3 Ways Biopharmas Are Using Field Insights to Better Engage HCPs

Healthcare professionals (HCPs) put a premium on interactions with field teams who get them what they need, quickly and reliably. But, only 27% of HCPs say that biopharmas communicate with them in a relevant and personalized way, according to data from the Digital Health Coalition.

The Veeva Pulse Field Trends Report is addressing this disconnect by revealing untapped insights into HCP

engagement based on an analysis of 600 million HCP interactions across more than 80% of biopharmas worldwide.

Now, biopharma field teams are turning these insights1 into action:

- Kyowa Kirin is closing the gap between content creation and field use, as new patient starts are 2.5 times more likely when reps share digital content in meetings with HCPs

- Lundbeck is using real-time intelligence to target KOLs, as treatment adoption improves by 1.5 times when field medical provides early disease-state education

- Boehringer Ingelheim is strengthening the rep-HCP relationship with compliant chat, which more than doubles digital engagement, keeping in-person the same or better

Empowering field teams with the right content, the right engagement opportunities, and the right channels builds strong customer relationships that create lasting value for HCPs and patients.

Read Veeva Business Consulting’s in-depth analysis to learn how these industry leaders are combining data and

technology to engage HCPs more effectively.

Thank you,

Dan Rizzo

Global Head of Veeva Business Consulting

1 Bolded insights are from Veeva Pulse data and not specific to mentioned biopharmas.

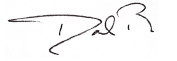

1. Maximize digital content adoption with your field team

When sales reps use digital content during HCP calls, it drives 2.5 times more new patient

starts than meetings that don’t use content, according to Veeva Pulse data. But, field teams

don’t share digital content in six out of 10 meetings. And, even though companies created 20%

more content last year, field teams used less than a quarter of it.

keys to an effective

content strategy

Jay McMeekan, senior director of the commercial

digital center of excellence at Kyowa Kirin, a Japan-based

specialty pharmaceutical company, believes that

field input into the process can bridge the gap between

content creation and content use.

Bring the field team in early to help you figure out what works and what doesn’t. Not only is it efficient, your content is more effective. They aren’t using the content because they were told to, but because they helped create it.”

–Jay McMeekan

Senior Director of the Commercial Digital Center of

Excellence, Kyowa Kirin

Kyowa Kirin’s team limits decks

to 10 slides, so reps

can identify the content they

need quickly.

Multiple versions of similar content makes it difficult for reps to know what assets

to use.

Early in the process, make sure you understand how reps

will use the content in front of the customer.

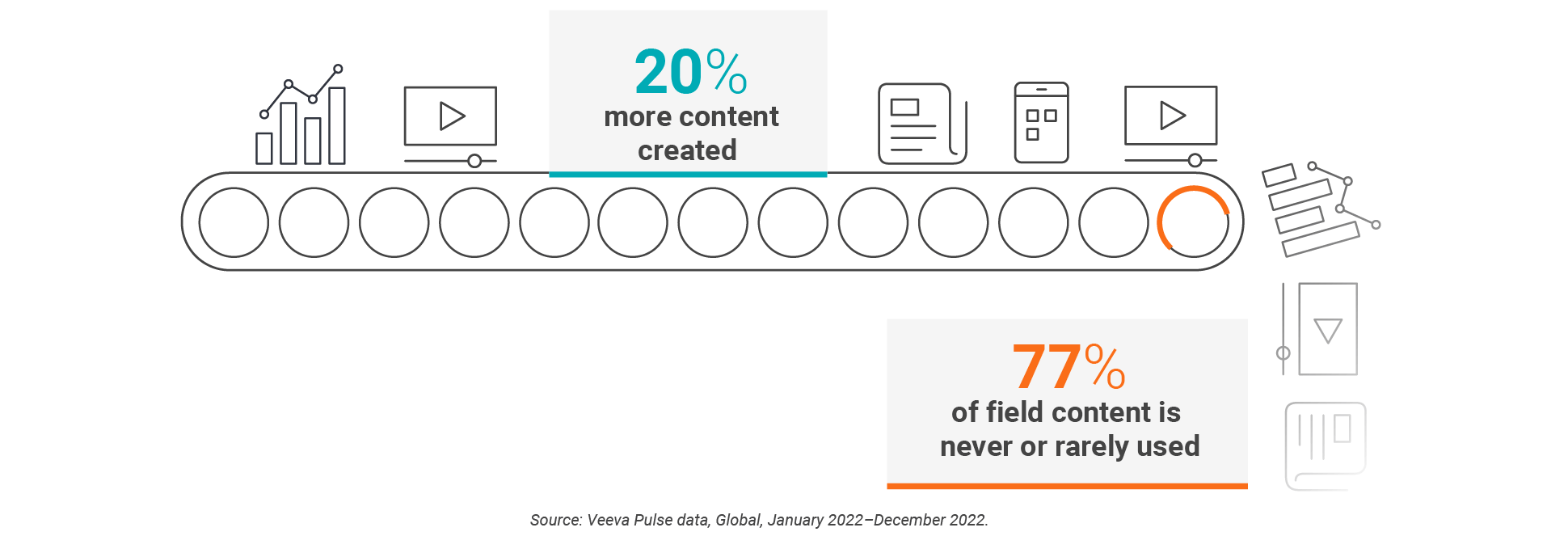

2. Improve treatment adoption with early KOL engagement

Early disease state education by field medical with key opinion leaders (KOLs) is associated

with 1.5 times greater treatment adoption across that healthcare organization over the first six

months post-launch, a Veeva data analysis shows. But, because of outdated KOL selection and

prioritization methods, 70% of KOLs engage with only one biopharma field medical team, limiting

scientific engagement and the ability to accurately measure field medical impact.

data-driven approach

to KOL engagement

Christine Castro, director, medical affairs excellence at

Lundbeck, sees the value in a standard, data-driven

approach to identifying, prioritizing, and engaging KOLs.

Lundbeck is combining real-time customer intelligence

and CRM data to create a new engagement strategy.

The right data is foundational to our engagement

strategy. As we prepared for the launch of

new treatments, this data-driven approach helped us build

the right relationships and focus our resources where

they will have the greatest scientific impact.”

–Christine Castro

Director, Medical Affairs Excellence, Lundbeck

Start by identifying your

objectives. What are you

trying to achieve? What KPIs

will you measure?

Are you engaging with the

right KOLs? Challenge your

KOL selection with external

industry data.

What will your customers

get out of meeting with you?

Make sure they see the

value – and document it.

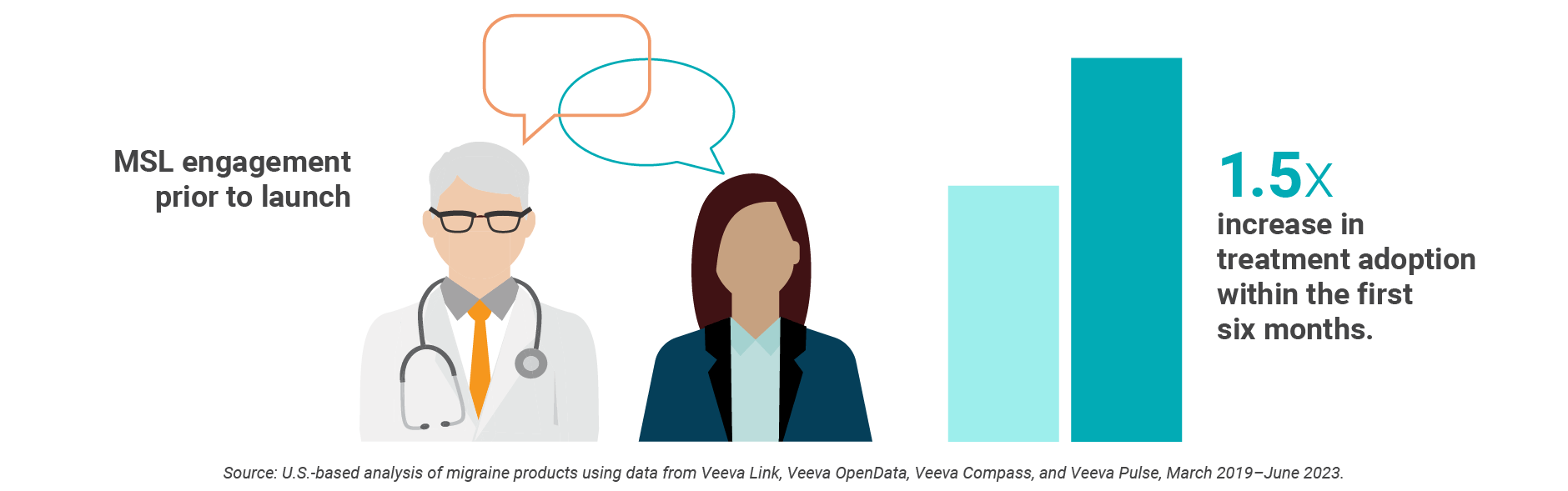

3. Empower reps to engage HCPs in their moment of need

While nothing can replace in-person interactions, adding an inbound engagement channel lets

HCPs raise their hand in their moment of need. When given a compliant chat channel, HCPs will

initiate conversations 30% of the time, and reps can respond with value and speed.

delivers a better

rep-HCP experience

Boehringer Ingelheim is putting this service-focused

model into practice, which more than doubles digital

touchpoints while keeping in-person volume the same

or better. This approach gives HCPs immediate access

to valuable resources without waiting for in-person

meetings.

Compliant chat allows reps to respond more quickly to

HCPs on a convenient platform, increasing access and

deepening relationships.”

–Jill Shoffner-Brown

Commercial Business Director, Boehringer Ingelheim

“I really think contact should be bidirectional – the right

channel should enable doctors to connect with reps, and

reps to connect with doctors.”

–Karin Fuchs, MD

OB-GYN, Veeva’s HCP Advisory Board

Customers can request patient

resources, content, samples,

and meetings in a compliant

way.

Field reps can easily make new

connections and respond

quickly between in-person

meetings.

For shared targets, partners

can increase collaboration

by engaging seamlessly on

one platform.

Reach out to Veeva Business Consulting to find out how you can use Veeva Pulse data to create a service-focused engagement model for your business.

