White Paper

Creating Digital Impact:

Three Steps to Smarter, Faster Field Planning

Better channel enablement is now the priority

Pharma companies that advanced their use of technology in the last few years improved engagement with healthcare professionals (HCPs). Market leaders in the region who focus on video meetings are also seeing tangible benefits, including more time with their customers and effective message delivery for field teams.

European pharma companies have embraced digital (and reverted to inperson) channels at different rates. What was a necessity during the pandemic has now become a choice. Commercial operations leaders will need to decide the role hybrid engagement should have in HCP-rep interactions.

This White Paper offers three steps for pharma companies to convert their digital capabilities into a competitive advantage: generating new channel insights, enriching customer profiles with data, and changing the approach to field plans. By using data more efficiently, companies could reduce their IT spend and enhance customer satisfaction. A simplified, integrated approach to CRM in their field strategies would also boost agility.

Leaving behind the manual approach

Field teams are often the number one spend item in commercial life sciences, and maximizing return on this investment is critical. Embedding omnichannel excellence—a seamlessly integrated customer experience across distinct touchpoints—within the organization can help overall business performance: for example, by improving customer engagement and productivity.

Most pharma companies have access to many tools and a digitally enabled field force, but back-end processes are often a stumbling block. It’s important to measure past performance to inform field plans but it’s not always straightforward. For example, field teams struggle to access consistent, timely, and accurate data. Some lack the capability to measure KPIs or are not trained to analyze data.

Field forces also rely heavily on manual solutions, particularly spreadsheets. Although helpful for some elements of team coordination, they are inefficient and fail to provide a single view of either field activity or customer interactions. The manual approach to planning is a lose-lose, burdening teams like IT and commercial operations while increasing time out of the field for reps and sales directors.

Rather than improve efficiency or accuracy, the manual approach adds layers of complexity just to keep information current. Reps cannot be sure they have the latest territory information, resulting in more time spent on field planning that could be focused on customers. As they are standalone tools by design and highly tailored to the needs of each organization, it can be difficult to integrate spreadsheets with CRM tools that track field activity.

Conversely, a digitally enabled commercial operations team can shorten cycle times and collaborate efficiently with the field. If reps are sick or off work, teams can quickly move the roster to cover vacancies. If they are working on CRM-integrated solutions, they can update resource allocations within the software at the click of a button.

By leaving behind the manual approach, field forces gain access to a goldmine of customer insights that they would otherwise struggle to use.

Reach and frequency are no longer enough

The old model of field planning was built on reach and frequency. Pharma companies assessed reps based on their outbound activities—such as the number of HCPs they managed to visit in a given month and how many times they contacted each one.

These measures are a helpful estimate of rep productivity. But they overlook other indicators that reflect the quality of those touchpoints—the duration of the meeting, for example, or progress in the customer journey.

The reach and frequency model is still relevant for many pharma companies planning their sales, but is it sufficient to move the dial on customer engagement? In the hybrid era, field forces must be empowered to identify the right journey and channel mix for each HCP.

