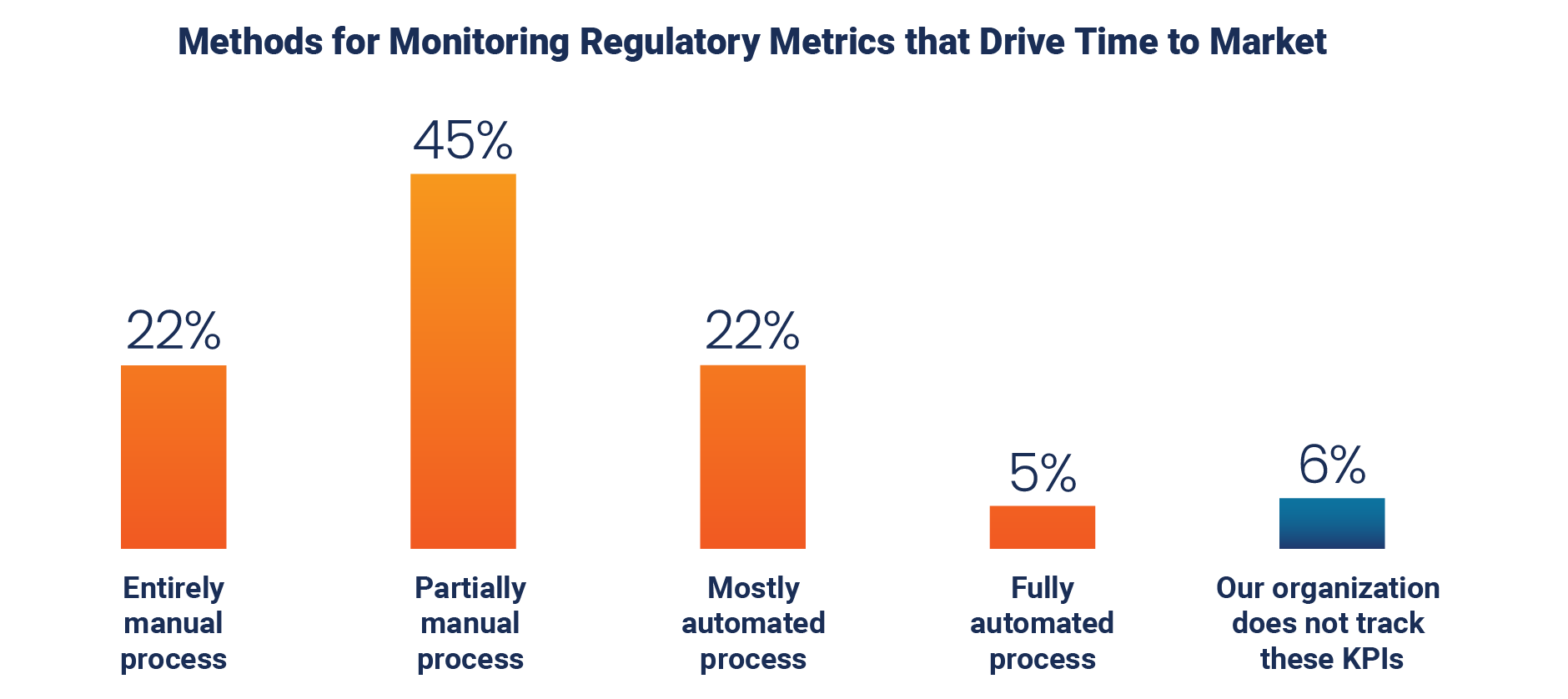

Manual vs. Automated Processes for Metrics Monitoring

A substantial majority of organizations rely on entirely manual (22%) or partially manual (45%) processes for monitoring regulatory affairs metrics. Only a small fraction (5%) report having fully automated processes in place, and a notable 6% do not track these key performance indicators (KPIs) at all.

Similarly, 11% report that they aren’t actively tracking estimated regulatory workload.

