eBook

Achieving Commercial Excellence: A Strategic Framework for Patient Data Assessment

Explore the four core pillars of strategic data assessment.

The evolving commercial imperative in life sciences

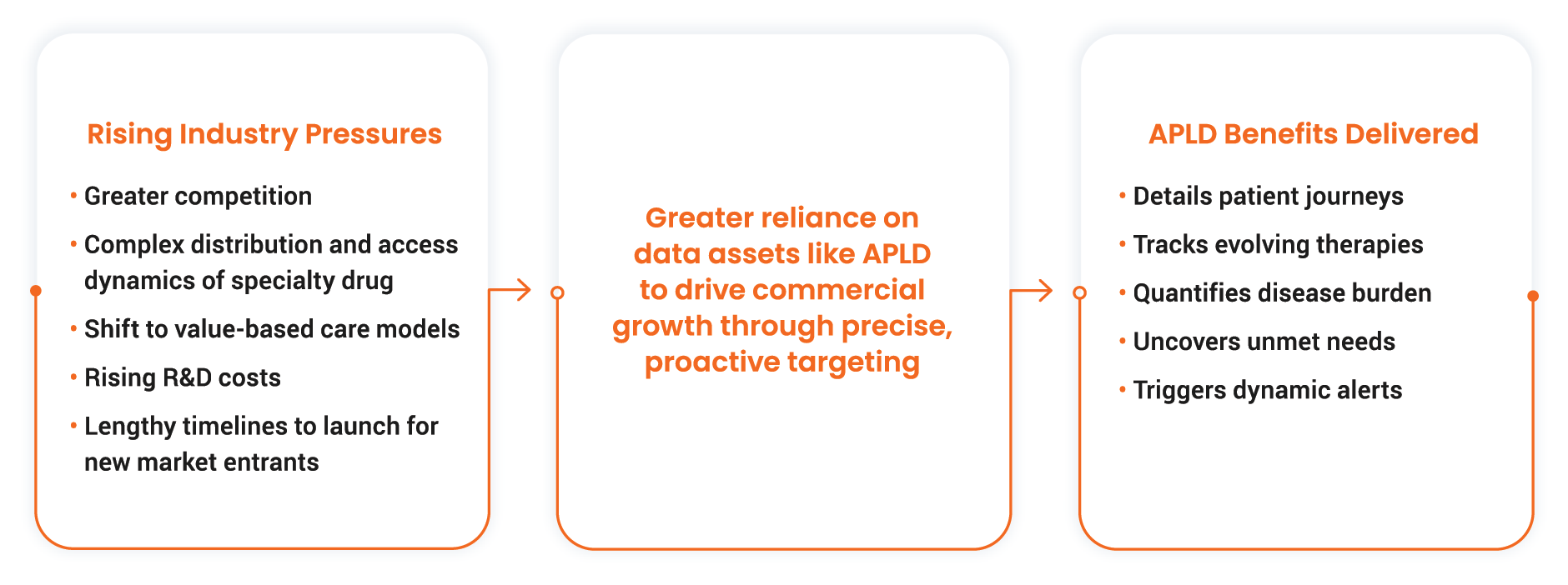

The life sciences commercial landscape faces unprecedented transformation, driven by a confluence of factors. These include intensifying competition from highly specialized therapies, managing specialty drugs with intricate distribution and access hurdles, and shifting to value-based care with reimbursement tied directly to patient outcomes. Persistent pressure on revenue forecasts and the need to balance commercial performance with rising R&D costs and lengthy market access timelines also add complexity. To help navigate these market dynamics, commercial teams critically rely on anonymous patient longitudinal data (APLD) to drive commercial growth through precise, proactive targeting.

As biopharma companies are inundated with information, many struggle with the dilemma of data overload versus actionable insight. Traditional commercial approaches often fall short due to common pitfalls like fragmented data silos, questionable data quality, and a lack of real-time visibility. These issues create significant operational inefficiencies, forcing teams to cobble together disparate data sets or manage multiple vendor purchases for a comprehensive view. This consumes significant time and resources, often leading to ineffective marketing campaigns, misallocated sales resources, and missed revenue forecasts. Assessing claims data has moved beyond simply measuring volume. It's now a sophisticated process driven by organizational and therapeutic area demands, the complexities of drug benefits, and persistent data fragmentation in specialty channels.