Global and Regional Trends

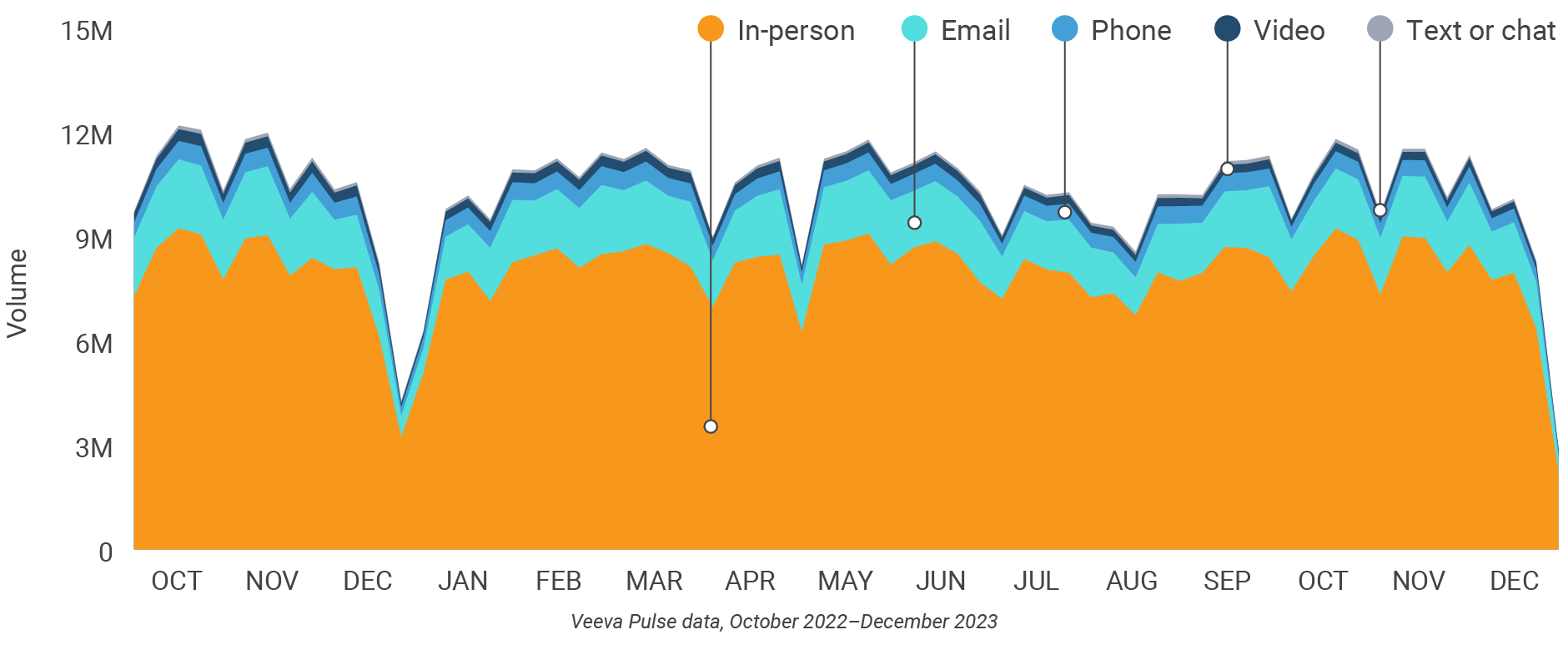

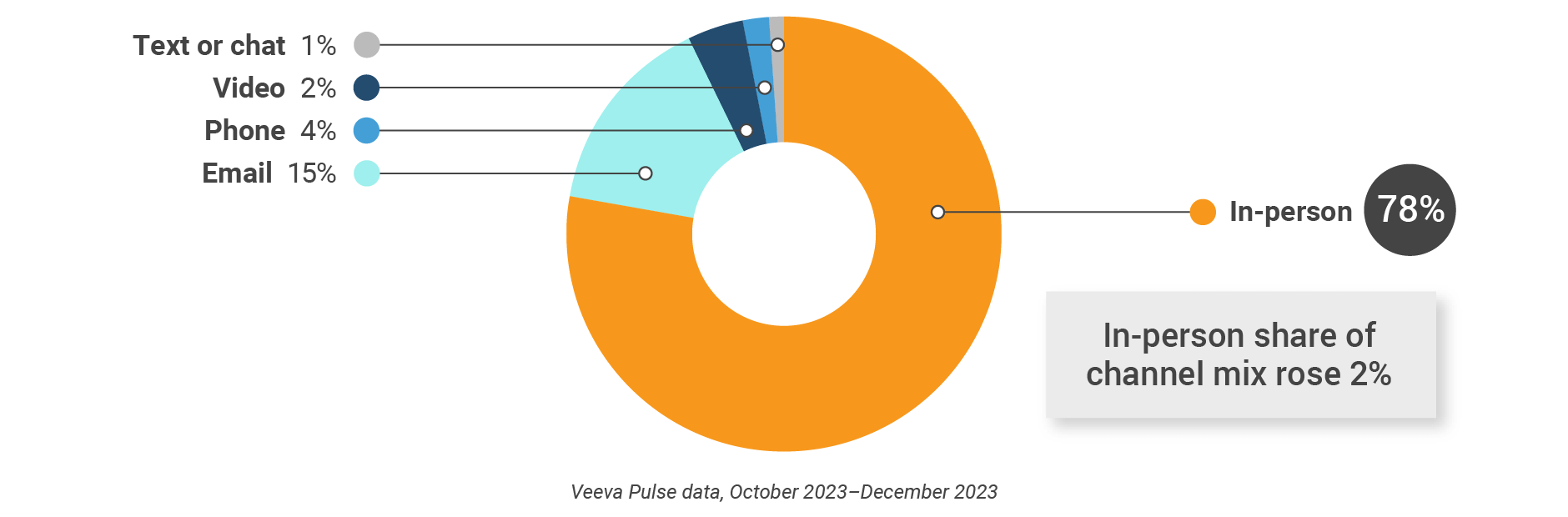

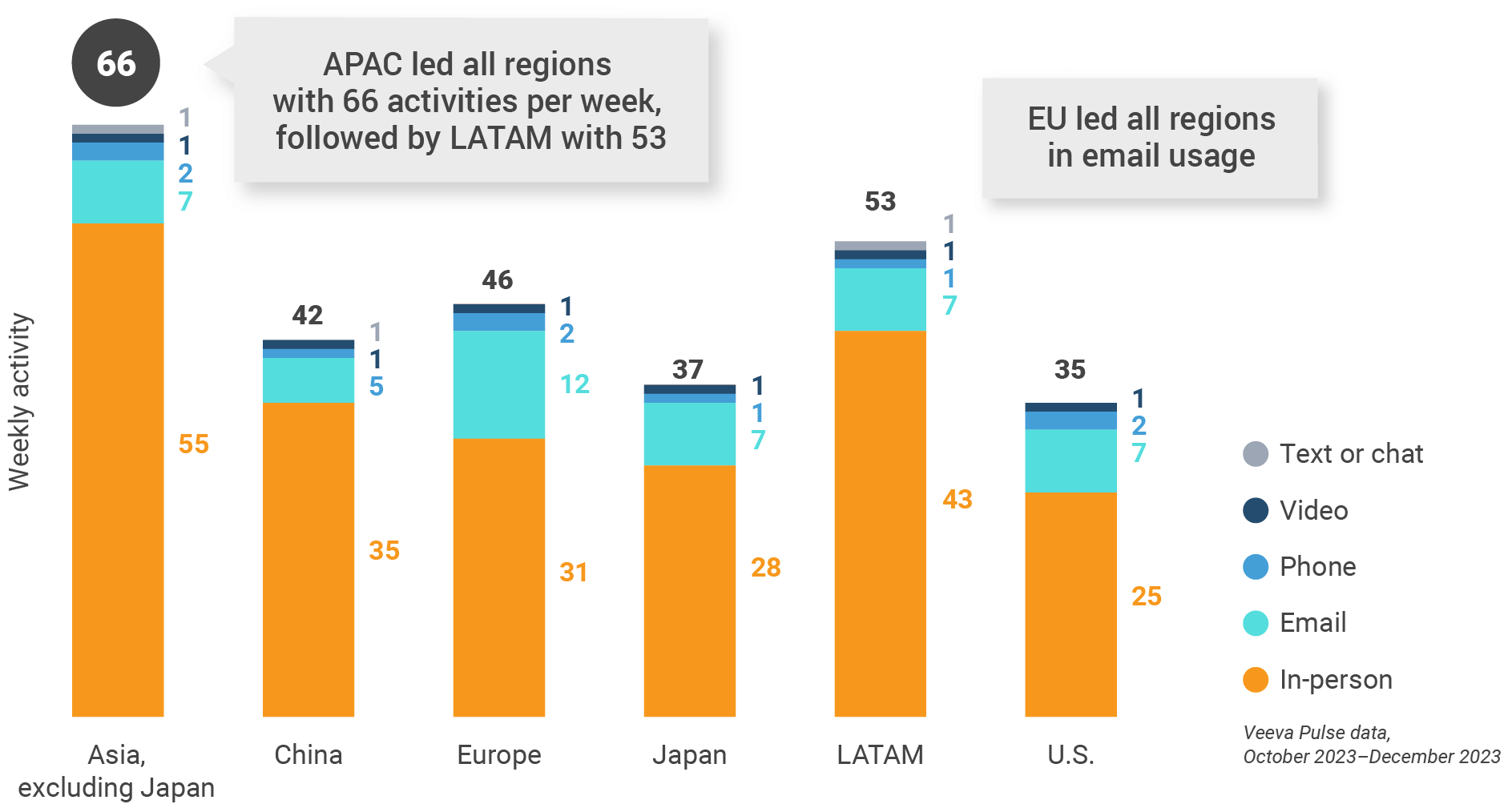

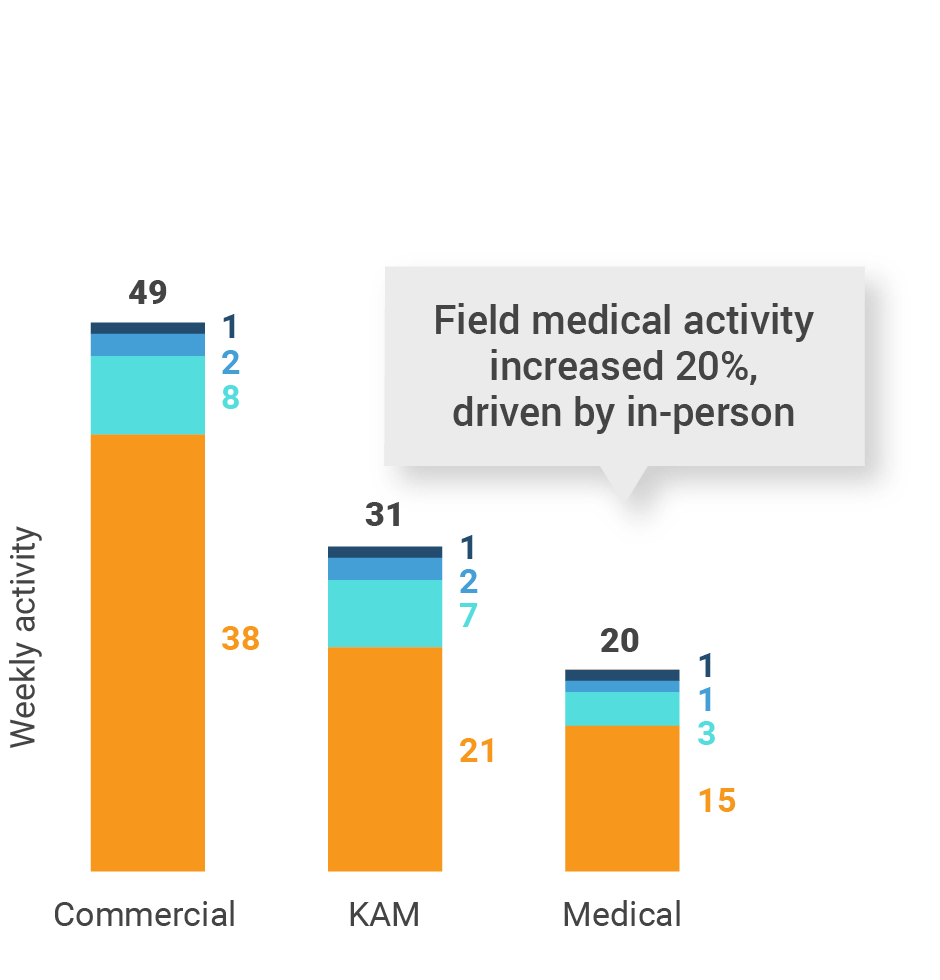

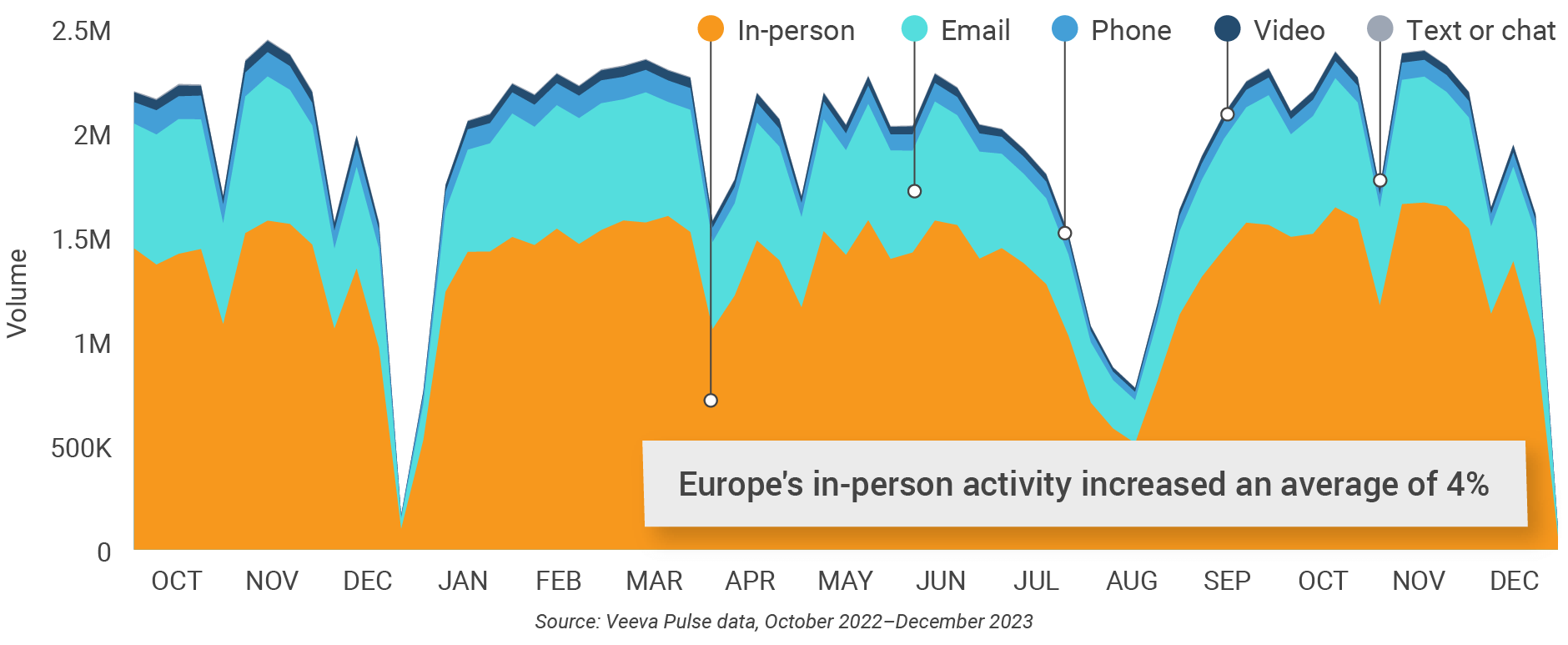

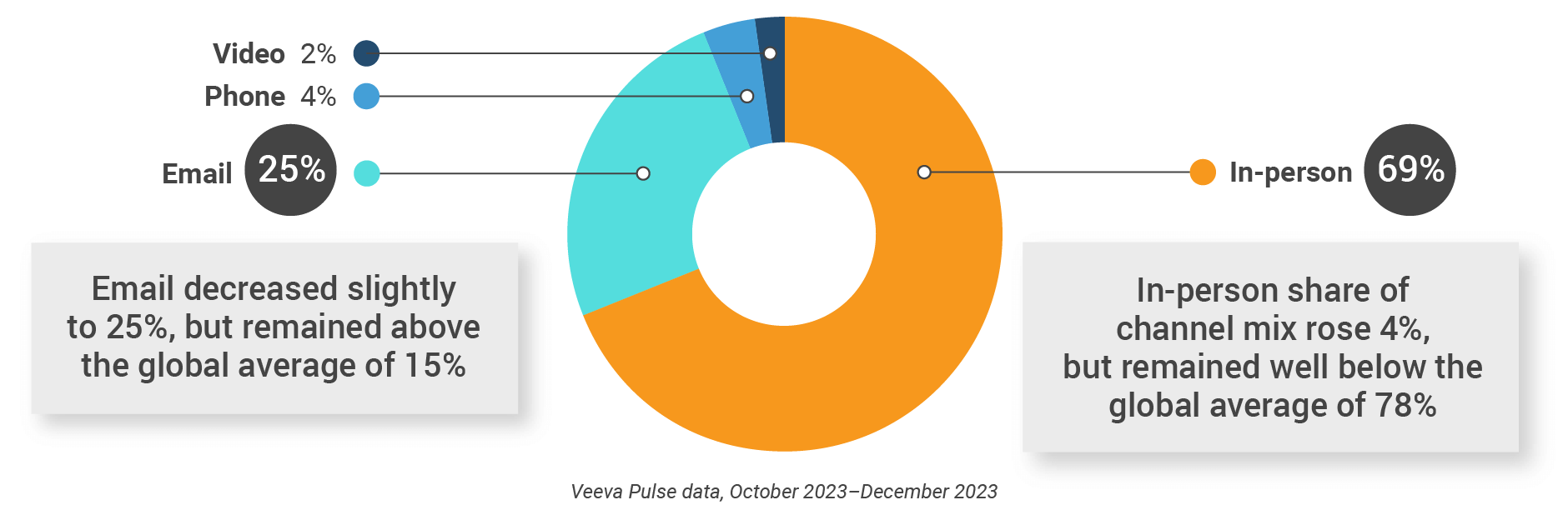

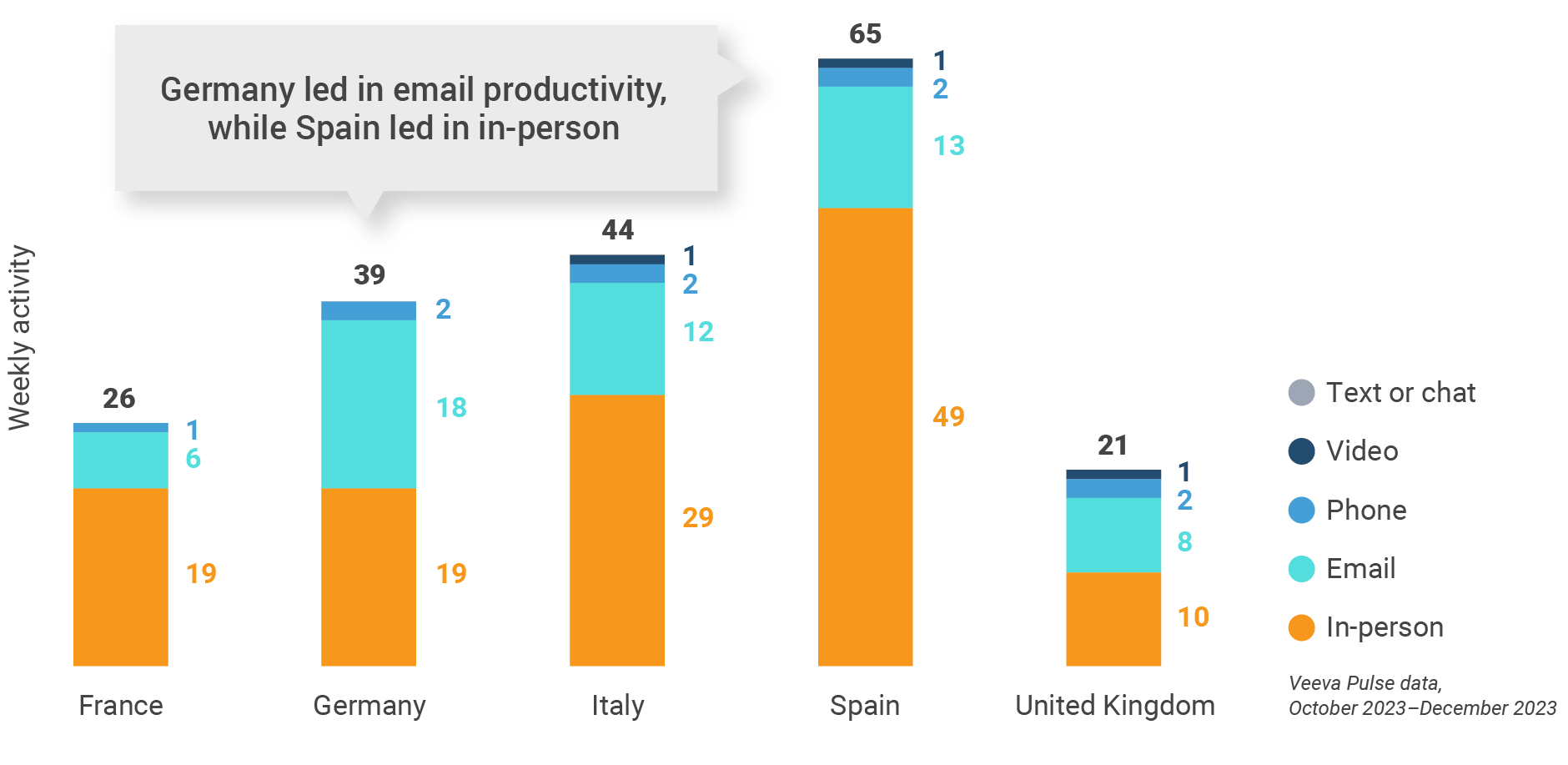

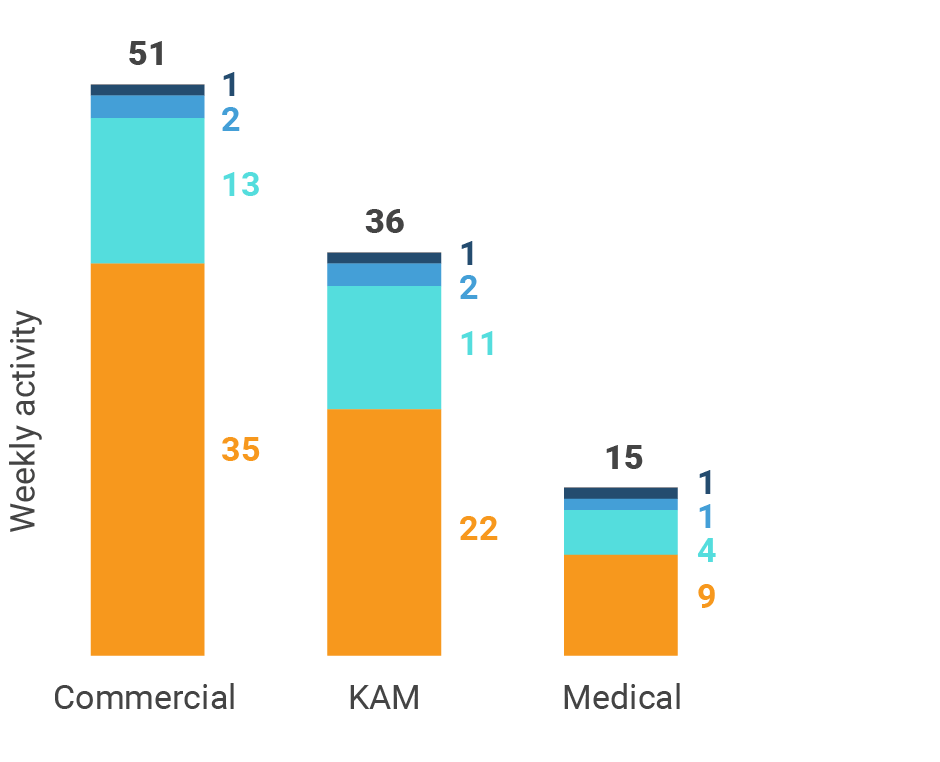

This report highlights global and regional field engagement trends from Veeva Pulse data gathered between October

2022 and December 2023. Veeva Pulse data is sourced from Veeva’s aggregated CRM activity, inclusive of field

engagement stats from all instances of Veeva CRM globally. Unless otherwise noted, chart insights compare Q4 2023

to Q4 2022.