If they were to implement and automate these measurements, respondents say the top three metrics that would most improve process effectiveness are:

- Time reduction for managing regulatory processes, including renewals

- Percentage of submissions completed right the first time

- Time to close regulatory commitments related to product changes

Without these metrics in place, it’s impossible to generate accurate, timely, and comprehensive performance insights. Medtechs may develop strategic blindspots and they won’t understand time-to-market bottlenecks or the precise workload distribution within their teams. This hinders effective resource planning, complicates the justification of investments in new technologies, and prevents a truly proactive approach to regulatory strategy. It also reinforces the perception that regulatory affairs is a cost center rather than a strategic enabler, perpetuating chronic underinvestment.

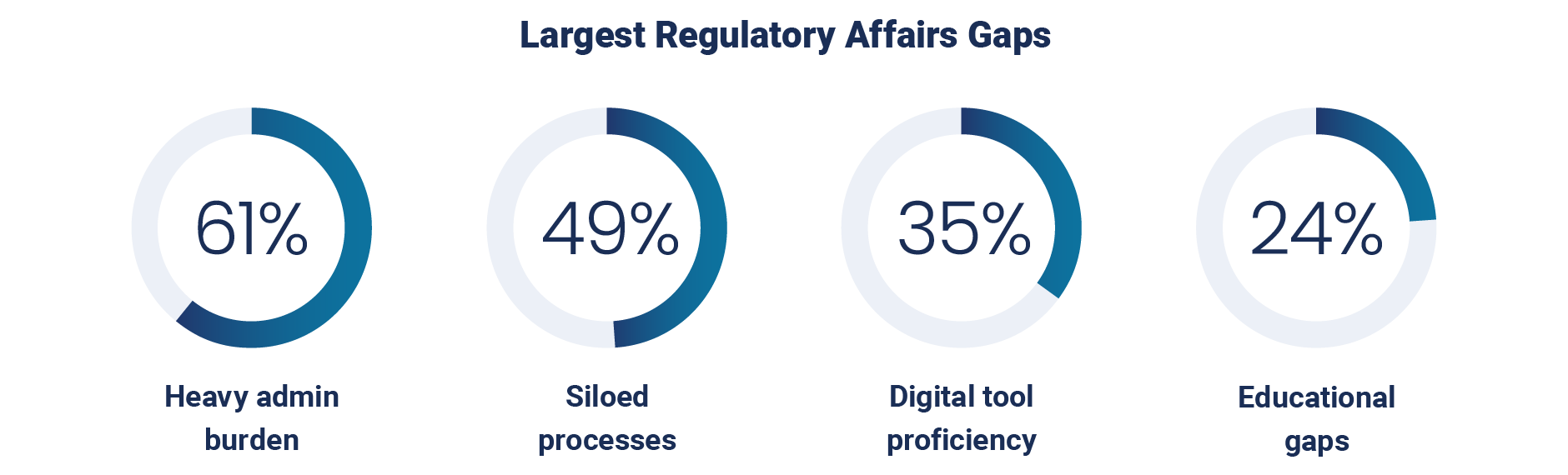

Largest Gaps in Regulatory Affairs Teams

In addition to insufficient metrics and tracking, respondents express that the most significant gaps in their regulatory affairs teams are heavy administrative burden (61%), siloed processes (49%), a lack of digital tool proficiency (35%), and educational gaps (24%).

This aligns closely with anticipated challenges over the next three to five years, which respondents say will include adapting to regulatory changes (39%), consolidating data across platforms (31%), and keeping data up to date (25%).

Without the necessary digital skills and modern tools, regulatory teams will continue to struggle with excessive administrative tasks and fragmented workflows that hinder seamless collaboration and data flow. This cycle also diverts valuable resources from more strategic activities such as regulatory intelligence, proactive compliance, and market strategy.

Future Outlook and Strategic Priorities

Looking ahead, regulatory professionals anticipate a dynamic environment, with clear intentions to adopt new tools and methodologies to address evolving challenges and enhance operational capabilities.

Regulatory Data Quality for AI Implementation

When asked to rate the quality of their regulatory data, specifically considering its importance for effective AI implementation, only 17% of respondents say their data quality is excellent, while the remainder categorize it as average or worse. This assessment suggests that while there is an understanding of the transformative potential of AI, the foundational data quality in many organizations currently falls short of the optimal requirements for successful and reliable AI deployment.