With such vast amounts of data available, how do you ensure insights are actionable?

Your Strategic Framework for APLD Assessment

Use this guide to develop a more holistic approach to data assessment and ensure the delivery of actionable insights to drive commercialization. Areas of focus will include:

- The four core pillars of strategic data assessment

- Fundamental characteristics of APLD

The four core pillars of data assessment

Commercial success hinges on far more than a product's value proposition; it demands a data-driven approach to commercialization that forms the foundation of every strategic decision marketers make. The ability to understand your market, patient journeys, and the competition with precision and speed are core differentiators.

To achieve this, companies must take a holistic approach to their data and partner evaluation, focusing on the following pillars:

These pillars are designed to elevate your evaluation framework from tactical scrutiny to a strategic approach. We’ll now turn our attention to the fundamental characteristics that transform raw claims information into a truly strategic asset.

The fundamentals of patient data: Building the foundation of actionable insights

When evaluating a claims data set, there are five fundamental characteristics that enable commercial teams to drive efficiency, make proactive decisions, and ultimately, meet their business objectives.

| Fundamental | Description | Benefit |

|---|---|---|

| A more complete journey |

|

|

| Data breadth and depth |

|

|

| Accuracy and consistency |

|

|

| Patient and transaction-level detail |

|

|

| Data recency and speed |

|

|

Positioning your organization for data-driven commercial success

Focusing on these fundamentals, supported by the right strategic partner, transforms APLD from a raw commodity into a powerful strategic asset. Adopting this comprehensive data assessment framework isn't just about managing information. It's the key for life sciences companies to truly drive innovation, optimize commercial performance, and achieve sustainable growth in today's increasingly competitive and data-driven future.

Preview Data from Veeva Compass

Explore data from Compass to ensure that your patient data reflects the fundamentals outlined above for your therapeutic areas of interest, including:

- Patient activity in network over time

- Key data attributes

- Market trends and competitive insights

- Patient journey and claims data samples

- Data lag and completeness over time

Helpful Resources

Assessment Checklist

I. Starting your assessment

Use this checklist to ensure you've gathered all necessary internal information and can articulate your needs effectively to potential partners.

Going into an assessment: What you should know

Ensure internal stakeholder alignment and data that is fit for use

- Will this be our primary data source?

- Who will be using this data?

- What questions are we trying to answer? What’s the priority of each question?

- Do we expect to have additional questions in the future that are unknown today? Does the data set facilitate this or would we need to get an additional data pull once we have new questions?

- What are we trying to accomplish and by when?

- Do we have current data gaps? What are they and what is the urgency around these gaps?

- Are we fully leveraging data today? How could we do more?

- Do we have the right resources (people, systems, tools) to work with big data? Do we need additional support?

Information to provide to your prospective partner(s)

Ensure consistency in responses from all partners

- Full market definitions (diagnoses, products, and procedures of interest)

- Clear metrics to be measured (patients, HCPs, claims, and records)

- Clear metric definitions (e.g., When reporting Rx claims, should lifecycle data be included? If yes, should final and interim claims be included?)

- Detailed business logic, data filters, and time periods to define patient cohorts of interest and key metrics

- Use cases to be supported using APLD

- Timeline to make a decision

II. Asking the right questions

Use this list of questions when evaluating prospective APLD partners and their data offerings to ensure your investment yields maximum strategic advantage and fuels your commercial success.

| Pillar 1: Data integrity and completeness | |

|---|---|

| Ensure that data is longitudinally complete |

|

| Confirm that data is a representative sample |

|

| Assess ongoing data quality and delivery |

|

| Determine how granular you can get |

|

| Understand how often the data is refreshed |

|

| Pillar 2: Compliance and security | |

|---|---|

| Protect sensitive data and mitigate risk |

|

| Pillar 3: Actionability and interoperability | |

|---|---|

| Turn data into actionable insights |

|

| Pillar 4: The partner's strategic value and stability | |

|---|---|

| Choose a reliable and forward-thinking collaborator |

|

Learn more about the Veeva Compass Suite.