Industry Report

2025 Media Buying Trends

Learn how biopharma marketers are diversifying media tactics and using data-driven targeting to reach relevant audiences.

Consumer media behavior is rapidly changing, with a rise in cord-cutting and increased time spent on streaming and audio content. As a result, biopharma marketers are diversifying ad strategies, prioritizing both quality of reach and variety across channels. Key trends include:

- More channels, more streaming: Advertisers are embracing a broader spectrum of media channels, with a significant pivot towards digital video.

- Health audience targeting is on the rise: Precise health audience targeting continues to increase across digital campaigns.

- Omnichannel coordination delivers results: Integrated campaigns across multiple channels are proving to be significantly more effective in driving conversions.

Linear TV is a foundational channel

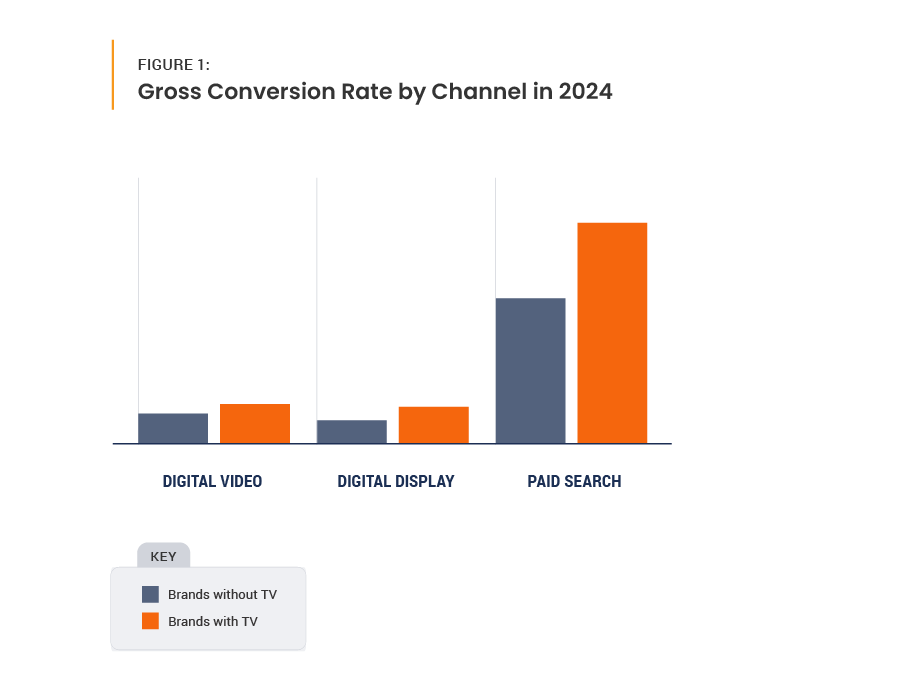

Linear TV continues to serve as a foundational channel for broad reach. Brands utilizing linear TV had higher conversion rates across all other channels, compared to brands that did not run linear TV.