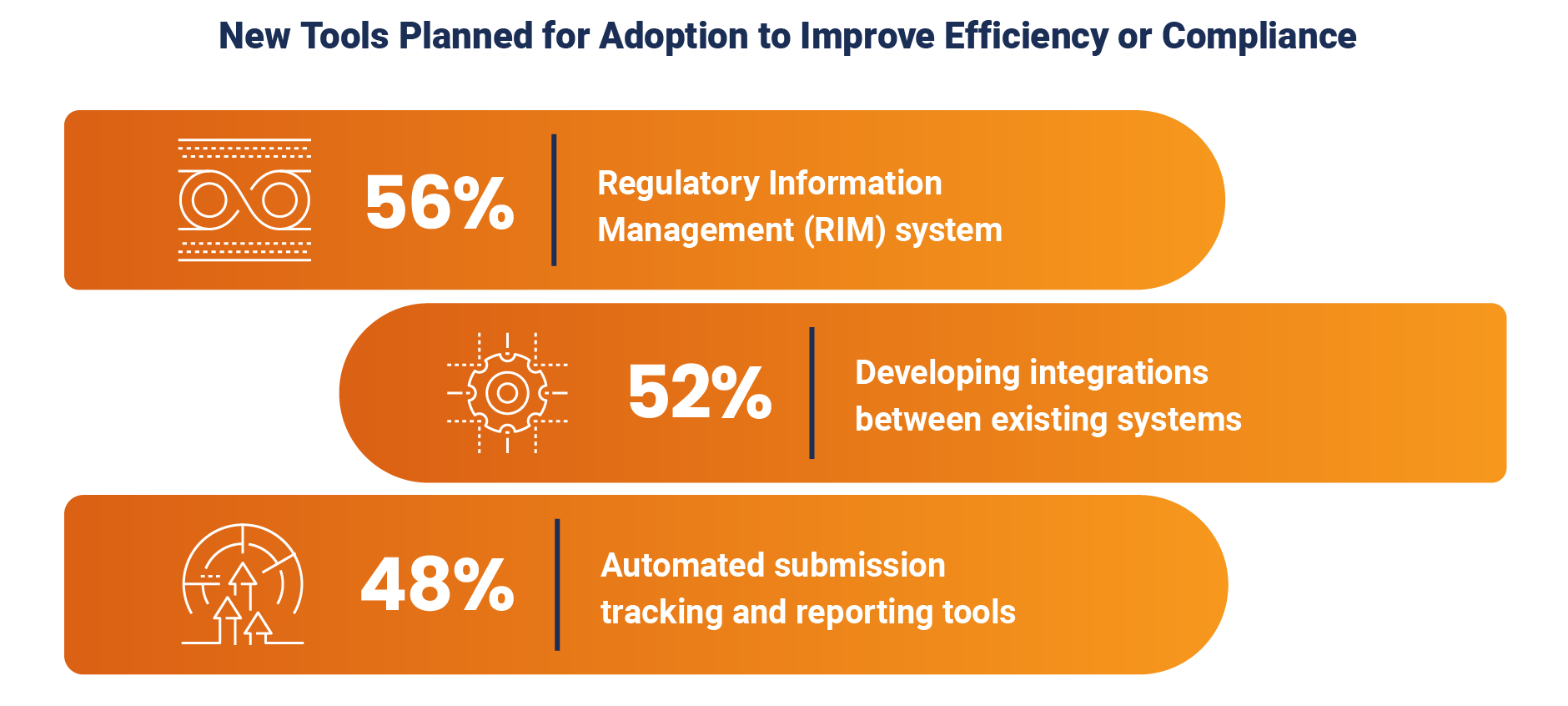

Planned Adoption of New Tools and Methodologies

In a clear evolution from 2023, 56% of respondents plan to adopt a RIM system compared to the 14% that reported having one in place just two years ago. About half of respondents (52%) are also looking to develop integrations between existing systems and 48% want to implement automated submission tracking and reporting tools. Respondents also share their interest in advanced technologies, with several mentions of generative AI for submissions.

The data signifies a clear strategic move towards more sophisticated technological solutions to address both current operational inefficiencies and anticipated future challenges as regulatory affairs teams are asked to do more with the same resources.

This includes the adoption of RIM solutions and enhanced system integrations, moving beyond reactive, ad-hoc manual fixes. Organizations also recognize that the increasing complexity of regulations and the need for a unified, accessible data view cannot be managed effectively with current manual or fragmented systems.