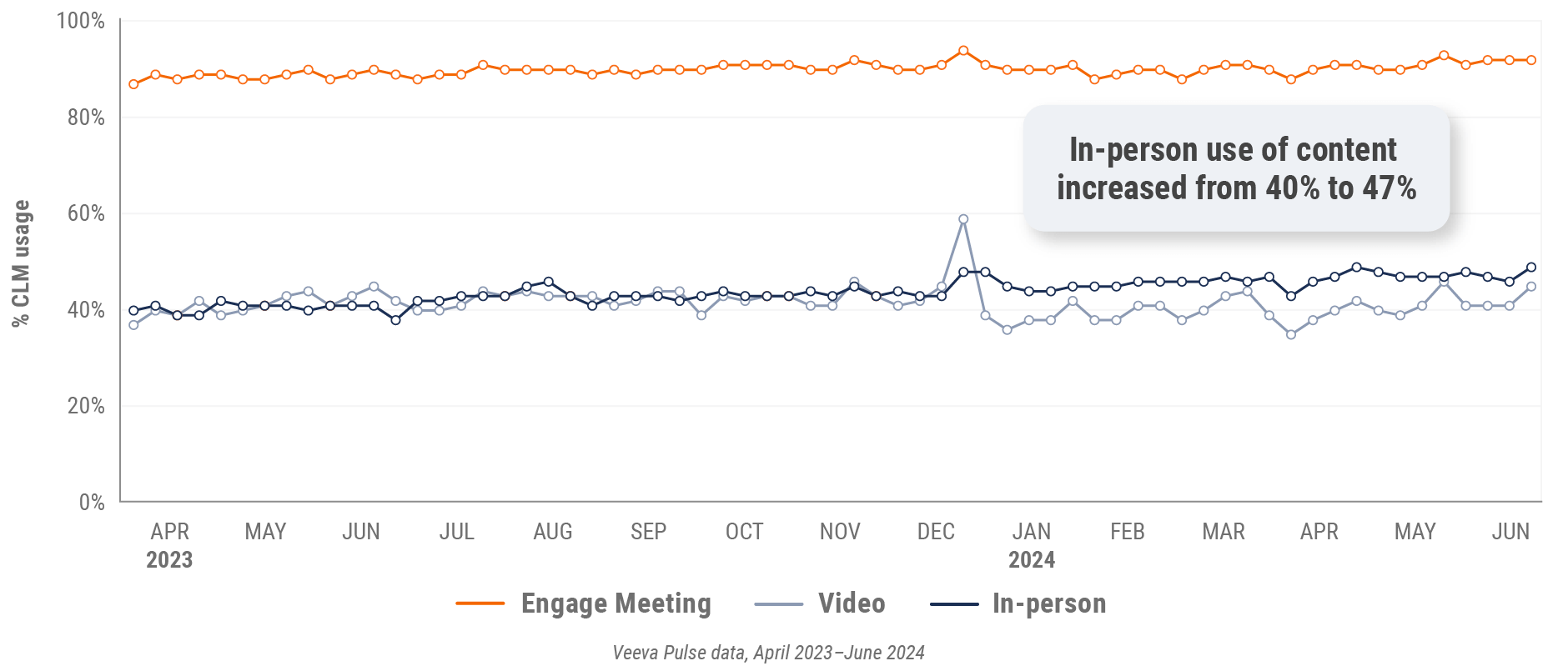

The opportunity of doing things differently is significant. The Veeva Pulse Field Trends Report shows that video meetings are more impactful than traditional calls or in-person meetings as they facilitate longer, deeper conversations centered on compelling content [Figure 1].

Calls using closed-loop marketing (CLM) are twice as effective at driving promotional response than those without. This is because CLM allows reps to capture real-time feedback from HCPs during their meetings, which they can later integrate into CRM software. CLM is even more effective when combined with remote channels.1

Commercial operations can improve field effectiveness by showing reps how to use the available insights to determine the best next actions. Face-to-face interactions are still critical to building relationships with customers, but a hybrid approach that uses these insights produces an even better customer response.

Figure 1: Trending Content Usage by Channel

Three steps to more effective field planning

Step 1: Generate and understand channel insights

Before making changes, it’s important to compare the performance of different field execution channels across markets and product areas. These insights set the baseline today by addressing fundamental questions. Are all markets equal in their adoption of multichannel engagement? Are approved emails and calls more effective for some customer segments than others?