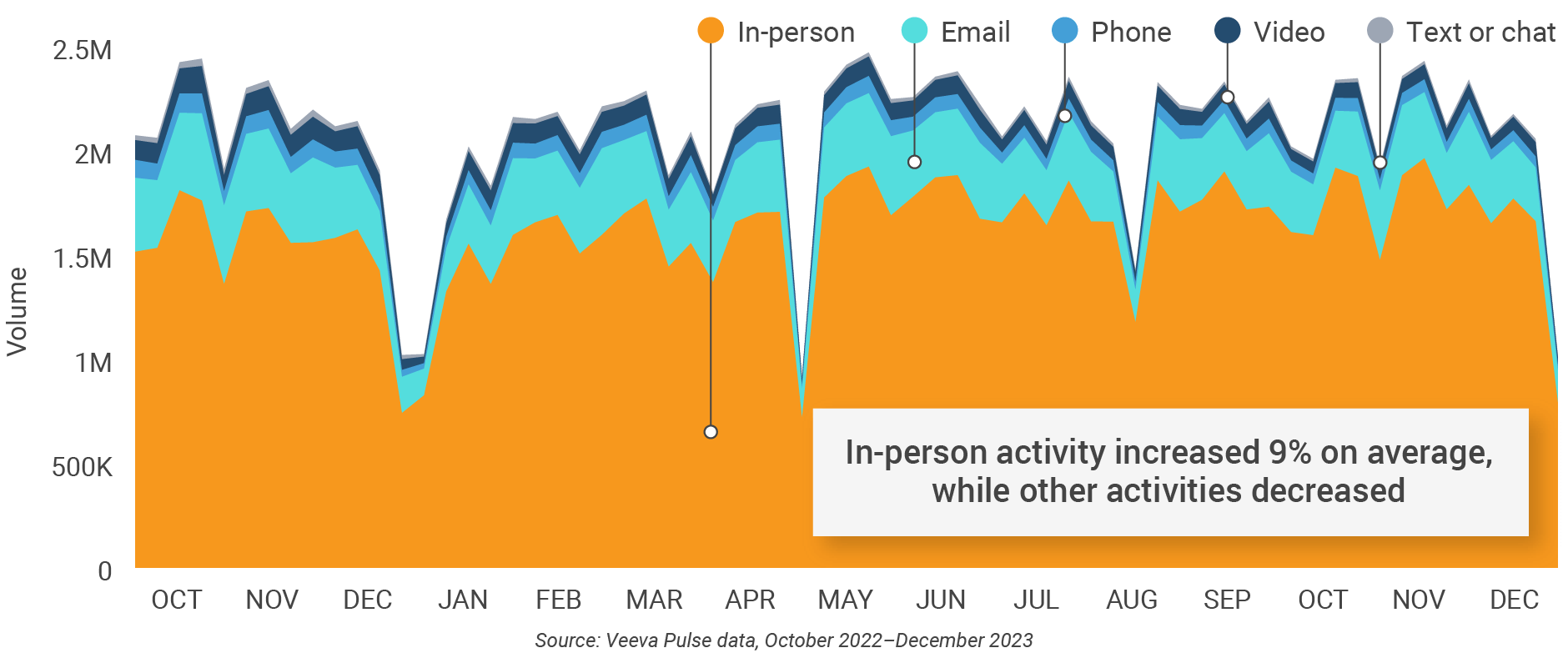

Global trends

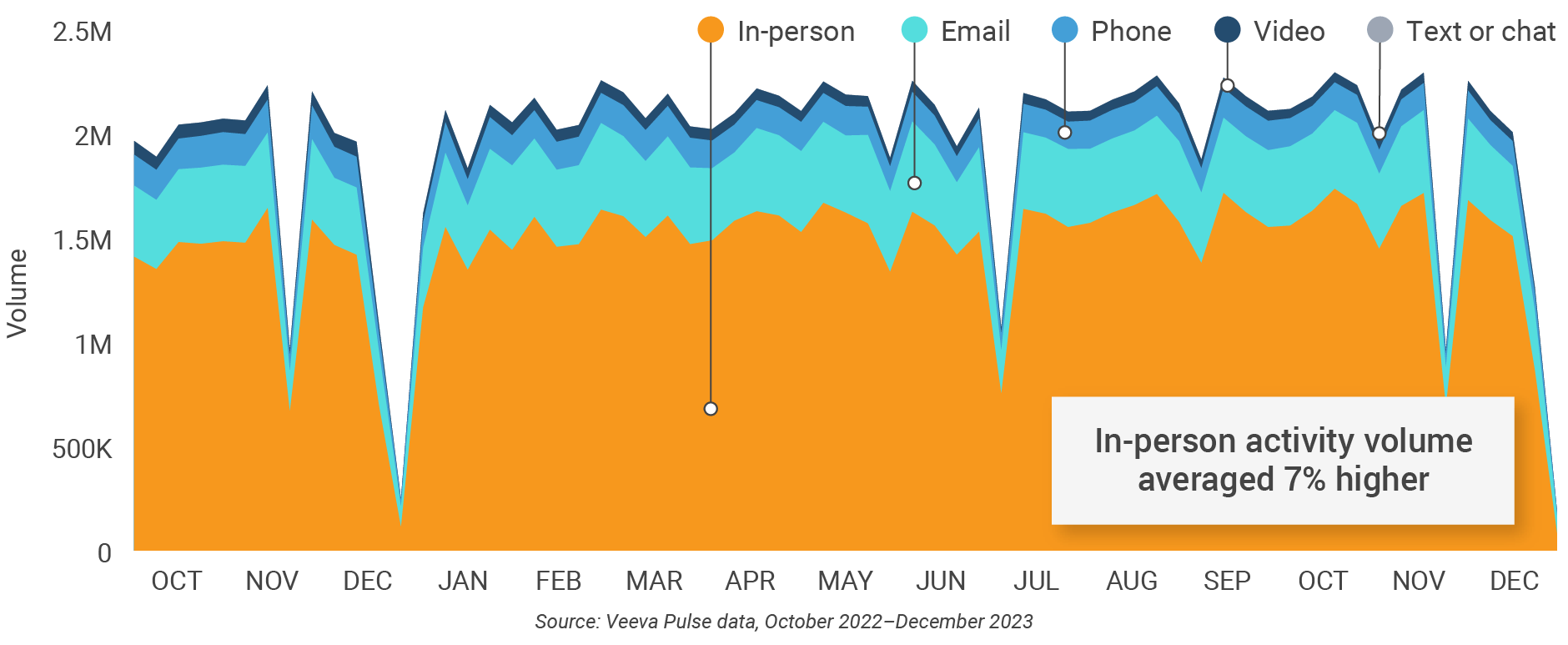

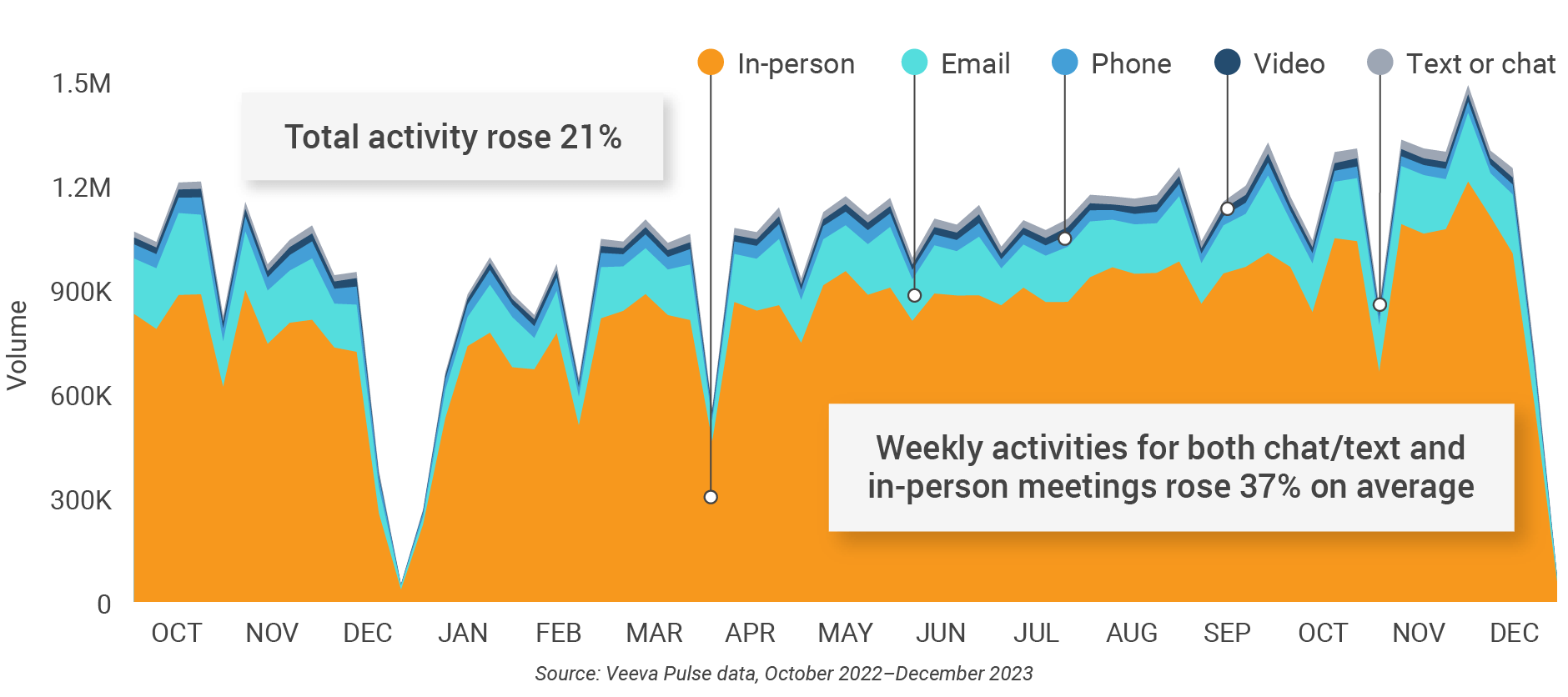

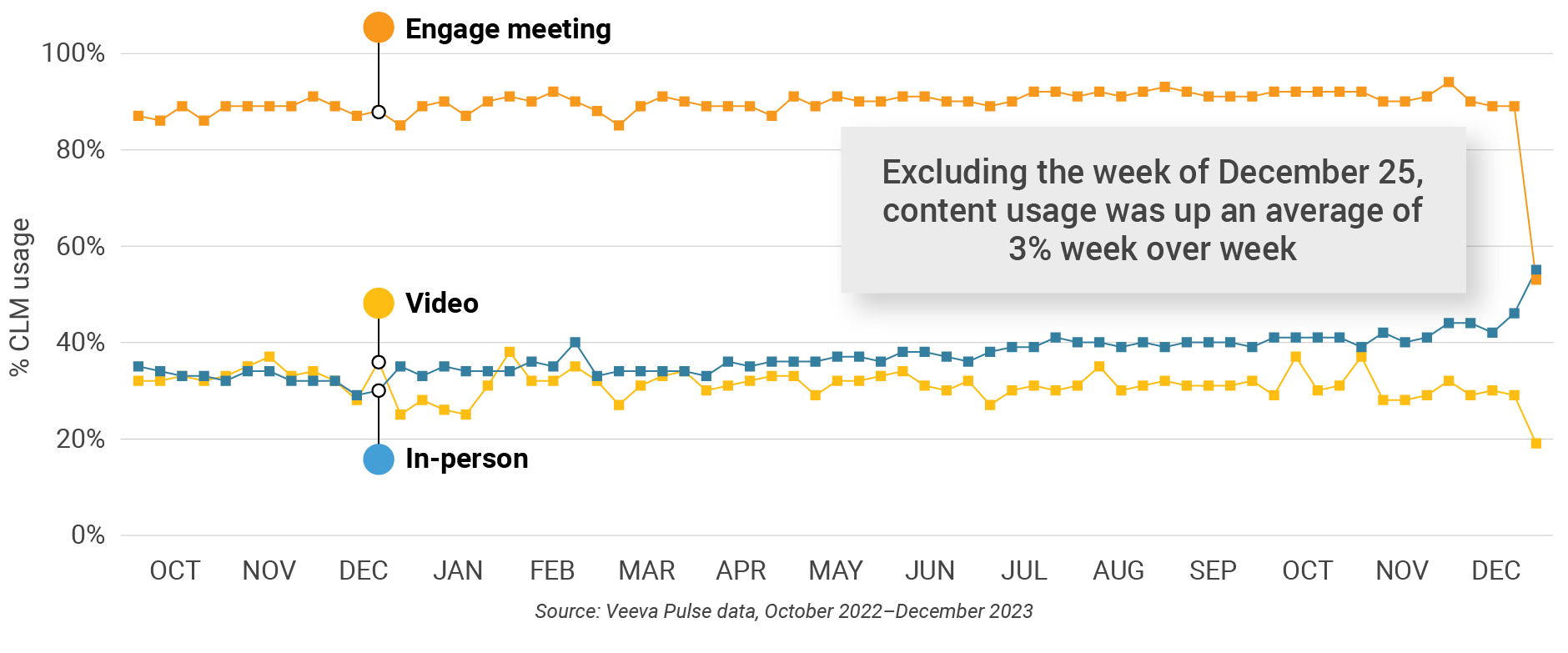

Figure 1: Channel mix evolution, global

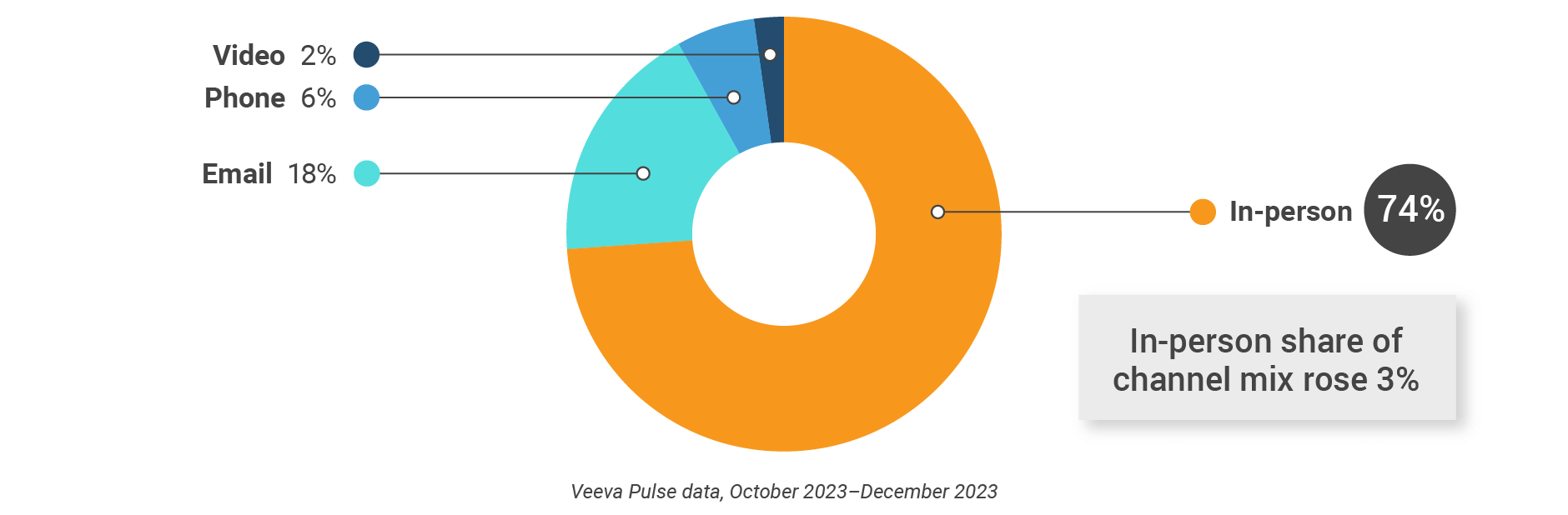

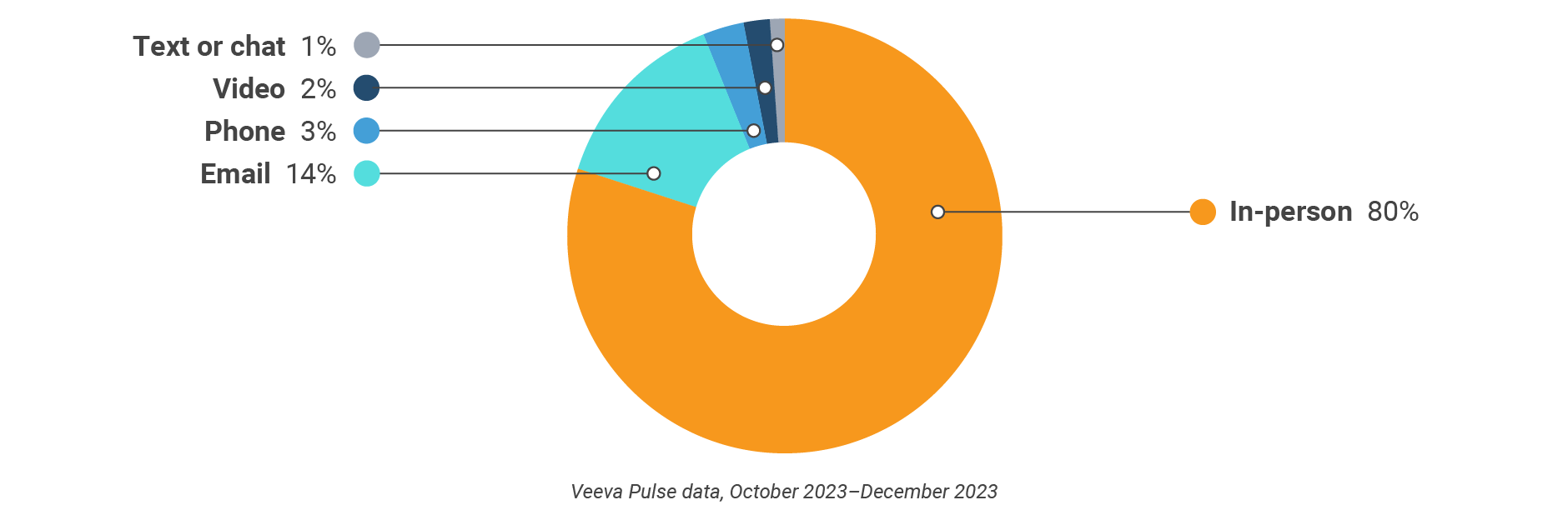

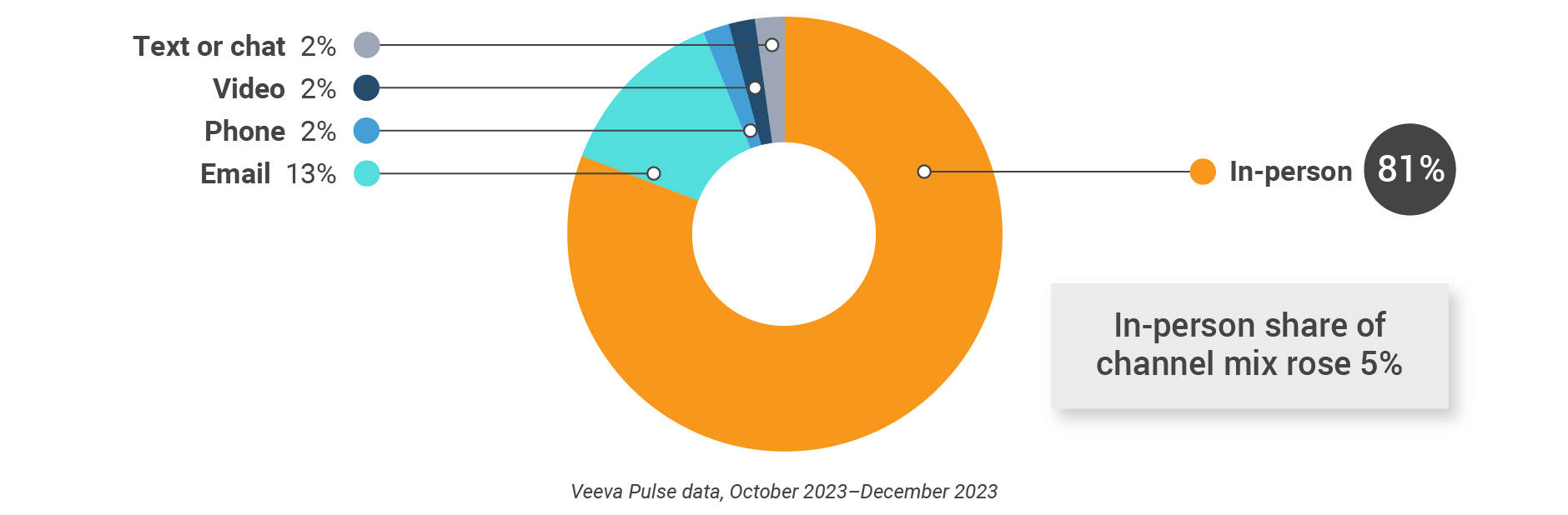

Figure 2: Channel mix, global

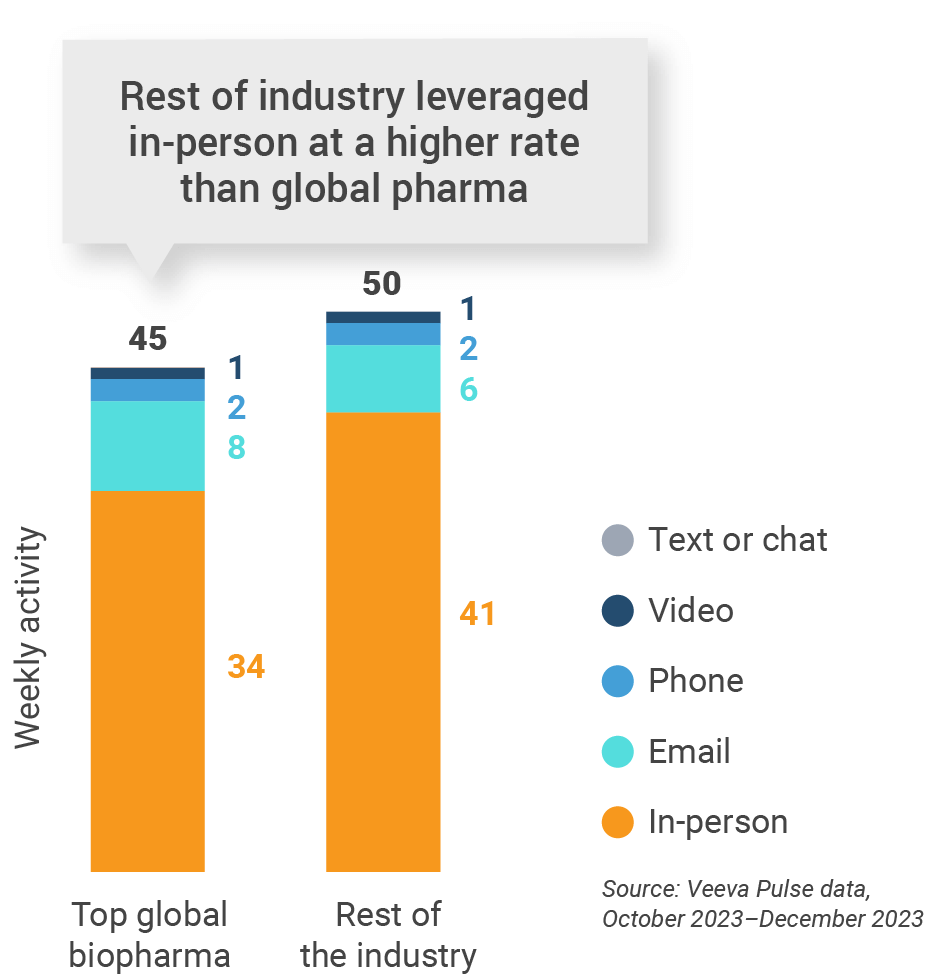

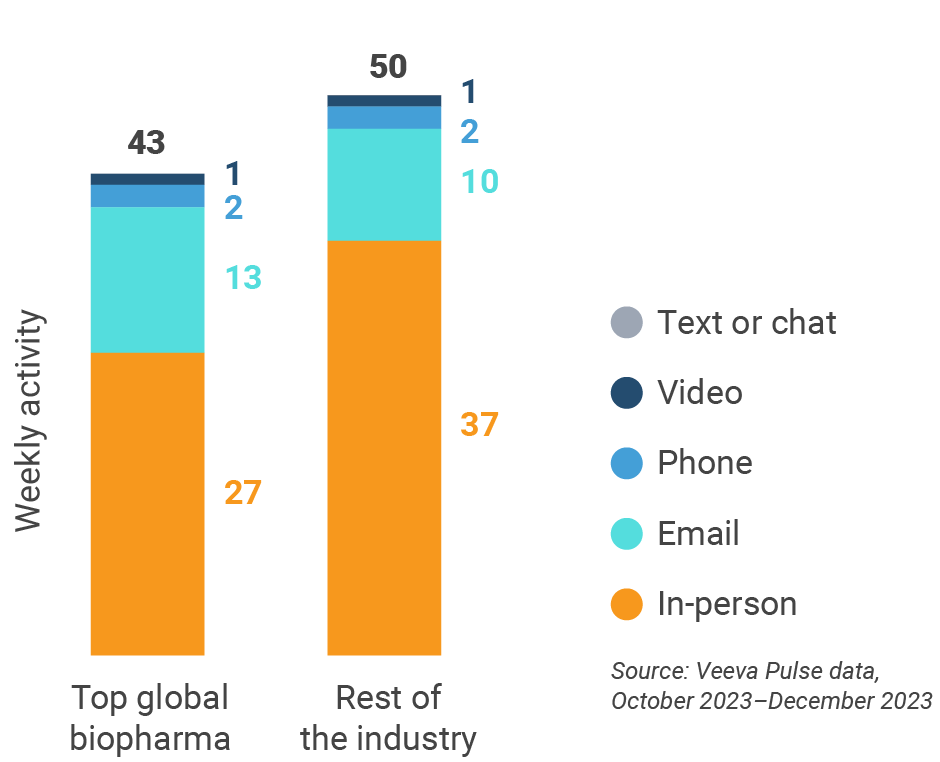

Global field team activity