However, poor data quality will severely limit the accuracy, reliability, and overall utility of any AI application. Organizations interested in AI for regulatory affairs must therefore prioritize significant investments in data cleansing, standardization, and robust data governance frameworks before or in parallel with AI development. Failing to do so risks a “garbage in, garbage out” scenario, where incomplete or leads to unreliable outputs and undermines the potential benefits of AI. This could lead to costly, ineffective implementations and so should be a strategic consideration for any digital transformation roadmap.

Conclusion and Actionable Recommendations

The 2025 Medtech Regulatory Affairs Benchmark provides a compelling narrative of an industry in transition, grappling with the complexities of an evolving regulatory landscape and the demands for greater efficiency and data integrity. The findings coalesce around several overarching themes that dictate the strategic direction for regulatory affairs.

Overarching Themes

- The automation imperative: The survey data unequivocally points to a critical, unmet need for increased automation across regulatory operations. This is driven not merely by a desire for speed, but primarily by the need to alleviate heavy administrative burden, enhance data quality, and improve the overall reliability of regulatory processes. Manual efforts are consuming disproportionate resources, adding to job dissatisfaction, and indicating that automation is a fundamental solution to operational sustainability.

- Data as a strategic asset (and liability): While medtechs demonstrate the ability to retrieve specific data points quickly, a significant confidence gap exists regarding the completeness and overall quality of their regulatory data. This foundational weakness poses a substantial hurdle for leveraging advanced technologies like AI and for achieving seamless data consolidation, effectively turning data into a liability rather than a strategic advantage.

- Shift from reactive to proactive regulatory management: Many organizations are currently operating with partially manual or reactive processes, often optimized for quick lookups rather than holistic data management. However, there is a strong and clear strategic intent to transition towards more integrated, proactive systems that can effectively handle the complexities of future regulatory changes and demands.

The survey data reveals a clear, logical progression: current challenges, stemming from manual processes, administrative burden, silos, and skill gaps, are driving the need for specific improvements in efficiency and quality. These improvements, in turn, are leading to strategic investments in digital tools and integrated systems.

Digital transformation is no longer a luxury but a fundamental necessity for regulatory functions to evolve from being a cost center to a strategic enabler of business objectives, fostering agility, reducing risk, and ensuring competitive advantage. The survey provides a clear mandate for a holistic, technology-driven approach to regulatory excellence.

Strategic Areas for Investment and Focus

To successfully navigate the evolving regulatory landscape, organizations should strategically focus their investments in the following key areas:

- Technology infrastructure: Prioritize investment in comprehensive RIM systems, robust data integration platforms, and targeted automation solutions that address specific pain points identified in the survey.

- Data quality and governance: Establish and enforce strong data governance frameworks, coupled with a continuous commitment to data cleansing and standardization efforts, to build a reliable foundation for all regulatory activities and future technologies.

- Workforce development: Invest in continuous training and upskilling programs to enhance digital tool proficiency, hire new profiles like data architects and curators, and foster a data-literate regulatory team capable of adapting to new technologies and processes.

- Process optimization: Commit to end-to-end process re-engineering, particularly for submission preparation and ongoing lifecycle management, to systematically reduce administrative burden, improve first-time quality across all regulatory operations, and ensure that quality data continues to be systematically generated.

Report Scope

The primary objective of this report is to provide a snapshot of industry trends, offering a point of reference against which regulatory professionals can assess their own practices and identify areas for improvement.

Overview of Respondent Demographics

The analysis is based on 130 complete responses from a diverse yet strategically focused group, predominantly from the director level and above within larger medical device companies.

The respondent pool exhibits significant representation from leadership positions, underscoring that the findings reflect the perspectives of experienced practitioners and key decision-makers. The findings are particularly relevant for mid-to-large scale organizations, as 59% of responses originated from companies with global revenues over $1 billion (USD). This demographic profile suggests that the challenges and opportunities identified are highly applicable to organizations navigating complex regulatory environments.

References

1. MedTech Europe, MedTech Europe IVDR & MDR Survey Results, 2024↩To learn more about how industry leaders are tackling today’s regulatory challenges with new tools and technology, watch this video.