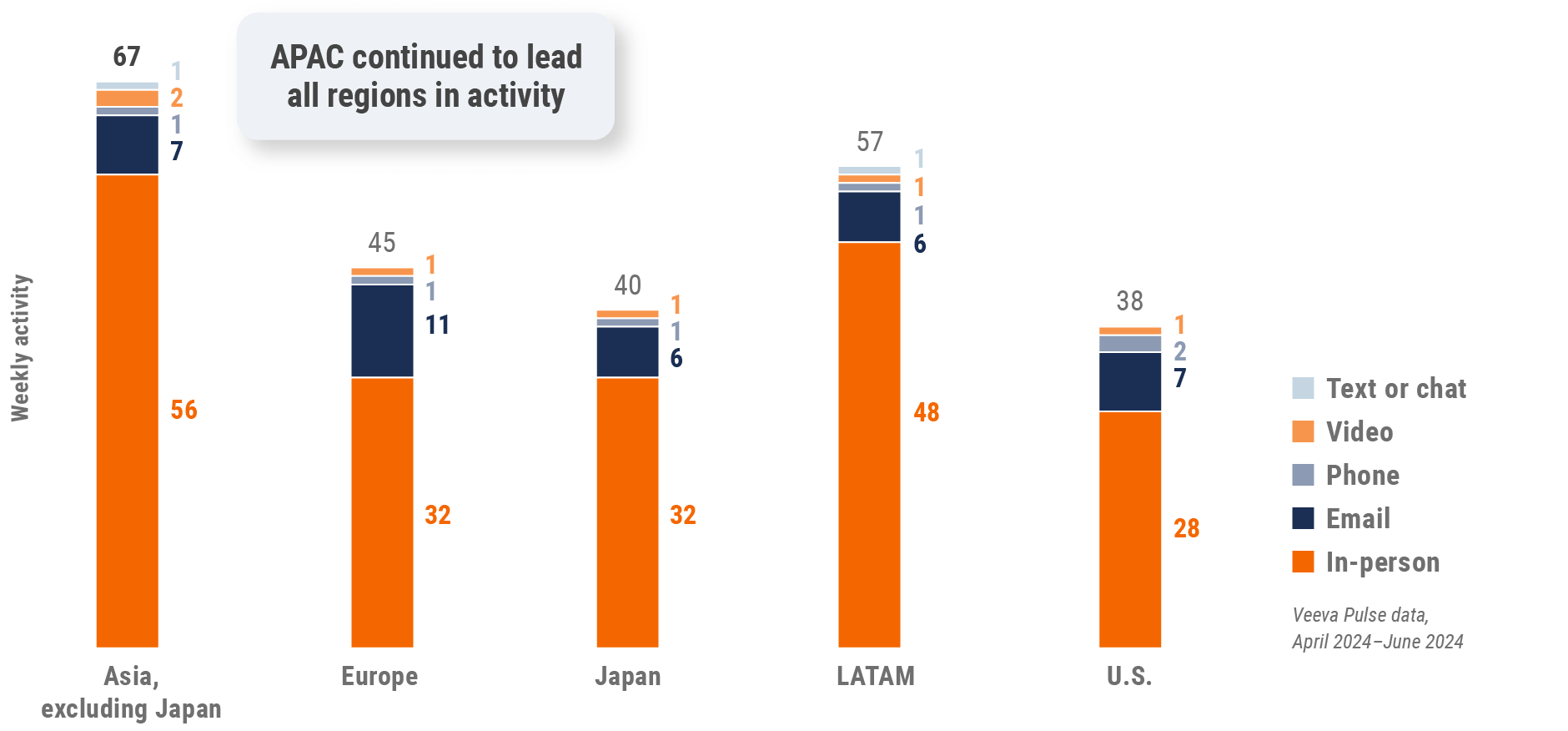

This is where benchmarking activity between channels and across markets can be helpful, as the level of advancement may vary widely [Figure 2].

Global field team activity Weekly activity per user by engagement channel Figure 2: Activity by region, global