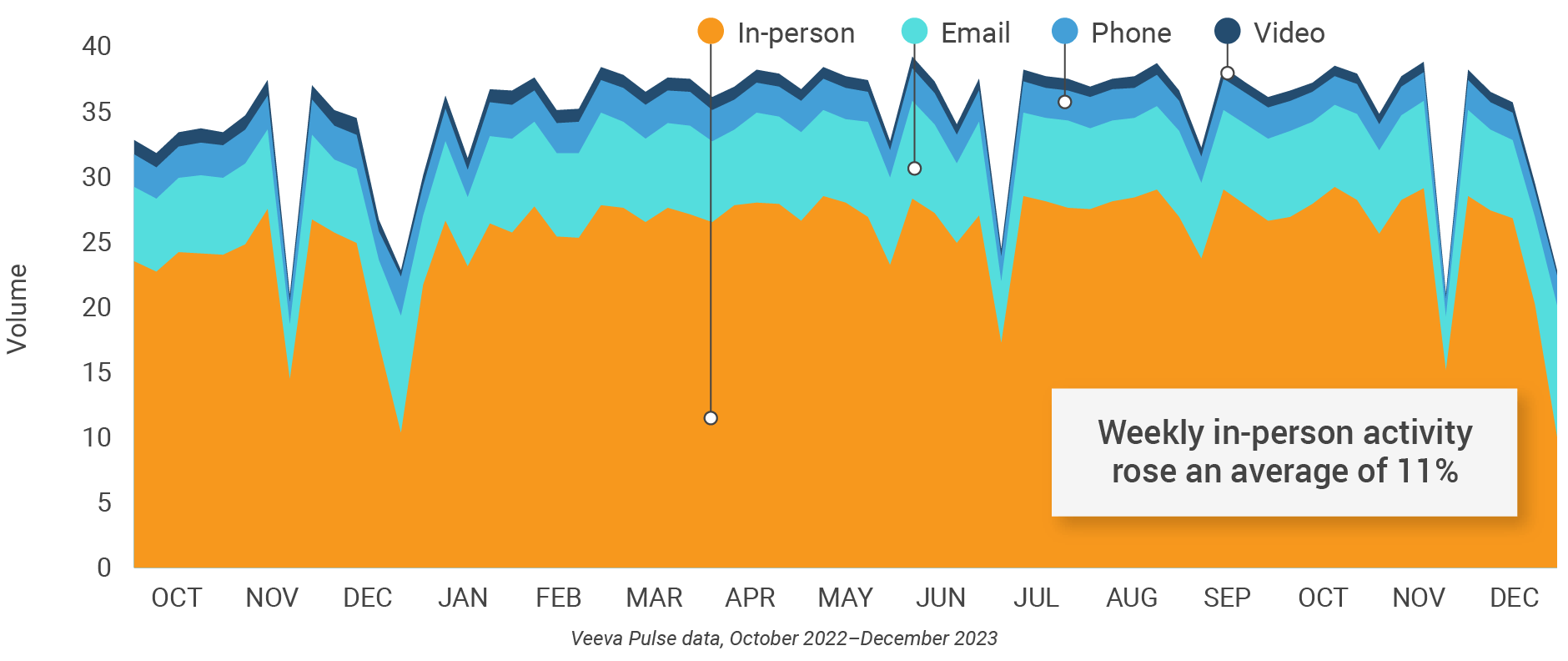

Weekly activity per user by engagement channel

Figure 3: Activity by region, global

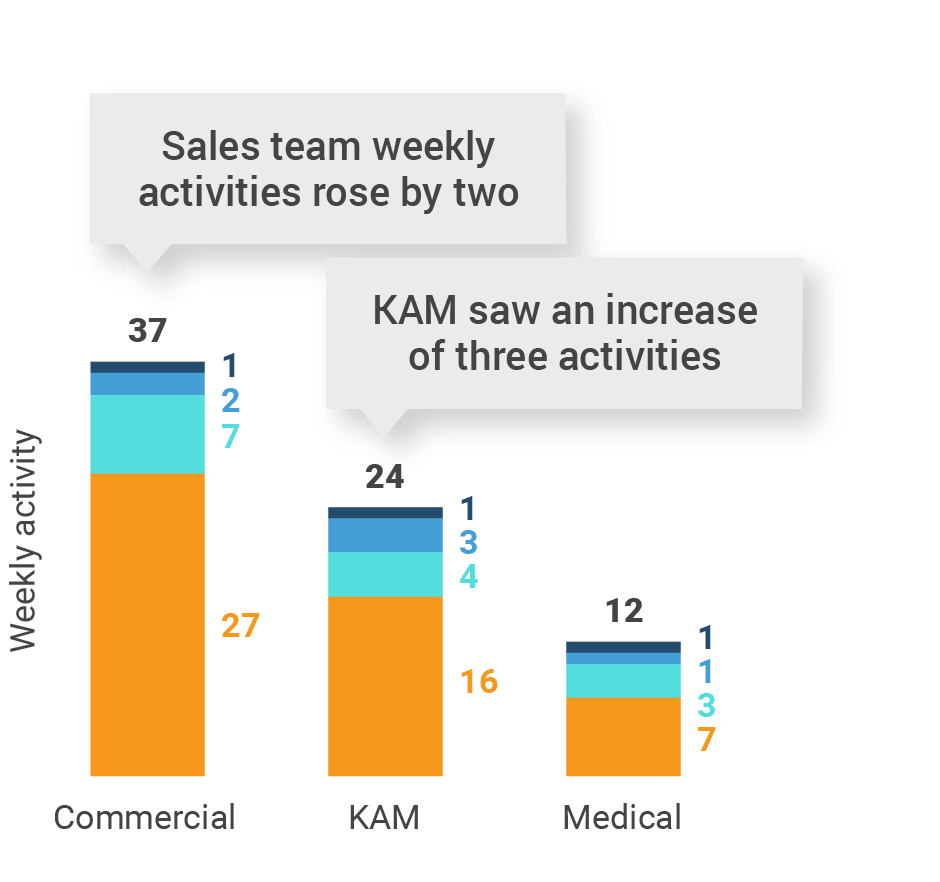

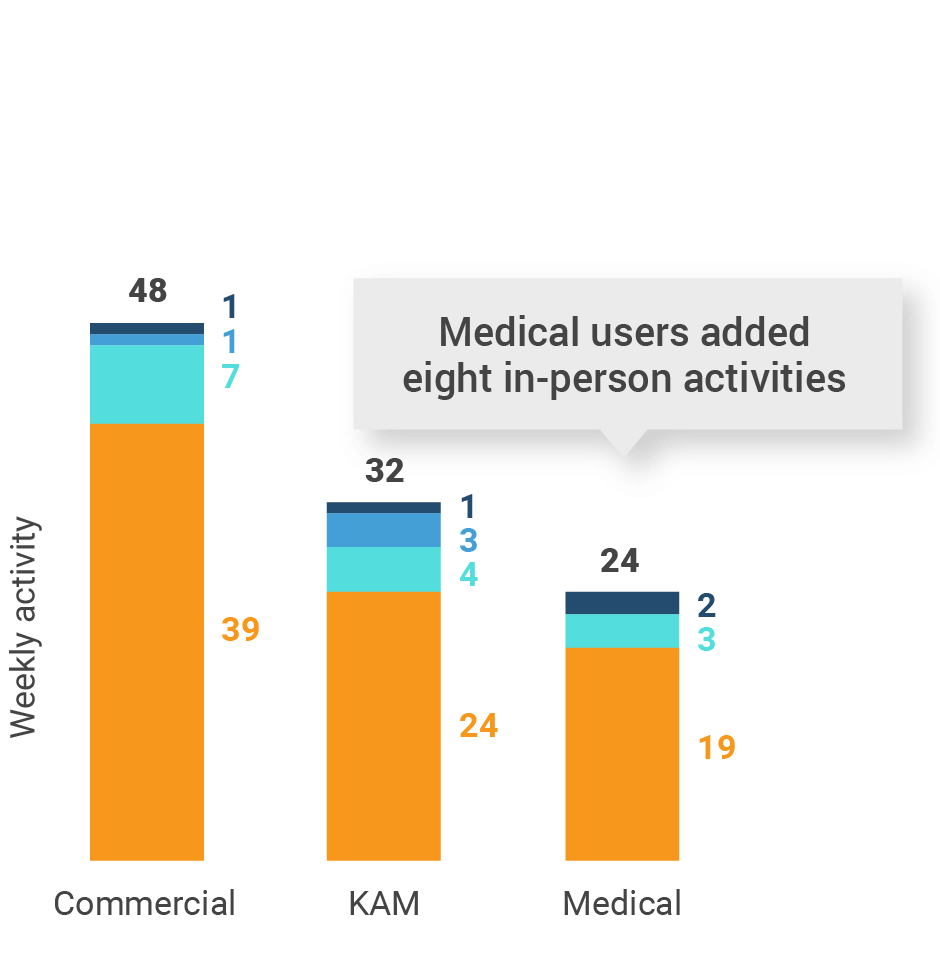

Figure 4: Activity by user type, global

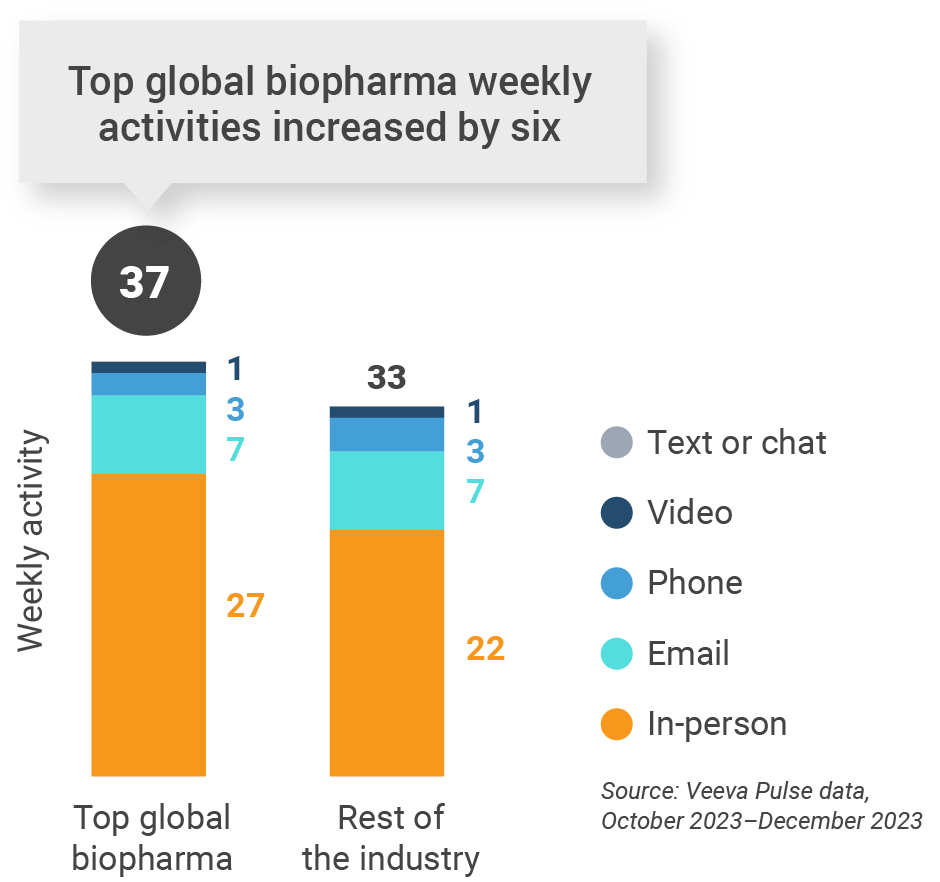

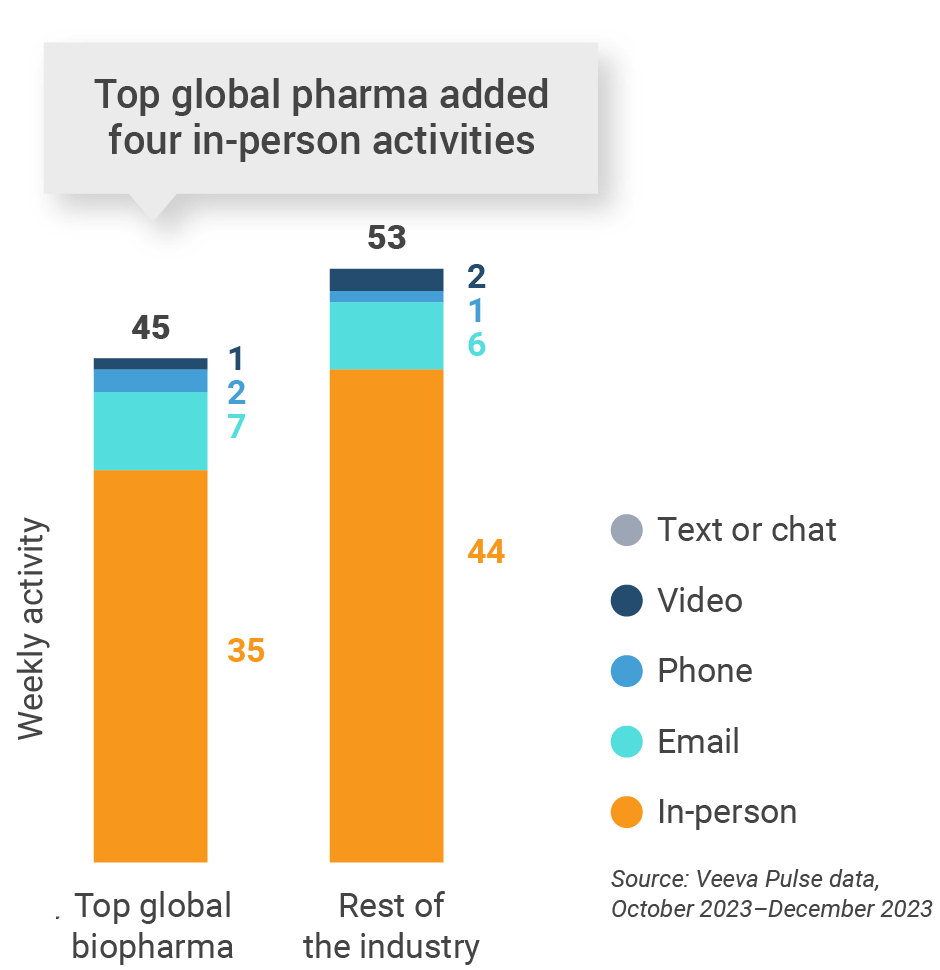

Figure 5: Activity by company size, global

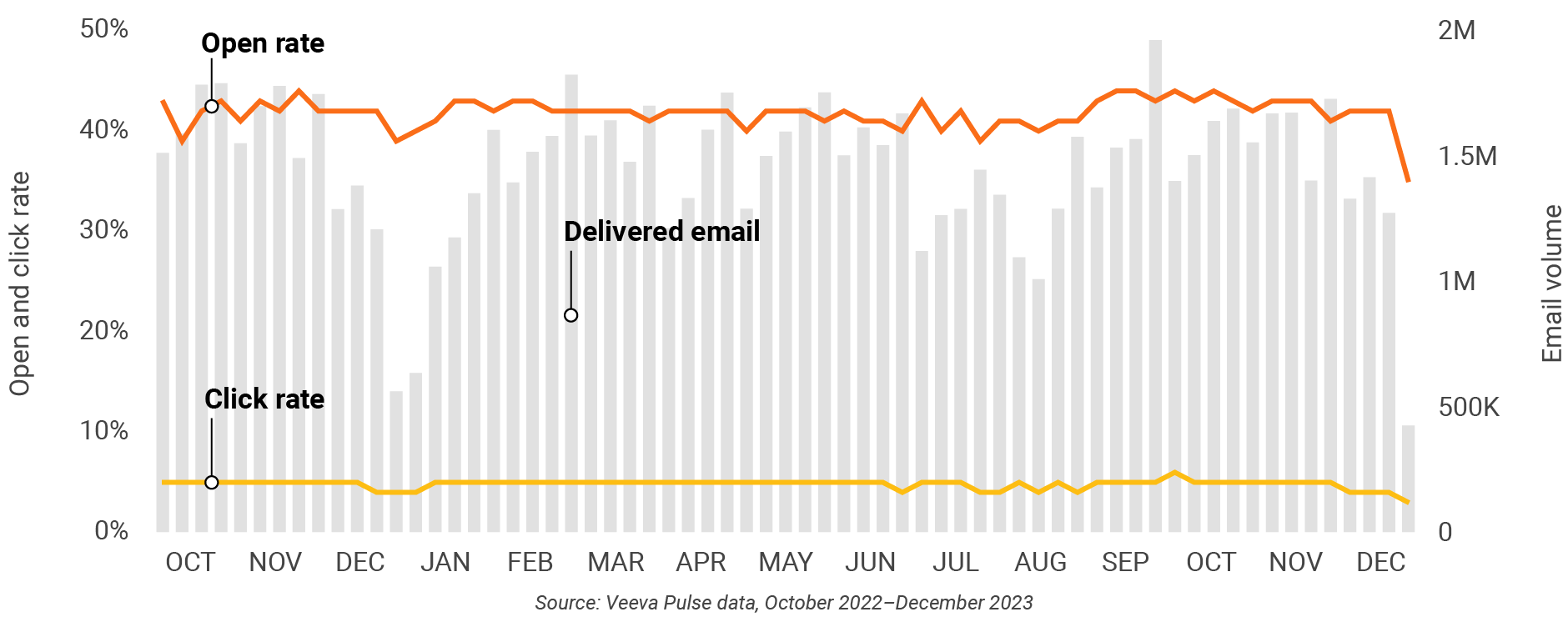

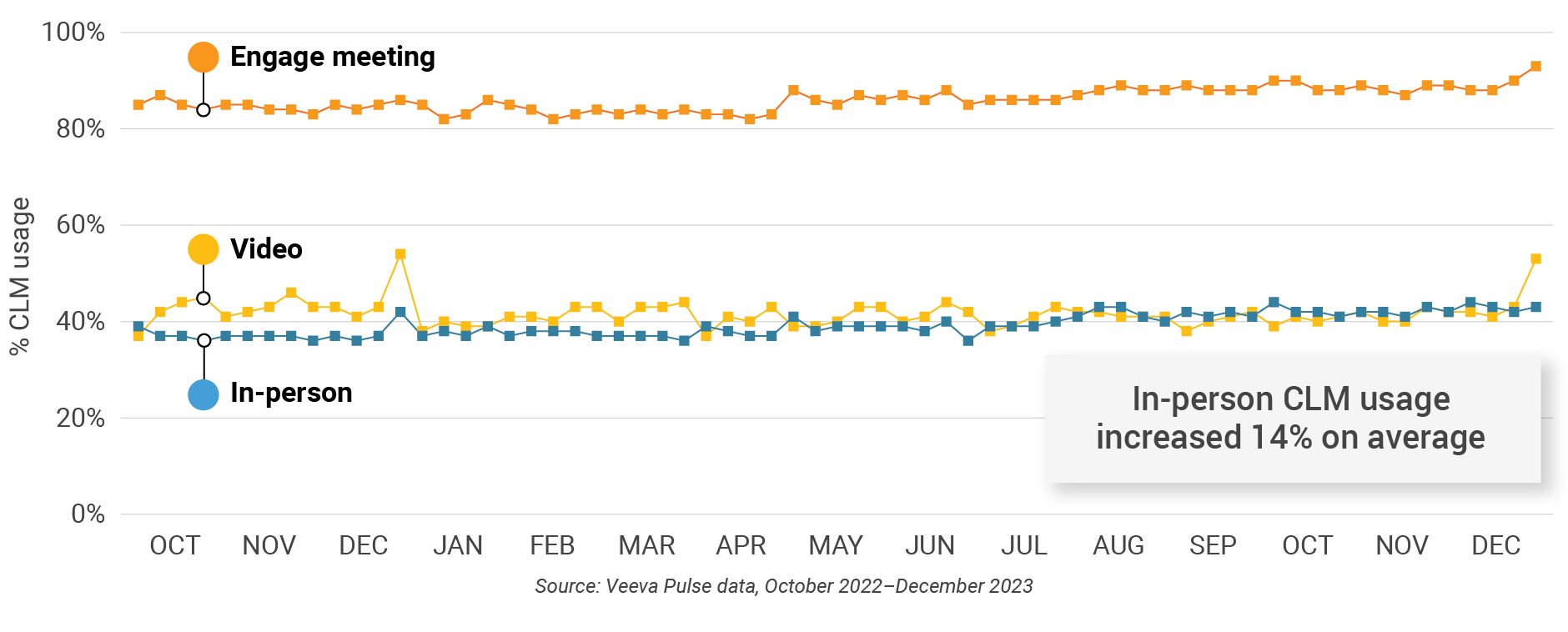

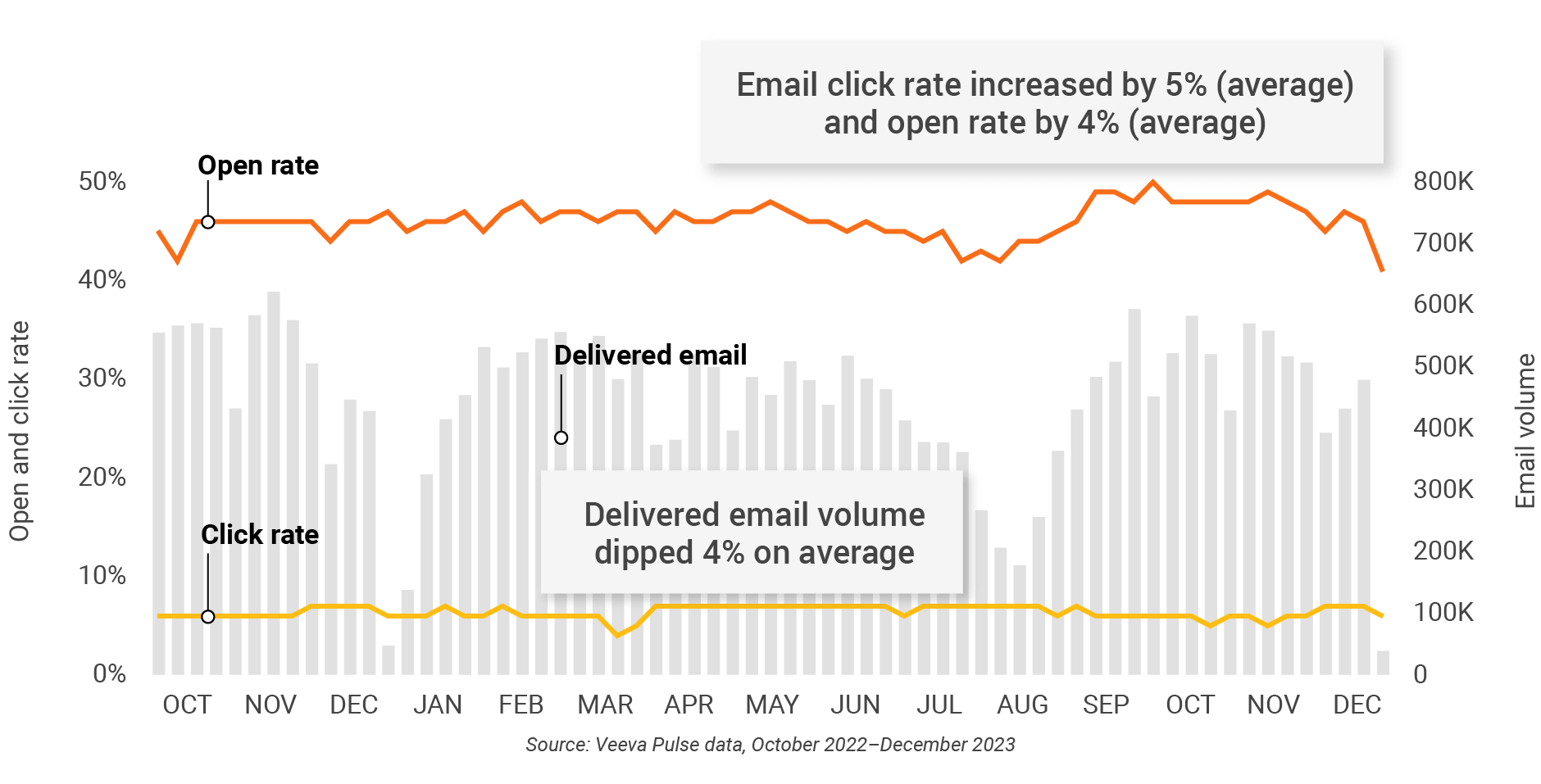

