Blog

Veeva’s Field Trends Report Reveals Big Differences in European Digital Productivity

Aug 17, 2022 | Aaron Bean

Aug 17, 2022 | Aaron Bean

The Veeva Pulse Field Trends Report gives life sciences companies worldwide the definitive picture of field team engagement with HCPs. Derived from field engagement activities of more than 80% of industry representatives, these insights enable you to benchmark your organization against industry peers to improve your commercial operations.

Globally, the results show that a blended approach of in-person and virtual channels secures three times the promotional response of in-person meetings alone.

Digital engagement is high in Europe compared to other regions. Market leaders are seeing the benefits of video meetings, including more time with their customers and effective message delivery for field teams, thanks to content and other visual aids. Video meetings offer a richer experience for HCPs, who consistently favor remote opportunities to engage with pharma companies.

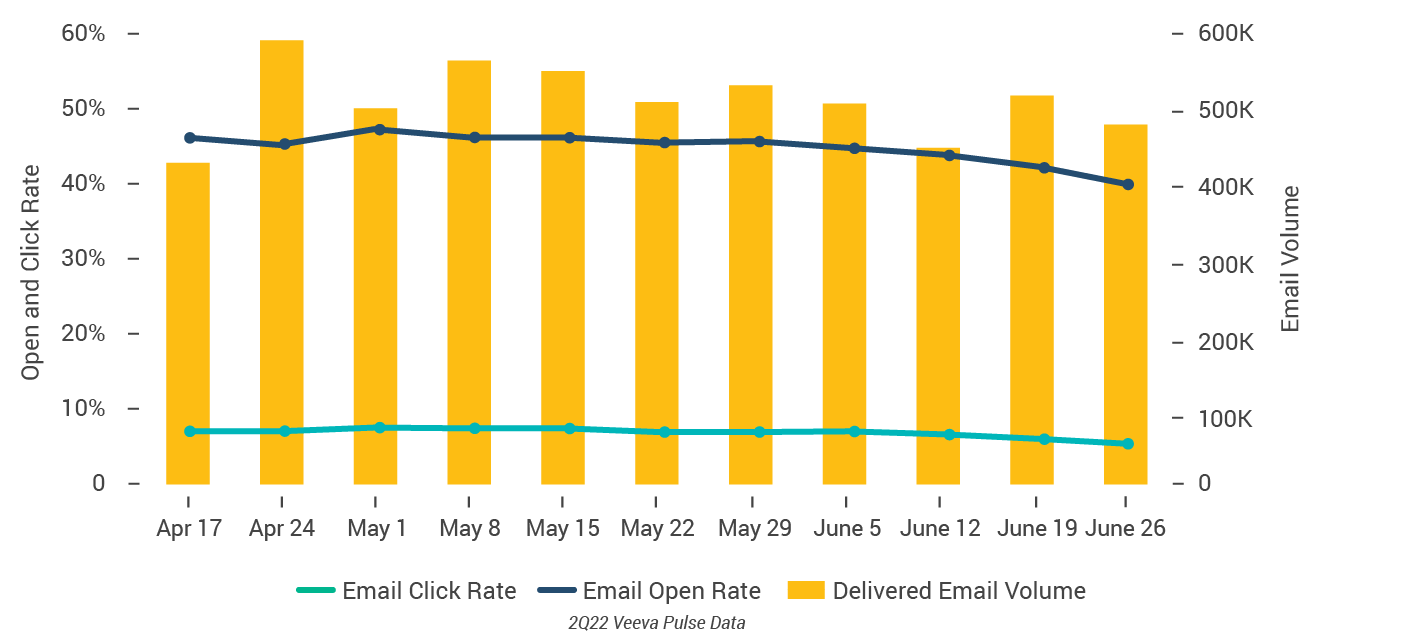

Across the region, email is another popular and effective part of the omnichannel strategy. The average open rate of Veeva CRM Approved Email was high over the last quarter, at 42%.