Digital video continues to increase

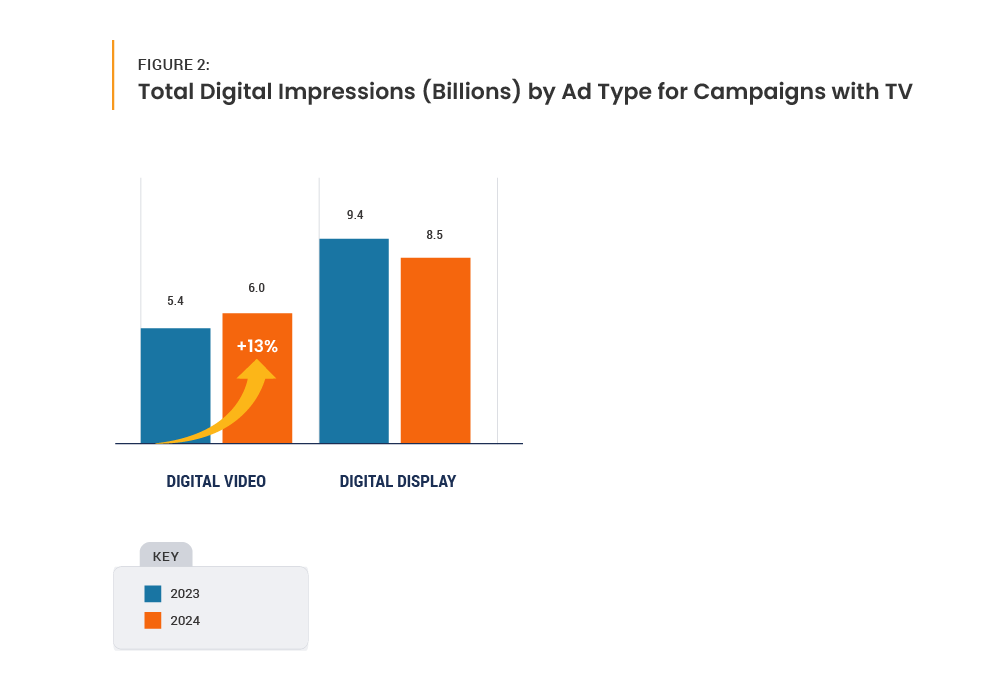

Brands that run linear TV also increased their impression volume in digital video, including streaming, by 13%. This shift reflects changing consumer habits and the growing effectiveness of digital video platforms in reaching target audiences.

Brands are diversifying their digital mix

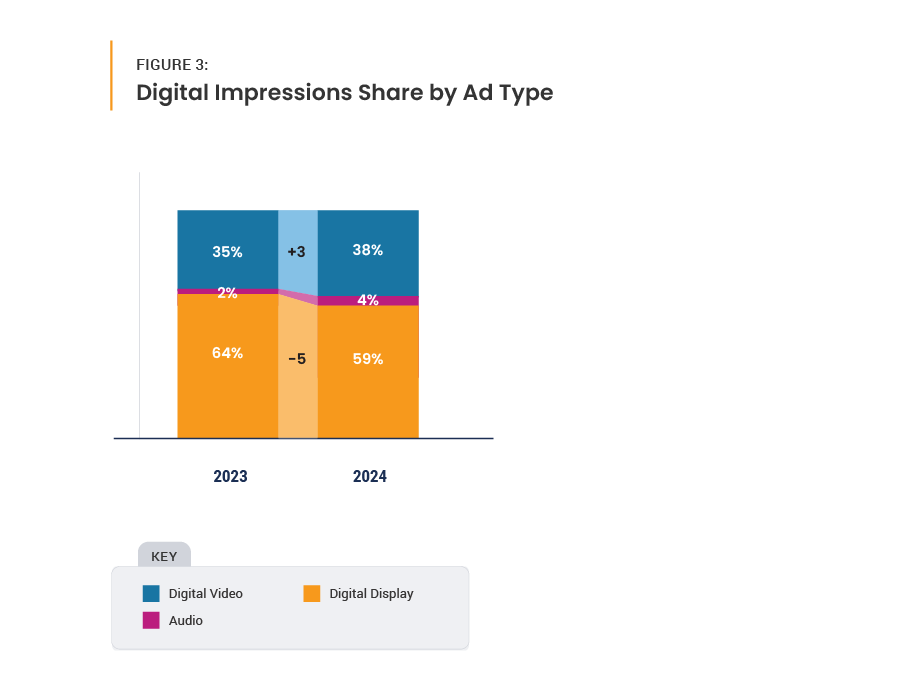

Brands are actively shifting digital ad types, increasingly incorporating more digital video and audio into the media mix. Overall, the share of impressions for digital display decreased year-over-year. This decrease was offset by a 14% increase in brands utilizing digital video and a substantial 40% increase in brands leveraging audio in 2024. This diversification allows marketers to engage with consumers across a wider array of digital touchpoints.