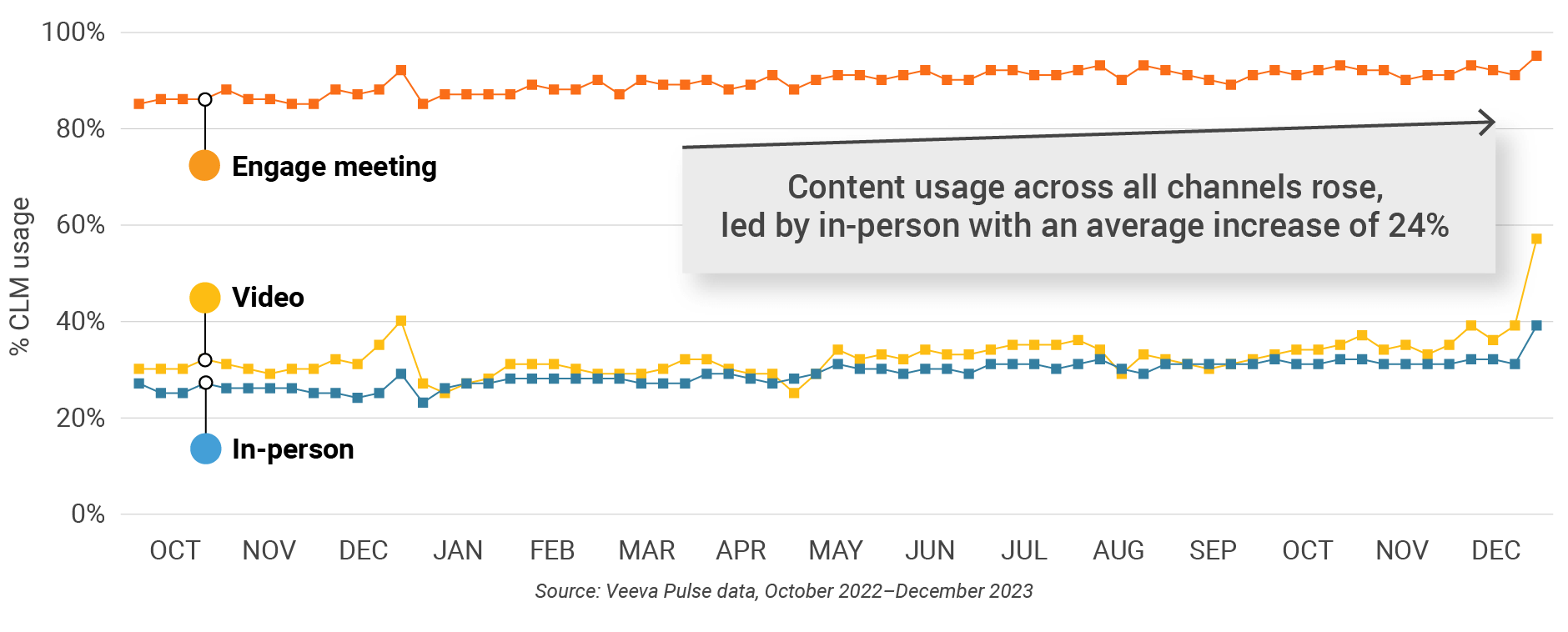

Global engagement quality

Consolidation of key quality metrics

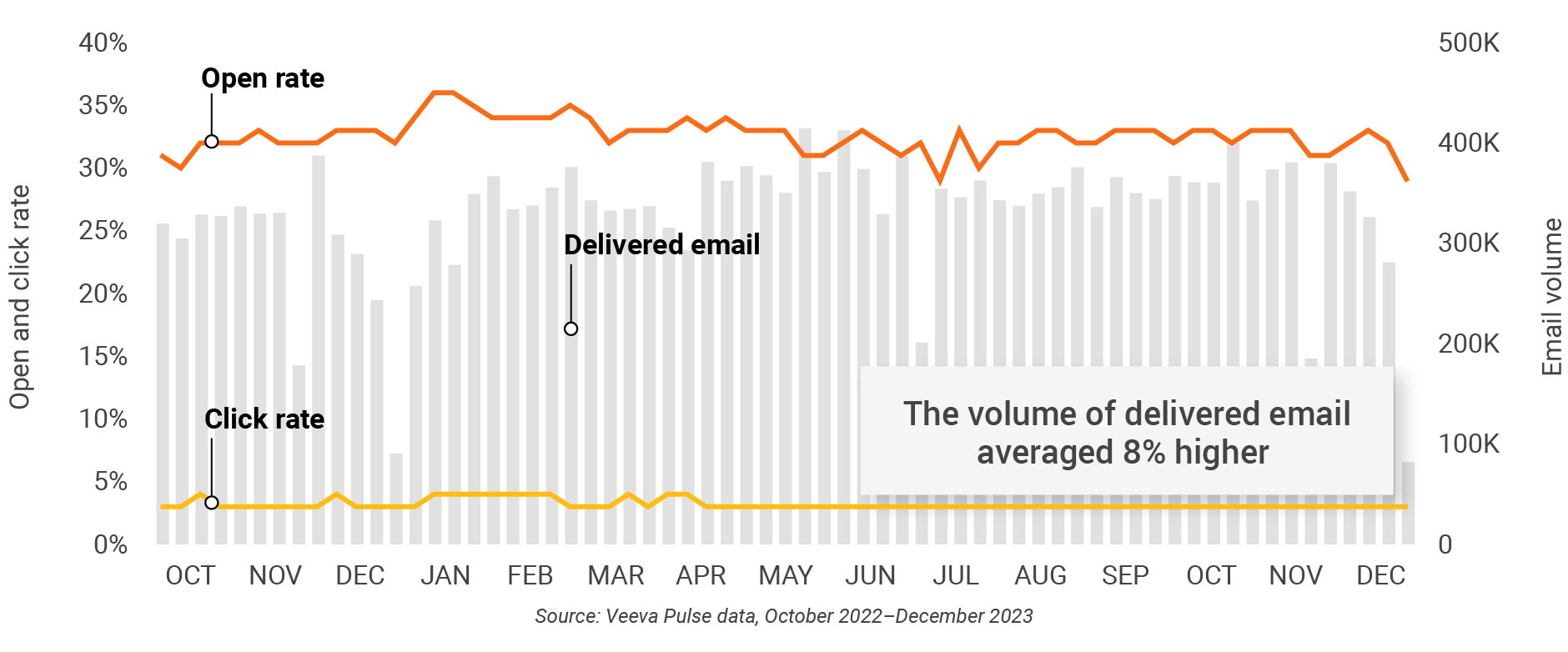

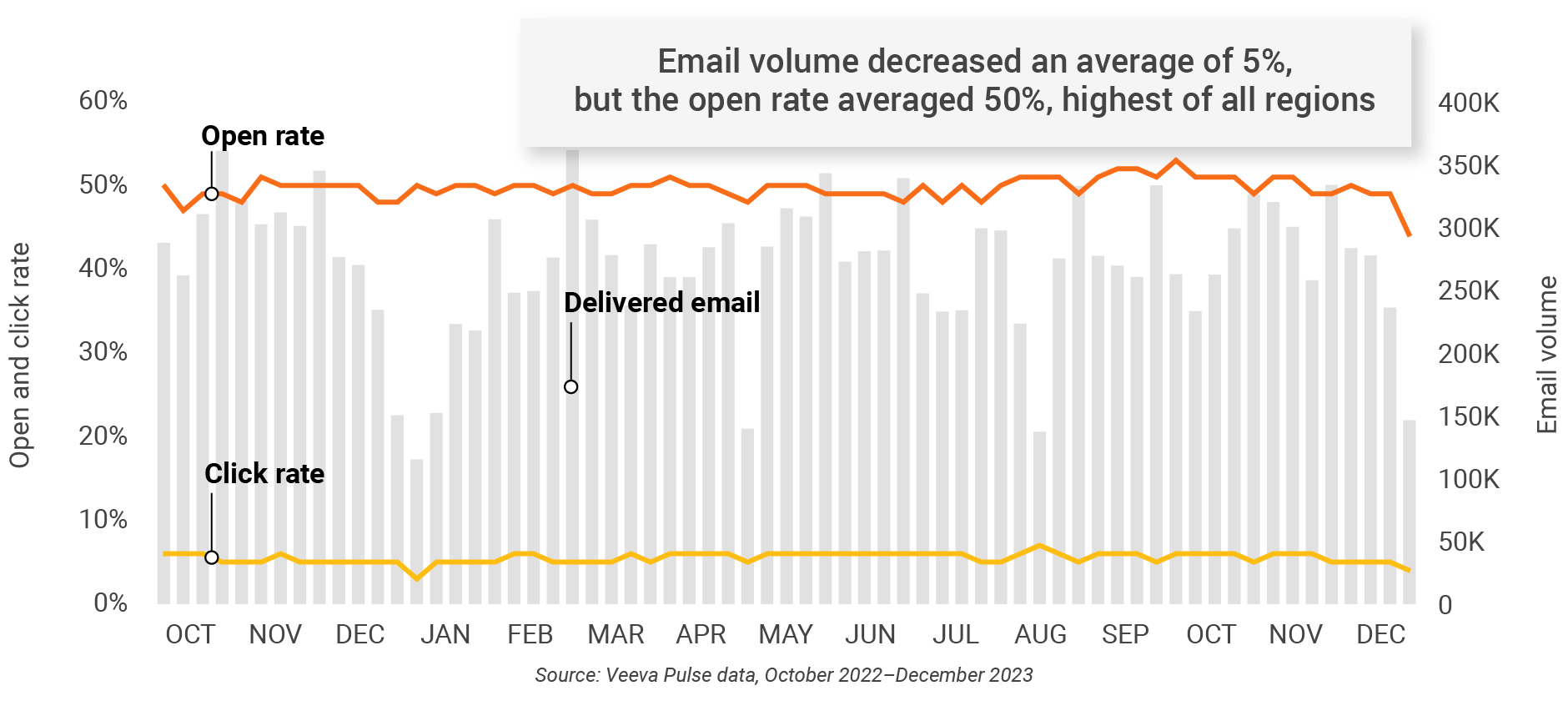

Figure 6: Approved email volume, global

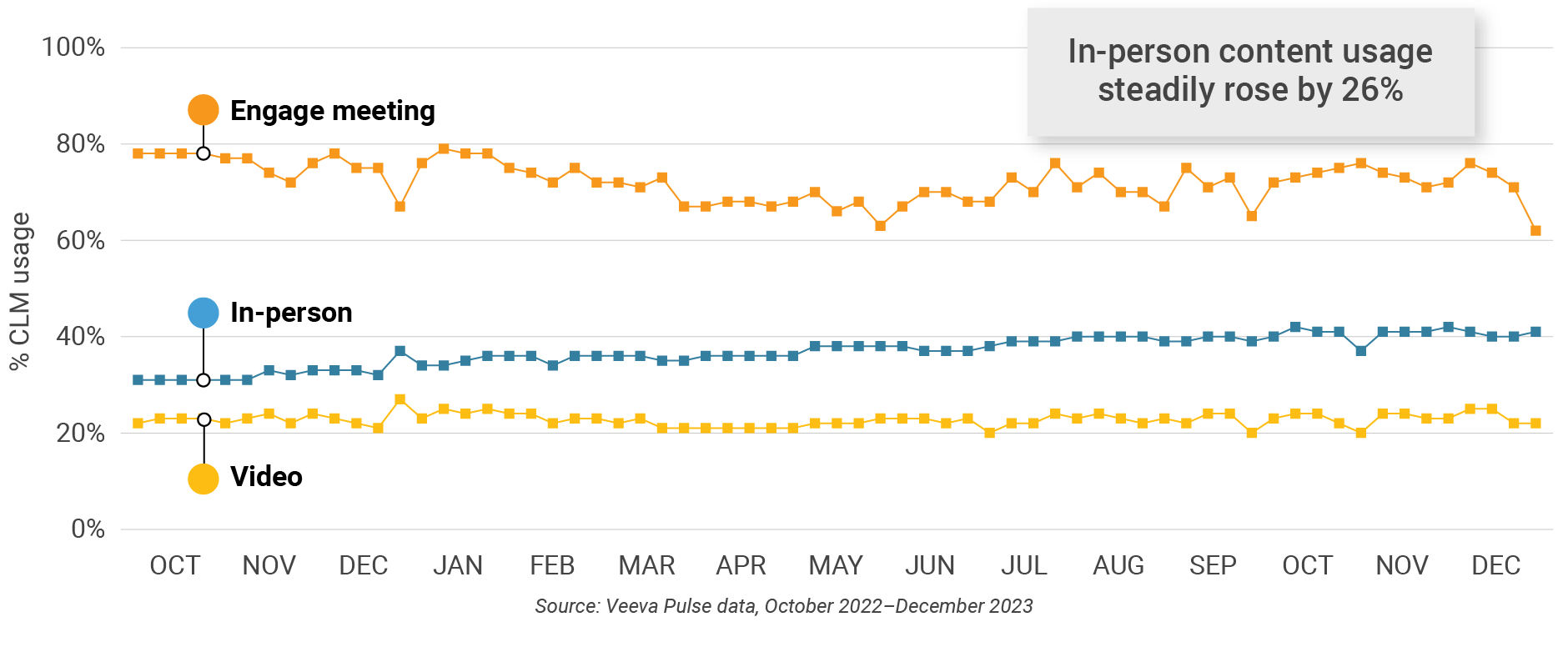

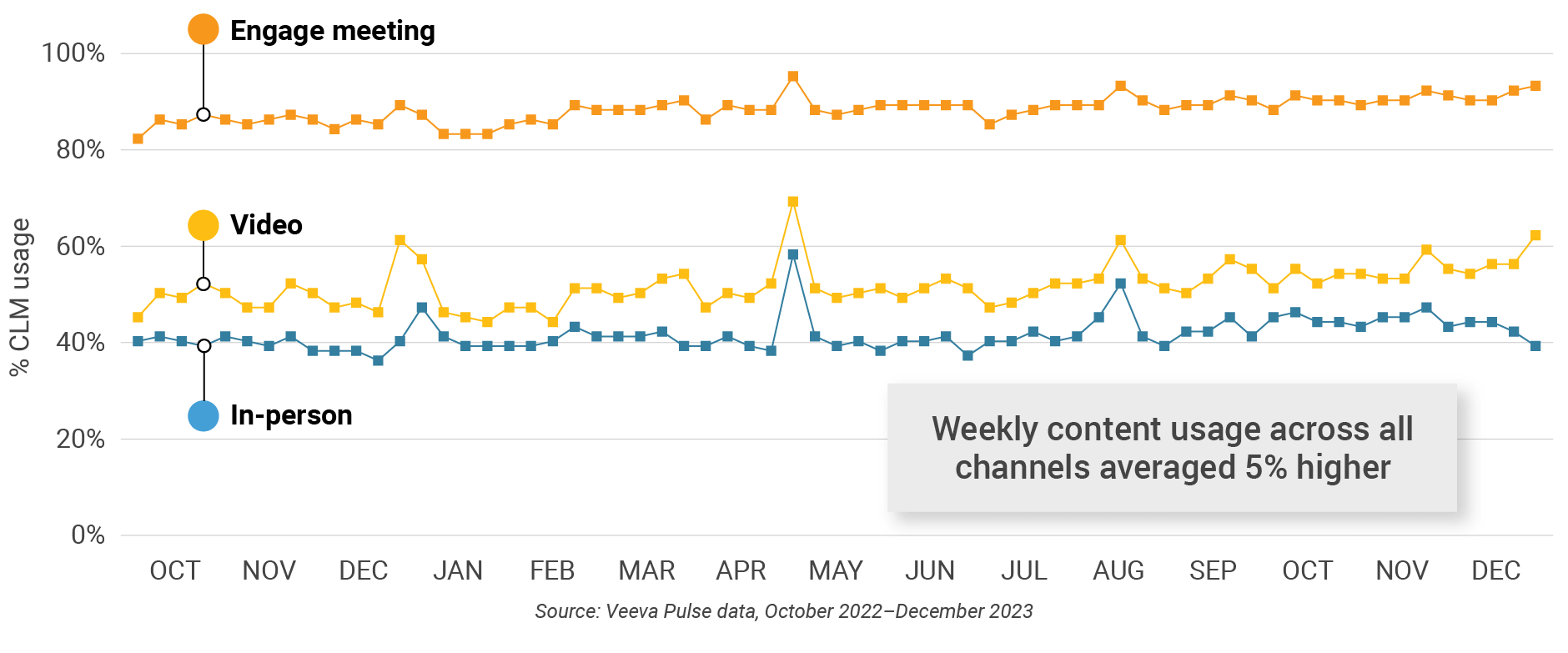

Figure 7: Content usage by channel, global

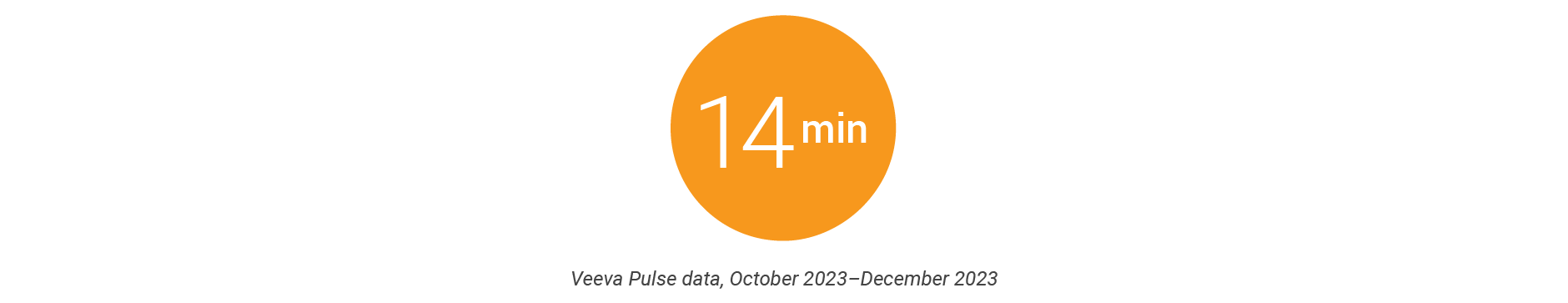

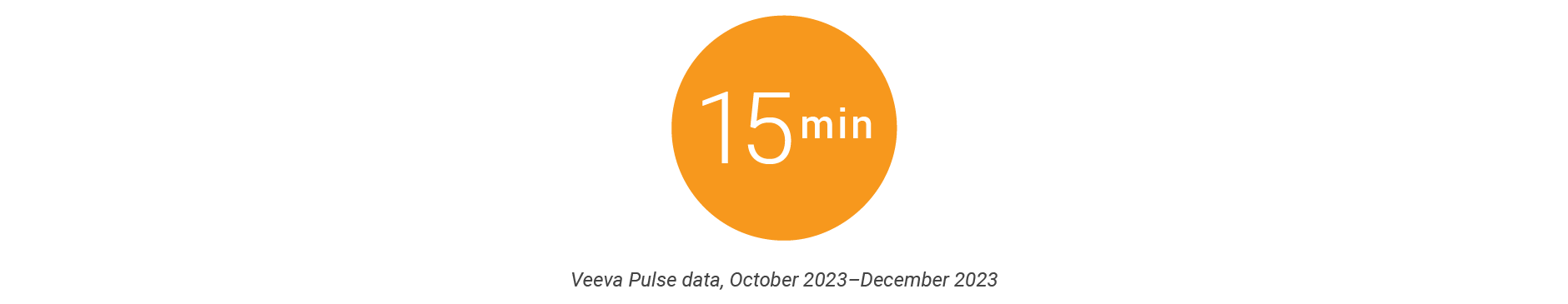

Figure 8: Veeva CRM Engage meeting duration, global

U.S. market trends

Figure 9: Channel mix evolution, U.S.

Figure 10: Channel mix, U.S.

U.S. field team activity

Weekly activity per user by engagement channel

Figure 11: Activity, U.S.

Figure 12: Activity by user type, U.S..

Figure 13: Activity by company size, U.S.

U.S. engagement quality

Consolidation of key quality metrics

Figure 14: Approved email volume, U.S.

Figure 15: Content usage by channel, U.S.

Figure 16: Veeva CRM Engage meeting duration, U.S.