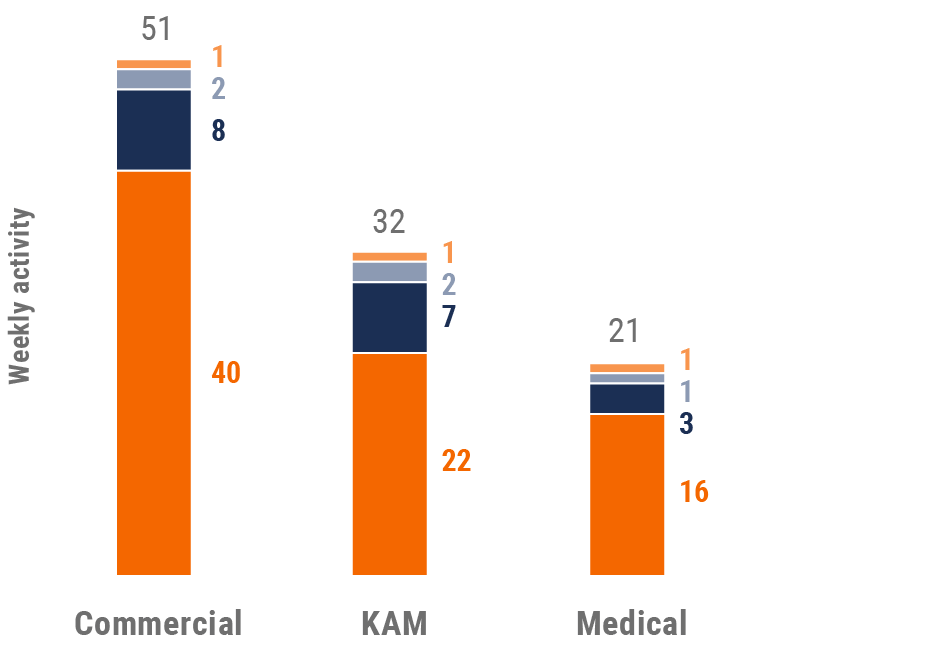

Figure 4: Activity by user type, global

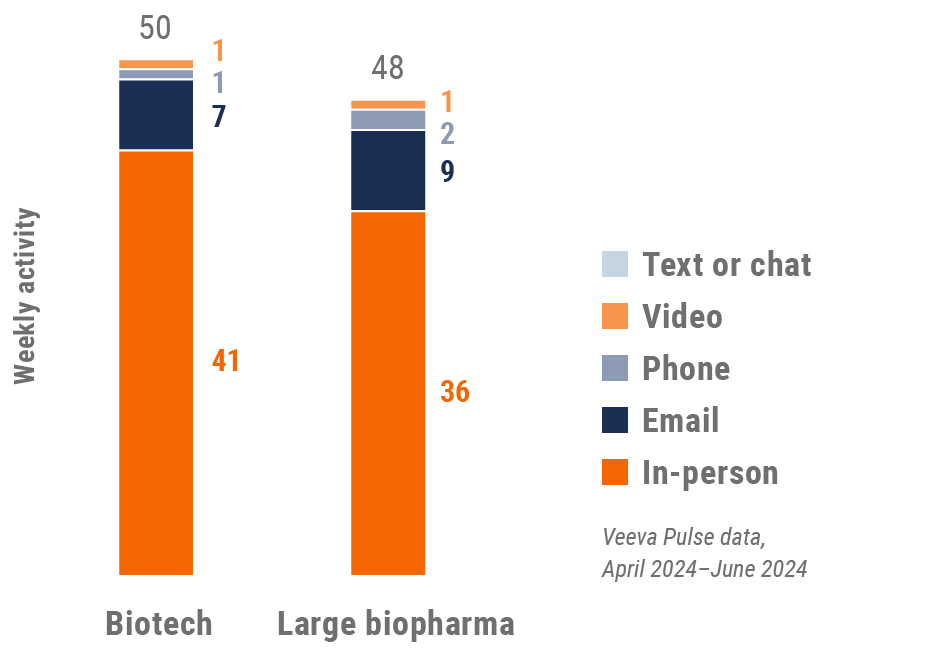

Figure 5: Activity by company size, global

In some markets, activity may persistently lag behind the industry. By benchmarking against industry peers, it is possible to pinpoint a performance gap in the use of approved certain channels where share of voice may be muted.

As you manage change and disruption in parallel, you need actionable performance insights to boost effectiveness in field enablement. By using industry-level data on field engagement activity, you can compare company performance relative to leaders in each market.

As you manage change and disruption in parallel, you need actionable performance insights to boost effectiveness in field enablement. By using industry-level data on field engagement activity, you can compare company performance relative to leaders in each market.

Step 2: Build data-led customer profiles

Once equipped with channel performance data, the next step is to deepen your understanding of individual HCP preferences. Sophisticated insights empower you to tailor the approach for each customer.

Field planning that relies on basic profiling—whether your customer is an early adopter, for example—is unlikely to advance the strategy. Instead, enrich your approach by layering CRM data onto the existing customer segmentation. Start by seeing if you can answer these questions:

- What are my customer’s overall channel affinities?

- Are they more likely to attend a live conference or virtual event?

- At which touchpoints do they prefer in-person meetings vs. video calls?

Some companies will be able to mine more than 10 years’ worth of data from their CRM systems to refine their targeting strategies. Create new customer archetypes by incorporating axes such as channel affinity (e.g., live events, faceto-face, approved email). These archetypes can be built by assessing past activity data (e.g., call logs, email open rates) and surveys. Assign each customer to a profile by using questions like:

- Which CLM slides have been represented to this customer?

- For how long was each slide presented?

- How has this customer interacted with our content over time?

Through this assessment, you’ll learn how your customers prefer to interact with your field teams, depending on where they are in the journey with your company. Your archetypes then help you scale insight for your field force, so it is easier to optimize the overall channel mix for the highest possible promotional response.

Step 3: Execute a multichannel field plan

Once your field forces are armed with granular channel insights and relevant customer profiles, they are well-positioned to act on multichannel field plans.

Being truly multichannel means realizing digital is not an add-on but a critical tool for field forces to be more efficient and effective. For some pharma companies, this will require a shift in how sales plans are viewed internally.

Sales plans are often used as proxy performance tracking tools that determine the field force’s efficiency. This could be counter-productive: for instance, by encouraging reps to revert to the channels that they are most experienced and confident using rather than the most appropriate one for each customer.

Field teams will feel empowered if they are given a plan that helps them execute in a sophisticated way, at scale. Even reps responsible for small territories will have too many HCPs to independently determine the most effective approach for each customer. This is where CRM data can help teams get to a granular level of planning.