Still, there are big differences in digital productivity between European countries, and in digital maturity by user types. It’s critically important to have industry context as you plan your strategy. Here are some of the key insights from the results for European field teams.

1. Market leaders use video for higher quality engagement

Globally, Veeva Pulse data reveal that the fundamental drivers of promotional response are time with the customer and use of content. Video meetings efficiently combine the two for the greatest impact, resulting in high-quality HCP interactions.

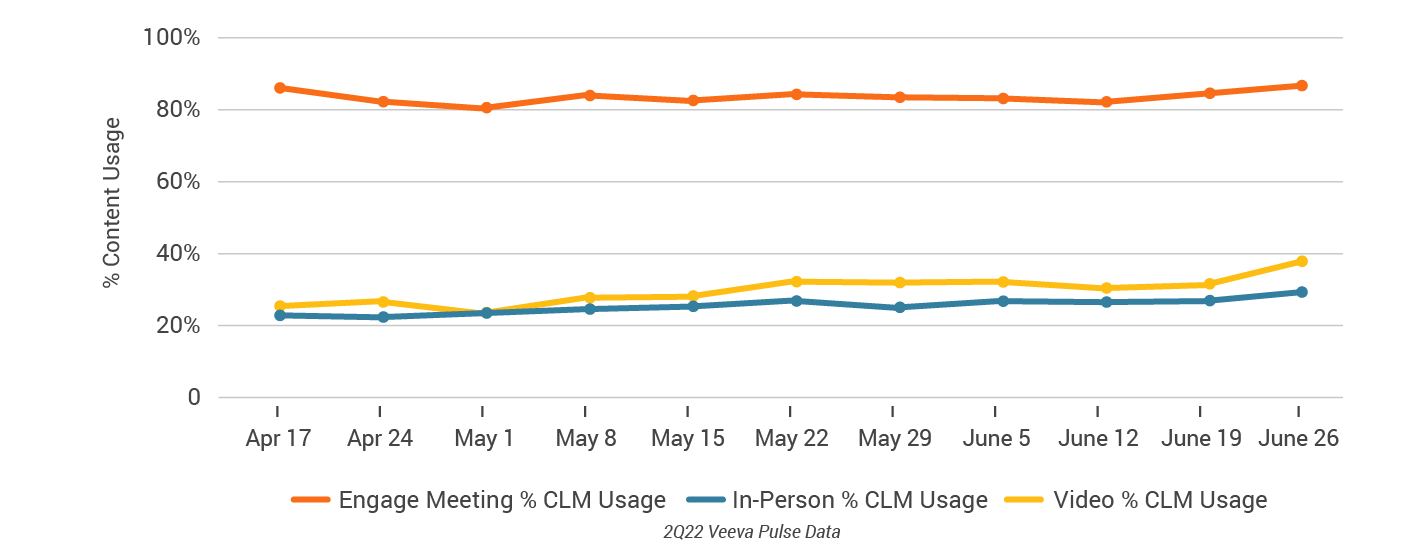

In Europe, for instance, we see a substantial difference in tracked content usage between Veeva CRM Engage and other video platforms (Figure 1). Tracked content usage through Veeva CRM Engage has consistently been at 80% or higher for the last quarter. This compares to less than 40% for video calls made using other platforms (and even lower for in-person meetings).

FIGURE 1: TRENDING CONTENT USAGE BY CHANNEL, EUROPE

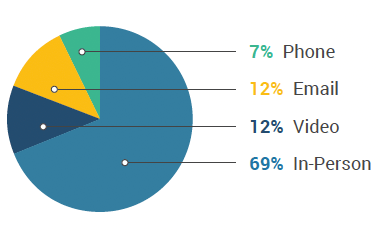

However, global market leaders are able to use video meetings for even greater impact. The top three leading oncology companies supplement in-person meetings with digital channels and use video in 12% of their interactions compared to 5% among their industry peers (Figure 2). Leading oncology companies are more than twice as likely to use content in video calls (33% vs. 16%) and have significantly longer meetings (47 minutes vs. 28 minutes).