Europe market trends

Figure 17: Channel mix evolution, Europe

Figure 18: Channel mix, Europe

Europe field team activity

Weekly activity per user by engagement channel

Figure 19: Activity by country, EU5

Figure 20: Activity by user type, Europe

Figure 21: Activity by company size, Europe

Europe engagement quality

Consolidation of key quality metrics

Figure 22: Approved email volume, Europe

Figure 23: Content usage by channel, Europe

Figure 24: Veeva CRM Engage meeting duration, Europe

Asia market trends

Figure 25: Channel mix evolution, Asia

Figure 26: Channel mix, Asia

Asia field team activity

Weekly activity per user by engagement channel

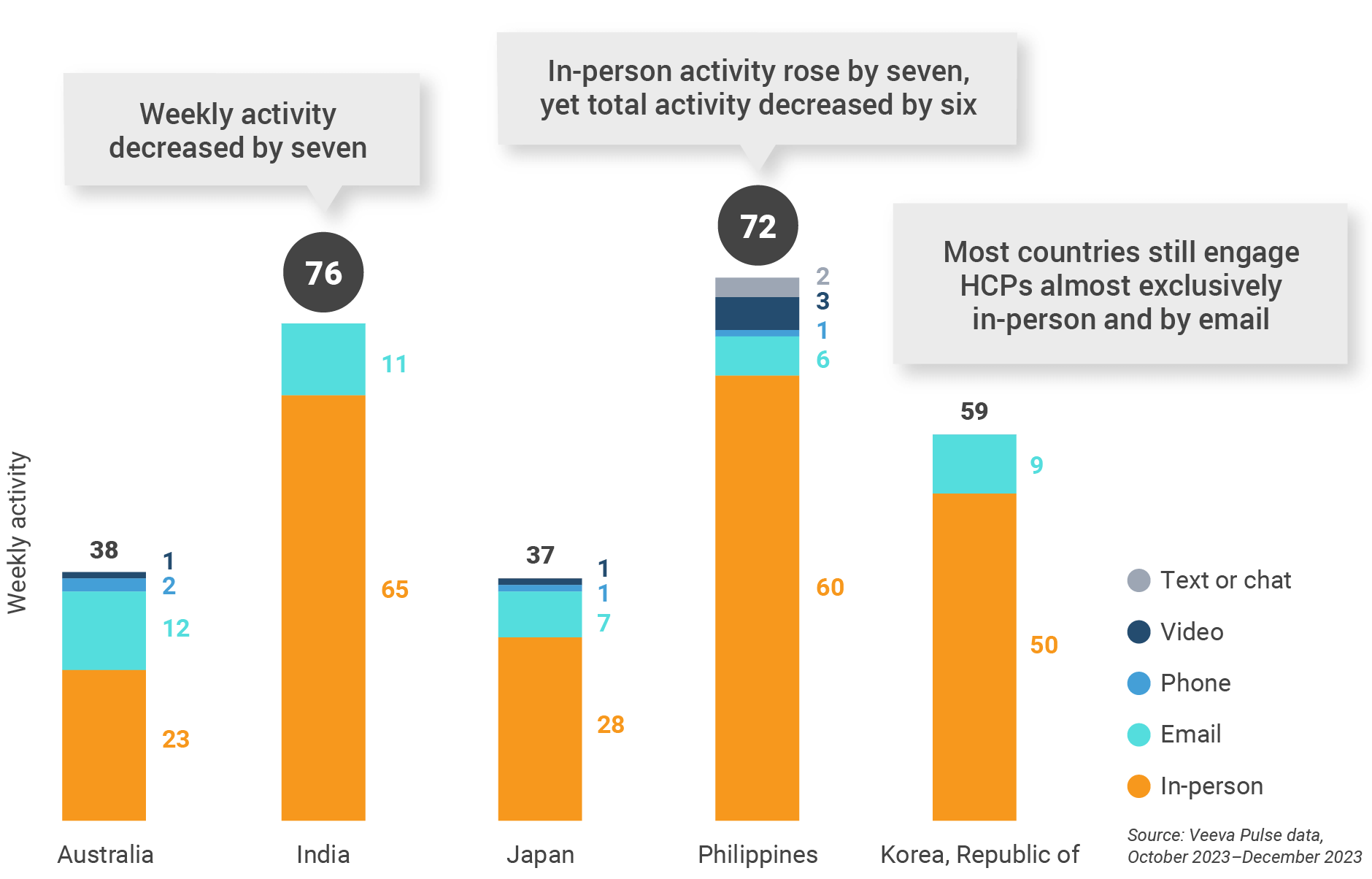

Figure 27: Activity by country, Asia

Figure 28: Activity by user type, Asia

Figure 29: Activity by company size, Asia

Asia engagement quality

Consolidation of key quality metrics

Figure 30: Approved email volume, Asia

Figure 31: Content usage by channel, Asia

Figure 32: Veeva CRM Engage meeting duration, Asia

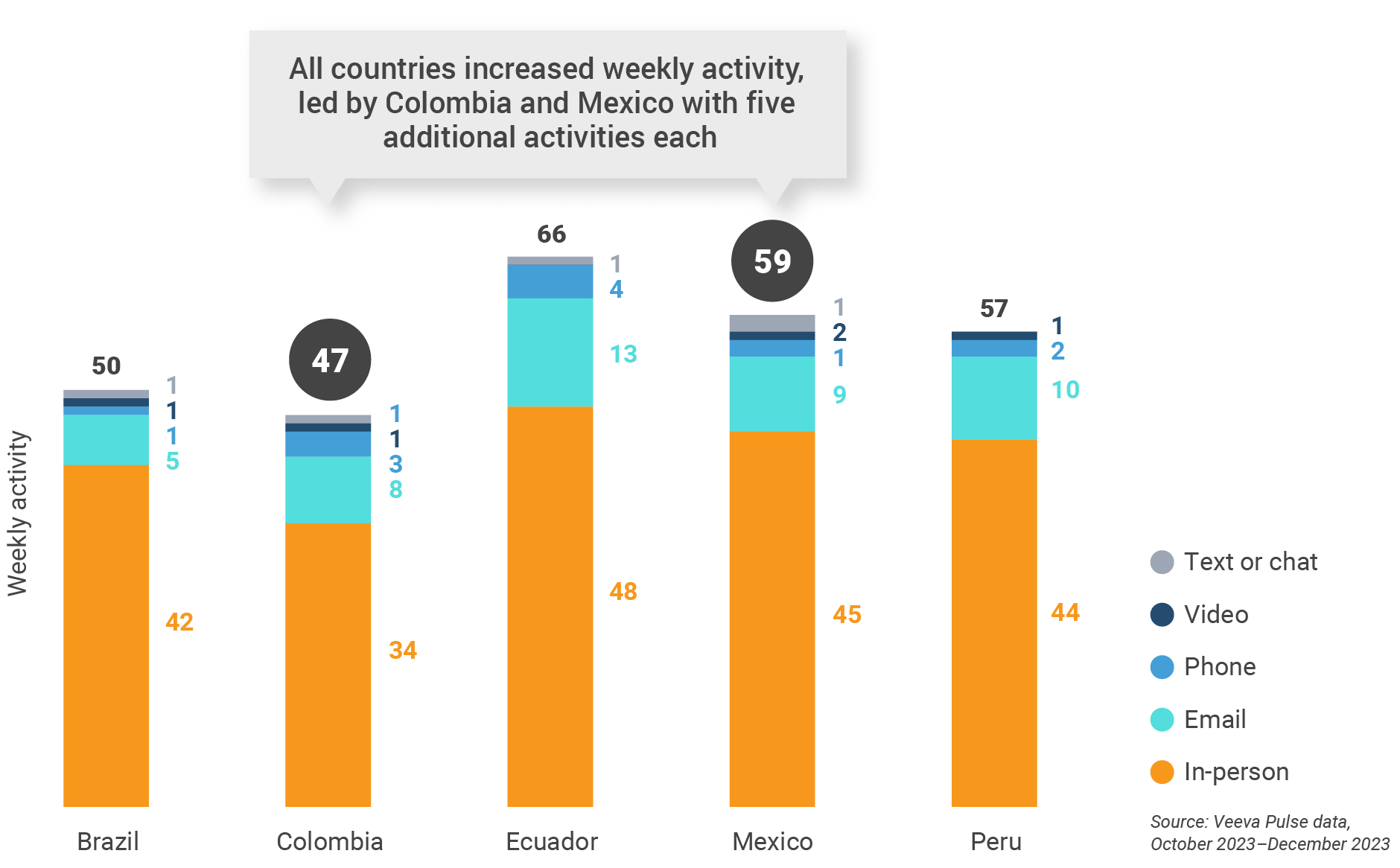

Latin America market trends

Figure 33: Channel mix evolution, Latin America

Figure 34: Channel mix, Latin America

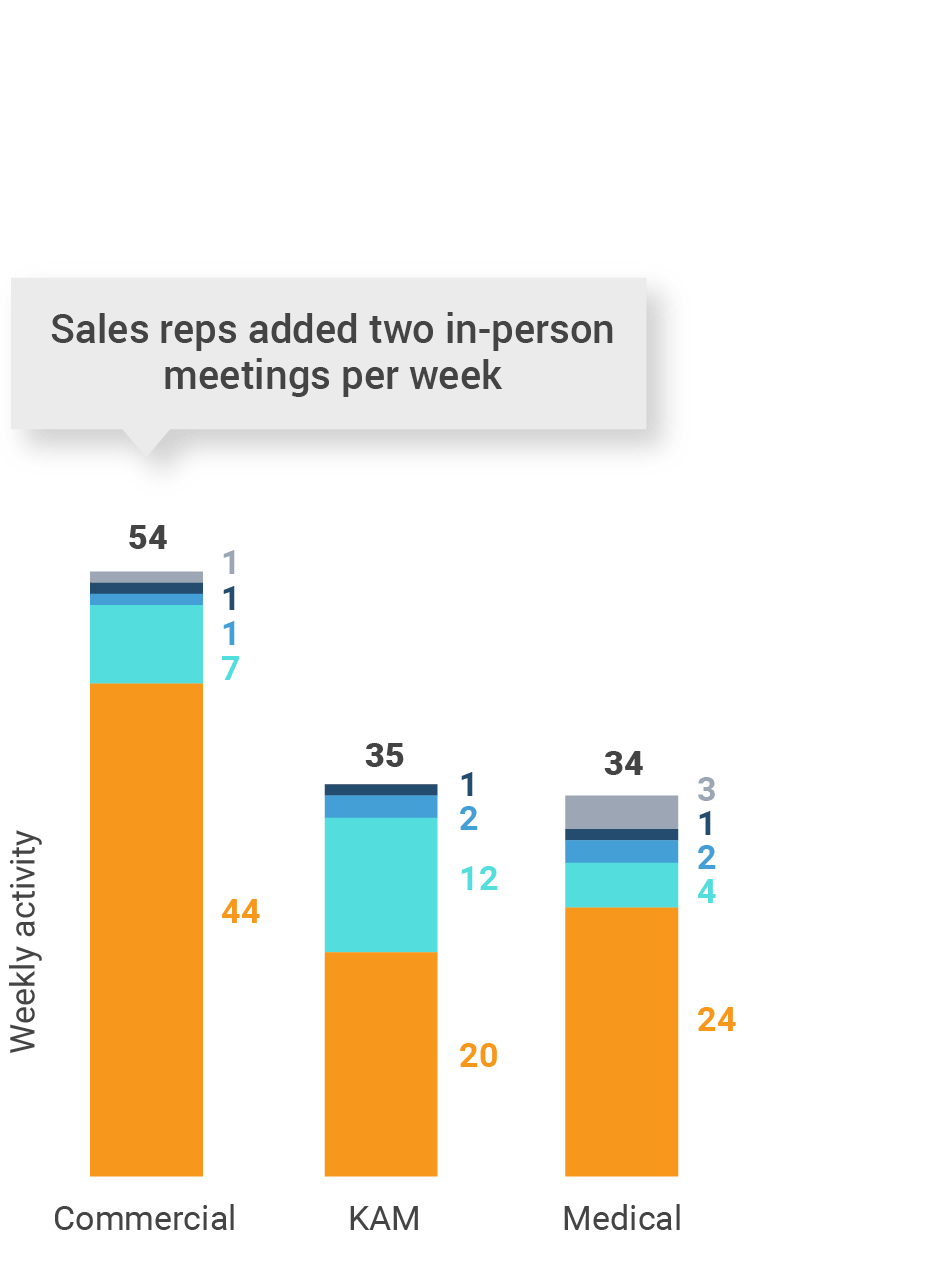

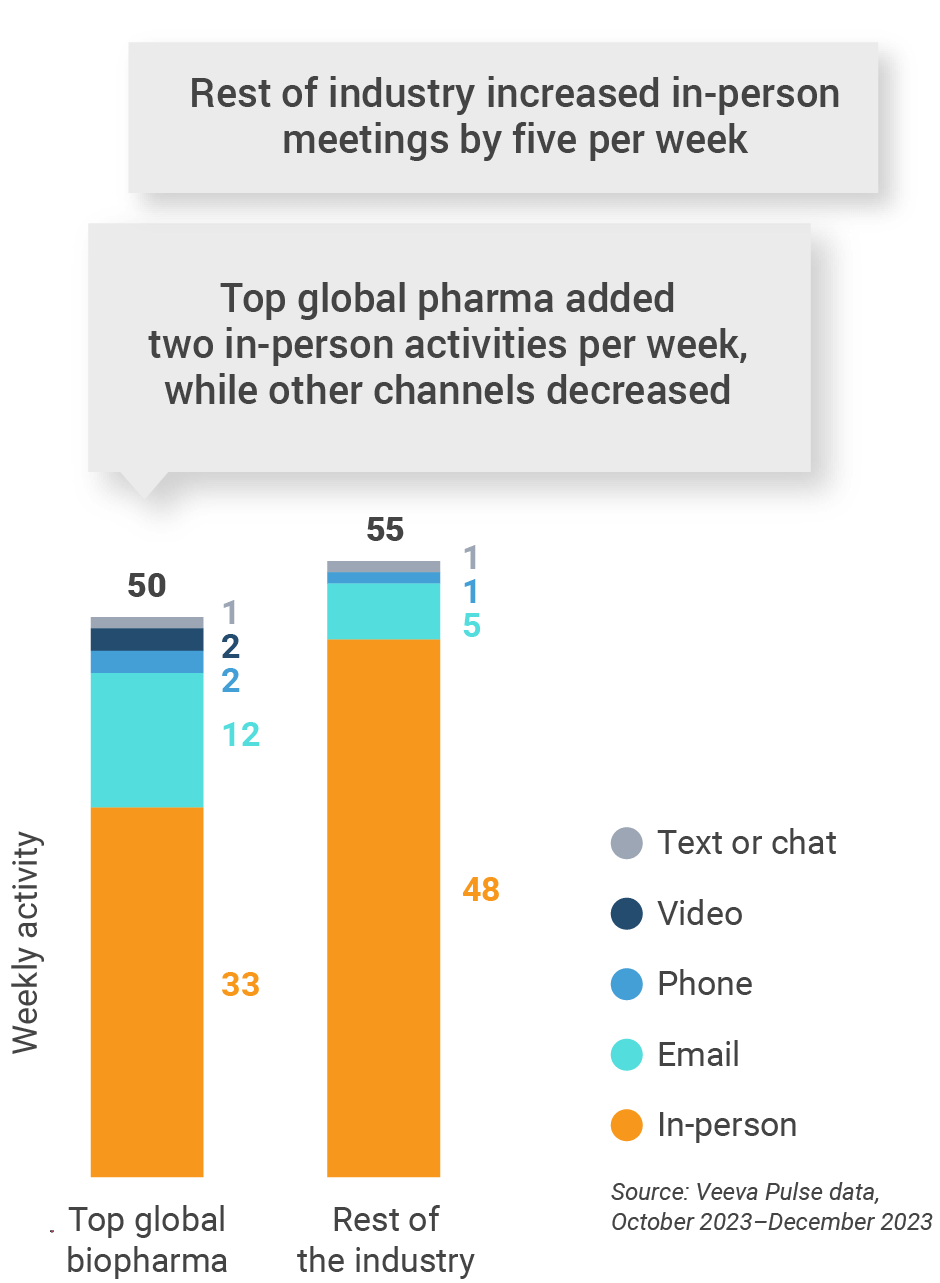

Latin America field team activity

Weekly activity per user by engagement channel

Figure 35: Activity by country, Latin America

Figure 36: Activity by user type, Latin America

Figure 37: Activity by company size, Latin America

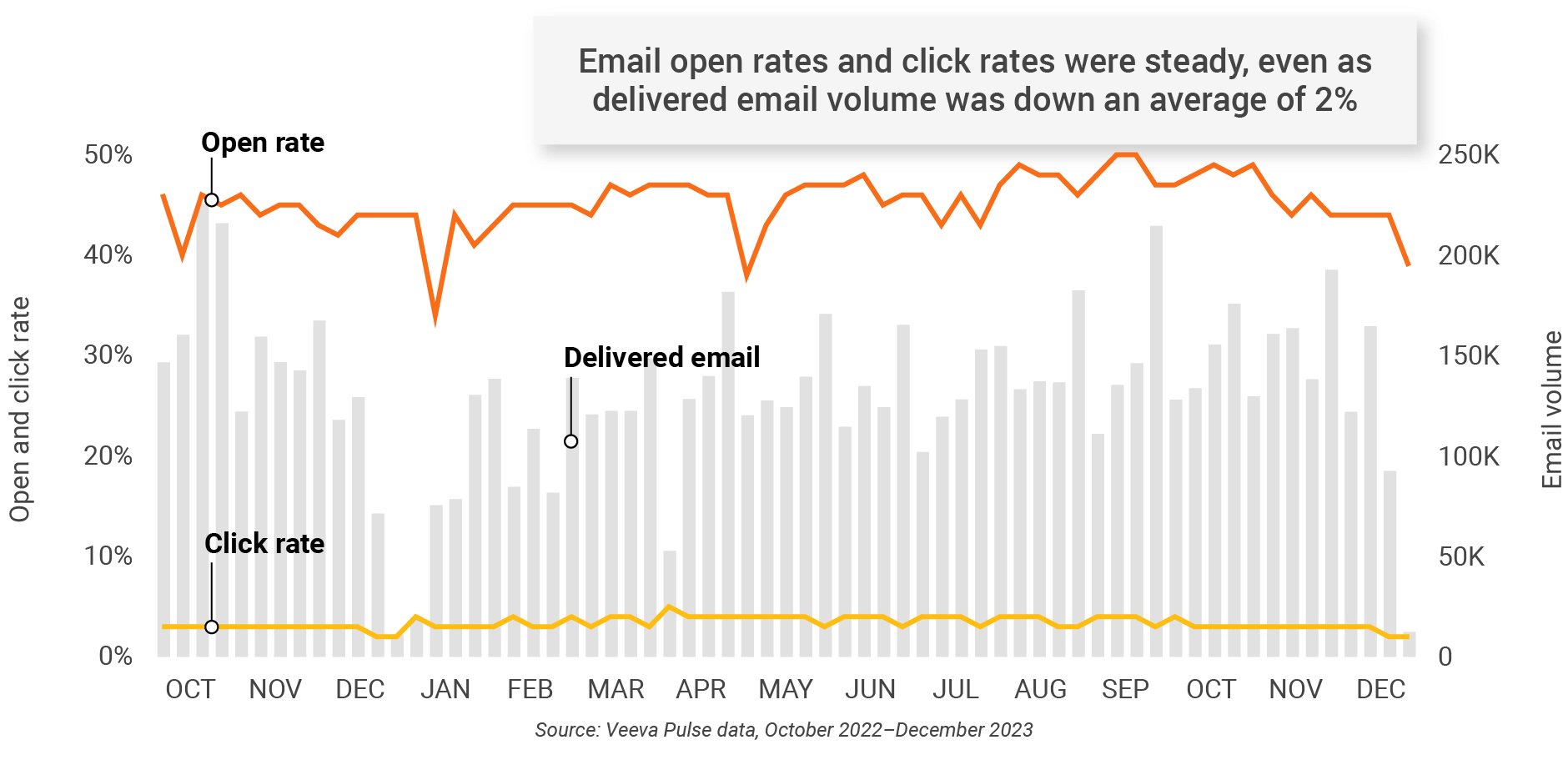

Latin America engagement quality

Consolidation of key quality metrics

Figure 38: Approved email volume, Latin America

Figure 39: Content usage by channel, Latin America

Figure 40: Veeva CRM Engage meeting duration, Latin America

Appendix: Data dictionary

Metric definitions

- Channel mix evolution over time: Weekly Veeva CRM activity volume broken down by the channel of engagement (in-person, phone, video, email, chat, or text)

- Channel mix: Total Veeva CRM activity volume broken down by engagement channel percentage

- Weekly activities per user: The average weekly number of Veeva CRM activities submitted per number of users active in Veeva CRM

- Approved email volume: Volume of approved emails sent via Veeva CRM

- Email open rate: Percentage of approved emails opened at least once out of all approved emails sent via Veeva CRM

- Email click rate: Percentage of approved emails clicked at least once out of all approved emails sent via Veeva CRM

- In-person % CLM usage: Percentage of in-person engagements that leveraged content in Veeva CRM

- Video % CLM usage: Percentage of video engagements that leveraged content in Veeva CRM

- Veeva CRM Engage meeting % CLM usage: Percentage of Veeva CRM Engage meetings that leveraged content in Veeva CRM

- Veeva CRM Engage meeting duration: The average duration of Veeva CRM Engage meetings in minutes

Engagement channel definitions

- In-person: Submitted calls with a CRM Standard Metrics call channel value of ‘in-person’

- Phone: Submitted calls with a CRM Standard Metrics call channel value of ‘phone’

- Video: Veeva CRM Engage calls and video calls via other platforms that are then recorded as calls in Veeva CRM with a Standard Metrics call channel value of ‘video’

- Email: Approved emails and emails sent via other platforms that are then recorded as calls in Veeva CRM with a Standard Metrics call channel value of ‘email’

- Chat or text: Submitted calls with a CRM Standard Metrics call channel value of ‘chat or text’