Instead of a rigid annual sales plan, shifting to shorter plans (even at a monthly cadence) could help your teams define the right set of activities for each customer based on the last interaction. In a scenario where the HCP in question has published a paper or presented at an event, you will want to adjust your approach as quickly as possible. Don’t let legacy technology and a rigid plan be limiting factors.

Finally, data is only useful if it is representative and actionable. Context matters to understand the ‘why’ behind the next action, so input from the field force is essential. For instance, a rep might know from visiting an HCP that they struggle to keep on top of their inbox, so an approved email is not the best strategy. That qualitative feedback has to be captured and quickly incorporated into field activity plans.

Full speed ahead

LEO Pharma, a Danish pharmaceutical company and a global leader in medical dermatology, set high expectations when preparing to launch its blockbuster product. As it was competing against a top 10 pharma company, the team decided to assess its system and process readiness for a successful launch.

The company discovered 26 different CRM systems in use across affiliates, undermining visibility into local field activities and resources. LEO Pharma also realized it did not have a good view of customer targets due to its vast territory sizes, averaging around 10,000 accounts per territory.

The team implemented one CRM globally to harmonize its operations. It also rolled out Align to ensure launch flexibility and unify all commercial operations processes across markets.

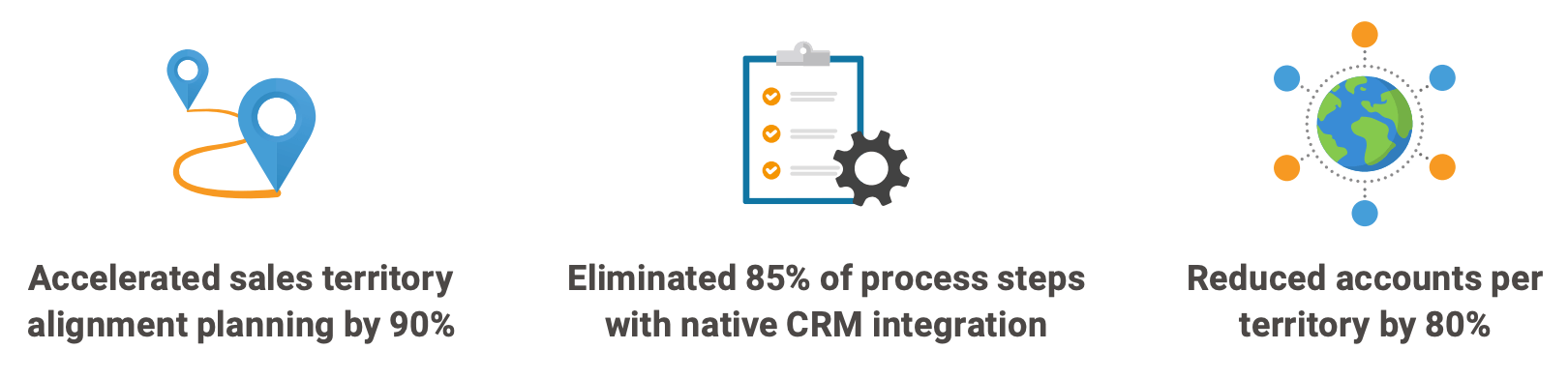

Align now automates the company’s territory alignments, CRM user management, target plan creation, and field feedback. This provides a single solution for field planning and field force management. Since implementing Align, LEO Pharma has drastically reduced the time and steps required during field planning.

"Align is our pit stop to manage field force goals, activities, territories, and roster members." Helene Slee, global commercial operations manager at LEO Pharma

Conclusion

Pharma companies have built up their digital capabilities in commercial operations over the decades, leading to an intricate patchwork of integrations and business rules. The result is that some companies are now held back by too many layers of process and manual solutions.

It is tempting to continue working with the existing architecture. But truly effective sales strategies are founded on rich channel insights, data-driven customer profiles, and flexible multichannel field plans. Success is simply not attainable when the favored solutions are bespoke and siloed from CRM software.

Conversely, an integrated approach to field planning keeps IT spend under control. It ensures that digital strategies pay off for companies through shorter cycle times and more accurate territory alignments. In addition to saving time, teams gain access to data from both the field and headquarters, improving the focus on key customers.

By ensuring sales plans are refreshed with the latest customer insights, and adapting, when necessary, companies will experience the competitive advantages of an omnichannel strategy.

Find out how to optimize your field planning using Align.

1 2024 Veeva Business Consulting Analysis