Critically, HCPs want more digital engagement. Globally, three-quarters of HCPs (rising to 93% in Germany) want to keep or increase their share of remote interactions with pharma companies1.

FIGURE 2: VIRTUAL ENGAGEMENT IN ONCOLOGY

LEADING ONCOLOGY (TOP 3)

TOP 20 ONCOLOGY

2. Email popular and effective in Europe

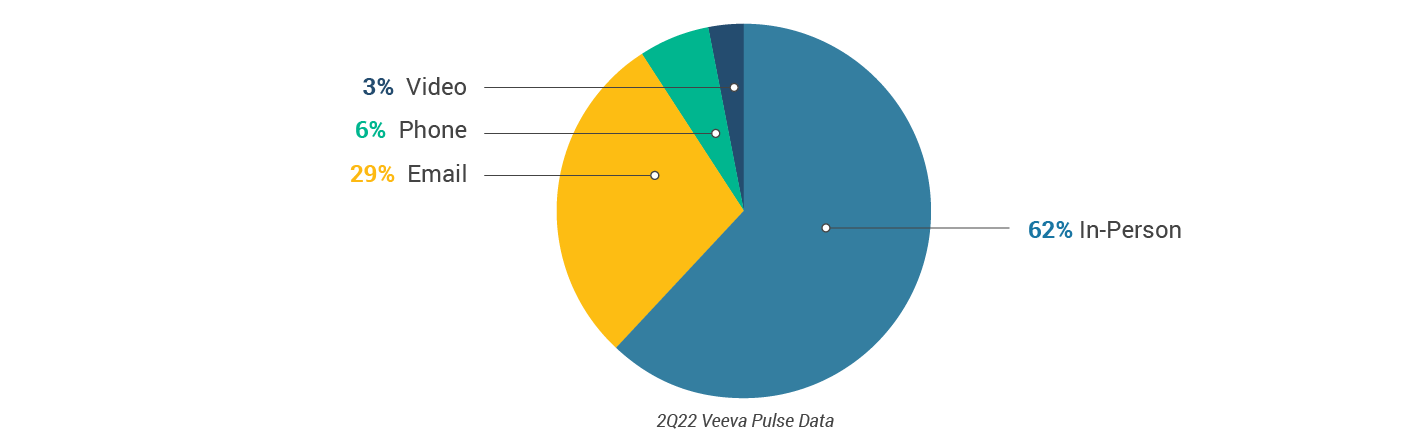

Globally, in-person is now the primary form of HCP engagement. Between April and June 2022, Veeva Pulse insights reveal a rough 70/30 mix of in-person to virtual engagement (video, chat or text, phone, and email) with HCPs.

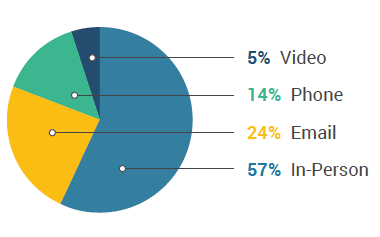

In Europe, in-person engagement is similarly dominant at 62% of the channel mix (Figure 3). However, email is a more significant secondary channel than in other regions, at 29% of total interactions compared to 18% globally.

FIGURE 3: CHANNEL MIX, EUROPE

Life sciences companies are consistently using email as a key connector of their omnichannel strategies. The volume of delivered Veeva CRM Approved Email remained high across the last quarter at above 400,000 weekly (Figure 4). Better average open rates relative to other regions (42% open rate vs. 27% in the US) suggest that the interactions are high quality.