User type definitions

- Sales: Users that have been classified with the ‘sales’ value in the CRM Standard Metrics user type field

- Key account manager: Users that have been classified with the ‘key account manager’ value in the CRM Standard Metrics user type field

- Medical: Users that have been classified with the ‘medical’ value in the CRM Standard Metrics user type field

- Top global biopharma: Top 17 global biopharma companies by revenue

- Rest of industry: All other biopharmas

Region definitions

- Global: All markets globally

- Europe: Albania, Andorra, Armenia, Aruba, Austria, Azerbaijan, Belarus, Belgium, Bermuda, Bosnia and Herzegovina,

Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, French Polynesia, Georgia, Germany,

Greece, Greenland, Guadeloupe, Guernsey, Hungary, Ireland, Italy, Jersey, Latvia, Lithuania, Luxembourg, Macedonia,

Malta, Martinique, Republic of Moldova, Monaco, Montenegro, Netherlands, New Caledonia, Norway, Poland, Portugal,

Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Ukraine, United Kingdom - Asia: Australia, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, Cocos (Keeling) Islands, Indonesia, Japan,

Kazakhstan, Republic of Korea, Kyrgyzstan, Malaysia, Mongolia, Myanmar, Nauru, Nepal, New Zealand, Philippines,

Samoa, Singapore, Solomon Islands, Sri Lanka, Taiwan, Tajikistan, Thailand, Turkmenistan, Uzbekistan, Vietnam - Latin America: Antigua and Barbuda, Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa

Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Guatemala, Guyana, Haiti, Honduras, Jamaica, Mexico,

Nicaragua, Panama, Paraguay, Peru, Trinidad and Tobago, Uruguay, Venezuela

Methodology

The Veeva Pulse Field Trends Report is a quarterly industry benchmark for global and regional healthcare professional

(HCP) engagement across the life sciences industry. The report is based on proprietary Veeva Pulse data and insights

from field engagement activities of more than 80% of all industry representatives worldwide (Asia Pacific, Europe, Latin

America, and the United States). Veeva CRM Standard Metrics — now used industrywide — provide the basis for

consistent collection and measurement of engagement KPIs including channel mix and productivity across regions,

roles, and market segments. The findings are based on:

- Approximately 600 million annual global field activities captured in Veeva CRM and Veeva CRM Engage

- 70 billion prescription (Rx) and medical (Mx) records captured in Veeva Compass Patient, U.S.-specific anonymous patient longitudinal data, including prescriptions, procedures, and diagnoses

- 3+ million profiles containing publications, clinical trials, conferences, associations, guidelines, grants, payments, social media, news mentions, and influence on community practice from Veeva Link Key People across 85+ countries and 24 therapeutic areas

- Global reference data of healthcare professionals, healthcare organizations, and affiliations from Veeva OpenData, containing addresses, emails, specialties, demographics, and compliance data (license information and industry identifiers) available in 100+ countries today and 115+ countries by the end of 2024

The Veeva Pulse Field Trends Report delivers insights that inform the industry and help field teams align their strategy to

key market trends for improved commercial success. The global Veeva Business Consulting team also helps customers

inform their strategies using industry benchmarking with Veeva Pulse data.