Health-based targeting is the new norm

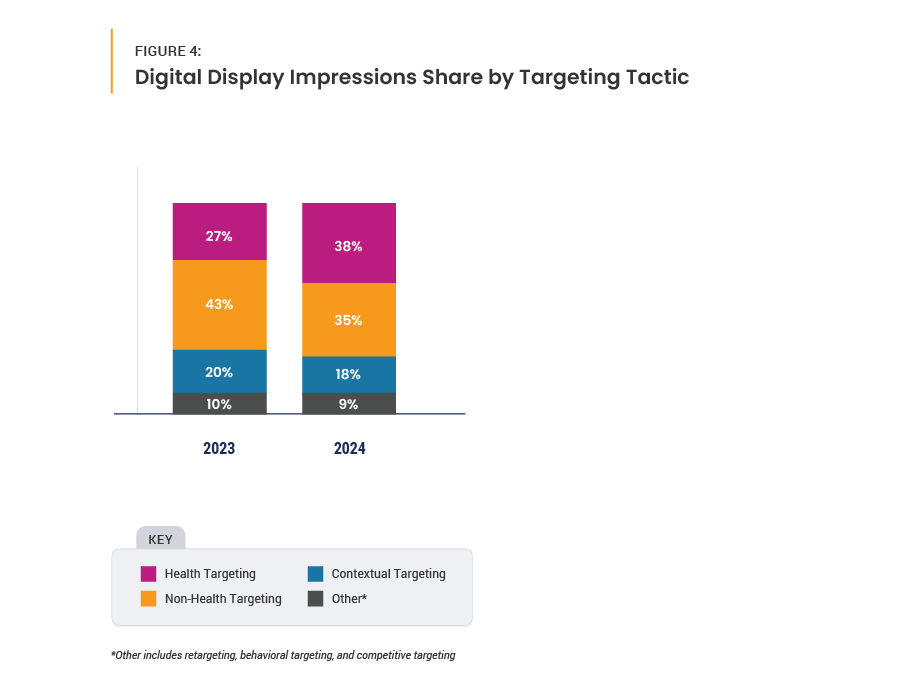

Driven by both cost-effectiveness and the value in reaching highly-qualified and relevant audiences, health audience targeting has become a standard practice. This trend continues to increase year-over-year, growing from 27% of digital display impressions in 2023 to 38% impressions in 2024.

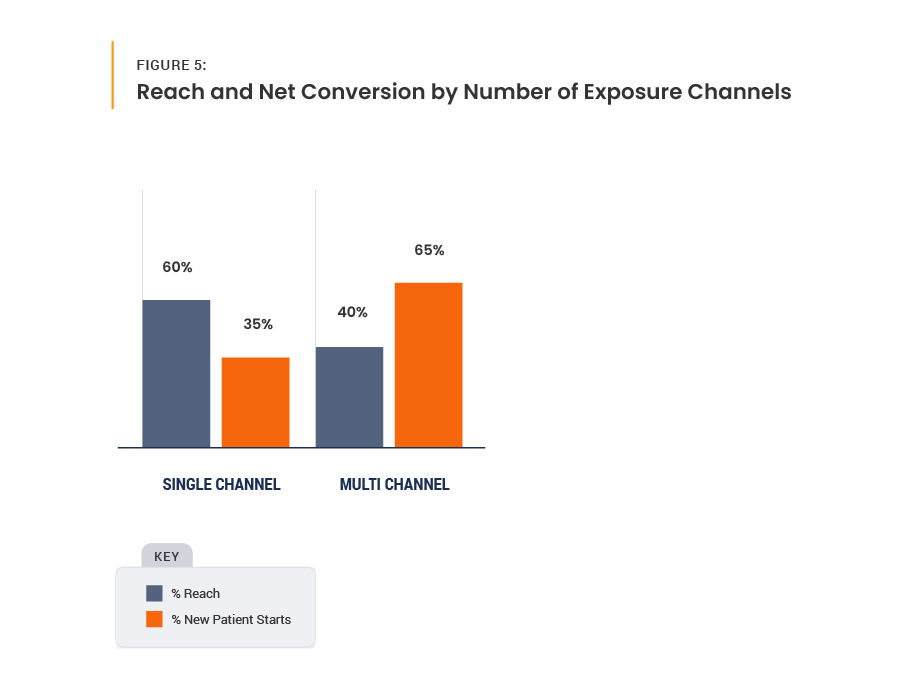

Amplifying conversions through omnichannel coordination

A cohesive, omnichannel strategy significantly boosts campaign effectiveness and is a growing trend among advertisers. Exposure to multiple channels results in a conversion index 2.7 times higher than exposure to a single channel.

Conclusion

The media landscape for biopharma marketing is dynamic, characterized by increasing fragmentation and a strong emphasis on data-driven targeting. By strategically diversifying media buys, prioritizing health-based targeting, and embracing omnichannel coordination, marketers can achieve greater efficiency and effectiveness.

Objective, third-party marketing measurement is crucial for brands seeking to continuously improve their marketing performance year-over-year. Learn five things to look for in a marketing analytics partner.

This analysis focuses on Veeva Crossix advertising effectiveness data from January to December 2024. Crossix measures DTC and HCP marketing annually for more than 200 brands and has partnerships with 17 of the top 20 pharma companies.