FIGURE 4: EUROPEAN ENGAGEMENT QUALITY –

TRENDING APPROVED EMAIL VOLUME VS. OPEN AND CLICK RATE

3. Significant regional differences in productivity

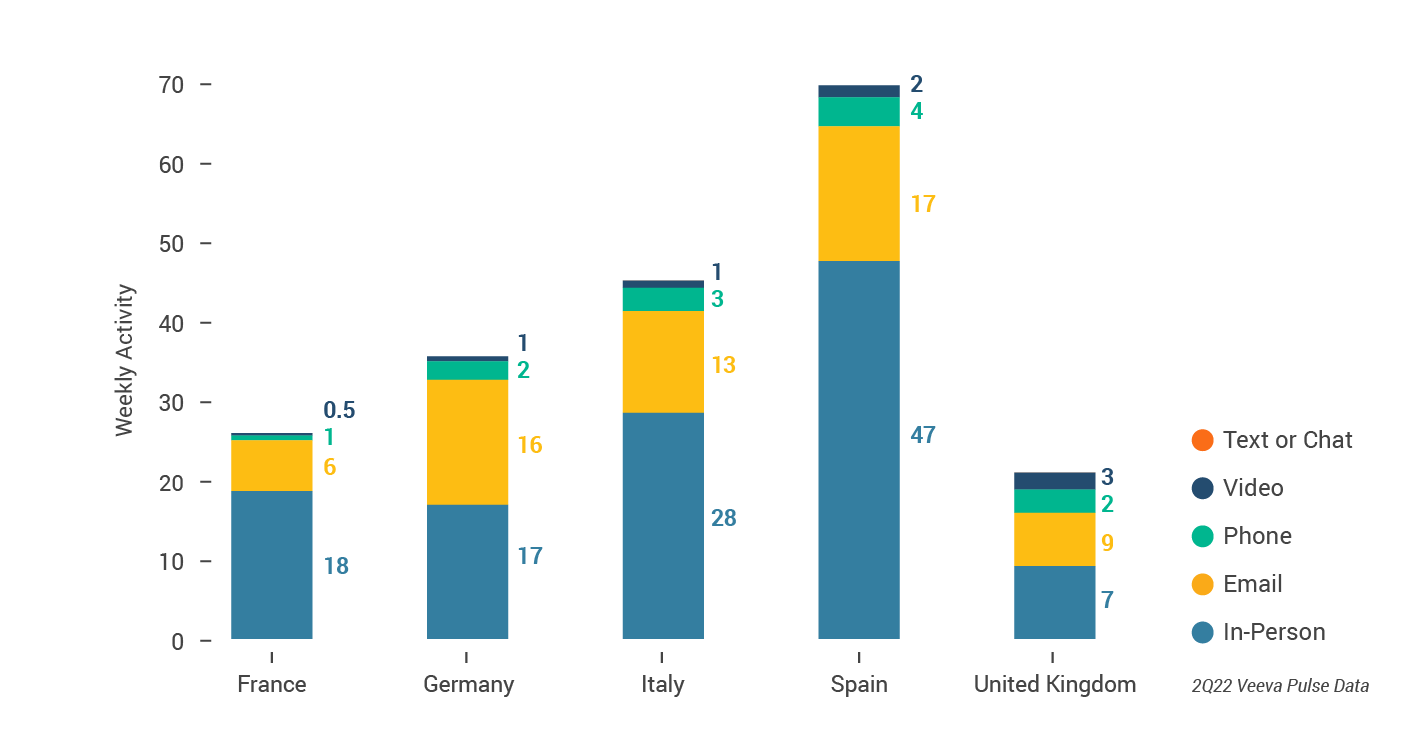

Europe enjoys a high level of omnichannel sophistication across all markets, recording between 8 and 23 weekly activities per user across video, email, and phone combined (Figure 5). However, there is significant regional variation in productivity, with the UK and Spain standing out for their distinct levels of weekly channel activity.

Veeva CRM users in Spain recorded a higher volume of interactions per user than in the four other major European countries (France, Germany, Italy, United Kingdom). Spanish users are particularly active in-person, recording 47 HCP interactions per week through this channel.

Conversely, in the UK, in-person access has not returned to the same level as in other European markets, at just seven weekly interactions (compared to 28 in Italy and 18 in France).

Veeva CRM users in the UK lean more heavily on video (three weekly activities per user, compared with two or fewer in other EU markets). Veeva Pulse data indicate that engaging with HCPs through a mix of in-person and virtual meetings has a 3x greater promotional response than in-person alone.

FIGURE 5: WEEKLY ACTIVITY PER USER BY ENGAGEMENT CHANNEL,

EUROPEAN COUNTRIES

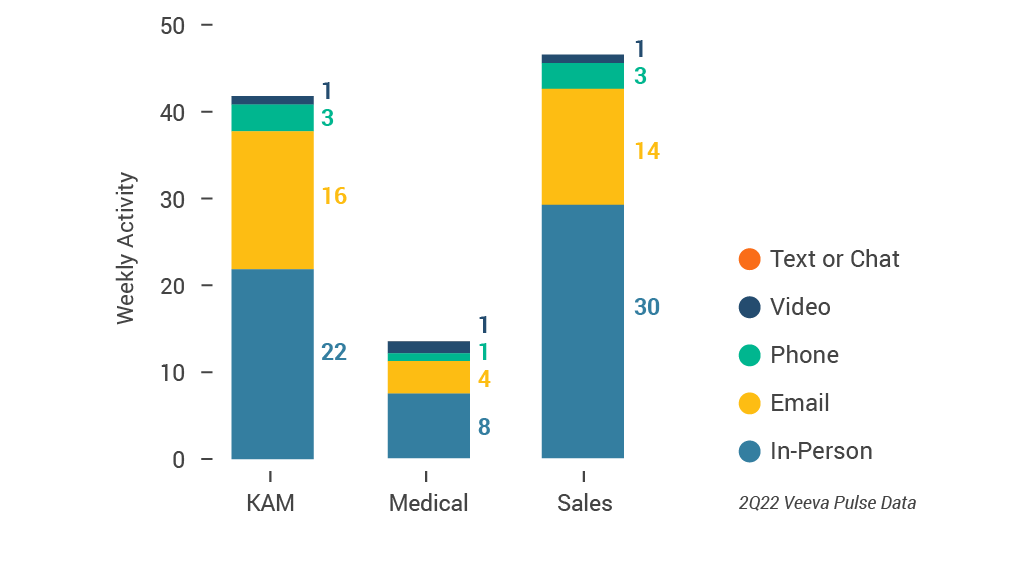

4. Medical behind KAM and Sales in digital maturity

A comparison of productivity by user type suggests Medical lags behind KAM and Sales roles in digital channel adoption. Despite often engaging the same HCPs (with the same channel preferences) as KAM and Sales, Sales completed three times as many weekly digital activities as Medical in Europe (Figure 6).

This is a missed opportunity as Medical has access to high-quality content – a key determinant of channel effectiveness — and the demand for medically-led engagement is growing.

FIGURE 6: WEEKLY ACTIVITY PER USER BY ENGAGEMENT CHANNEL,

BY USER TYPE, EUROPE

Discover how your team and market compare

Given that HCPs worldwide are enthusiastic about digital engagement, expanding the use of video (and email) is likely to be a beneficial move. Video meetings create a promotional accelerator and complement in-person meetings (rather than replacing them).

In the full report, we also explore newer channels, like chat and text, that could support your “pull” model when HCPs reach out directly to your reps for information.

Today, a blended model — centered on deep in-person and digital connections — is the most effective way for reps to remain accessible, even when they’re not physically present with HCPs. In effect, the new engagement approach means that the best reps never leave the room.

Download the Veeva Pulse Field Trends Report to see all the latest global field trends and find out what’s happening in your market.

“Doctors’ Changing Expectations of Pharma Are Here to Stay”, BCG, September 2021