White Paper

Top Health Advertising Trends: Multicultural Campaigns Up 66%, Streaming Video Up 15%

Changing consumer behavior across digital channels is creating new opportunities for life sciences advertisers to reach patients and healthcare professionals (HCPs) in more targeted ways. Across the first half of 2022, Veeva Crossix data showed health brands diversifying their media mix and increasing their focus on multicultural campaigns.

KEY TRENDS INCLUDE:

These trends are based on aggregated media measurement and health data from hundreds of brand campaigns measured by Veeva Crossix from January to June 2022. Read on to learn how these trends can inform your 2023 pharma advertising campaigns.

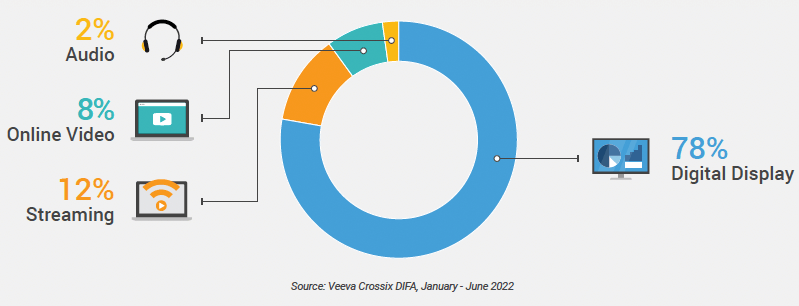

Health advertisers continue to diversify media buys

Advertisers implemented modest but noteworthy changes to their digital media mix in the first half of 2022. Although digital display still accounts for the largest share of advertising impressions (Figure 1), the overall percentage dropped slightly from the previous year as other channels grew. Streaming video and digital audio saw increases in share of marketing mix, from 9.2% to 12.2% and 1.1% to 1.6% year-over-year (YOY) respectively, while online video saw a slight decline from previous years.

FIGURE 1: ADVERTISER MEDIA MIX BY AD FORMAT

These trends are driven in large part by changes in consumer behavior. In July 2022, streaming viewership exceeded cable and broadcast viewership for the first time. The trend continued in August, with streaming video accounting for 35% of all content consumption on television screens, compared to 35% for cable and 22% for broadcast.

Audience quality for digital audio campaigns increased 37% YOY

Last year, audio emerged as an increasingly effective channel to reach patients. That promising trend continues: through June 2022, both the number of advertisers using audio and audio impressions served increased compared to the first half of 2021.

Other notable trends include:- Brands using digital audio saw a 37% improvement in audience quality YOY, demonstrating that media buyers are increasingly reaching the right audience with this tactic.

- Advertisers are using a variety of audio tactics to reach their audience where they are. In addition to historically popular desktop and mobile ad formats, companies are investing in connected home placements via traditional streaming audio partners.

Streaming video impressions up 15%

Streaming video has also seen impressive growth year-over-year, with average impressions per campaign increasing by 15%. This channel was the second-largest source of overall impressions in the first half of 2022.

In addition to the increase in impressions, streaming now accounts for 12% of clients’ digital media mix (vs. 9.6% in 2021). Additional growth is likely as consumers continue to flock to streaming services and advertisers reap the benefits of more personalized audience targeting.

Advertisers are also increasingly accessing streaming inventory programmatically. For years, streaming video was largely long-form content available via full episode players (FEPs) from major broadcast networks and subscription services such as Hulu.

As consumer consumption has grown, so have advertisers’ investments, expanding how brands can purchase streaming ad inventory. Although most streaming impressions are still bought via direct partnerships, nearly a quarter of all streaming impressions are now purchased programmatically. This growth is expected to continue parallel to the overall increase in programmatic usage by Crossix clients across media types.

Multicultural campaigns increased by 66%

Over the last two years, pharma advertisers have increased multicultural representation in campaign messaging and targeting as part of a broader effort to reach historically underserved populations and improve diversity, equity, and inclusion (DEI) strategies. Crossix data shows a 66% increase in multicultural messaging campaigns from 2020 to 2022.

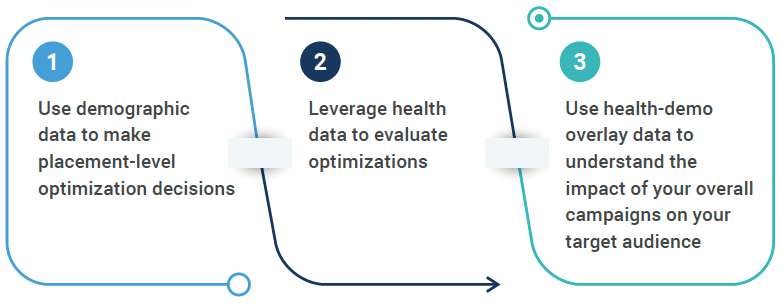

With a greater emphasis on multicultural messaging, marketers should reconsider traditional measures of performance and optimization when evaluating such campaigns. For example, focusing on ROI may not help marketers understand if they are reaching the right patient in an authentic way or driving the desired health outcomes.

When measuring and optimizing campaigns to reach underserved patient populations, the following framework can provide a more meaningful, comprehensive assessment:

In addition, objective, third-party marketing measurement can quantify the impact of campaigns and, ultimately, determine whether they are effectively connecting patients with relevant treatment information.

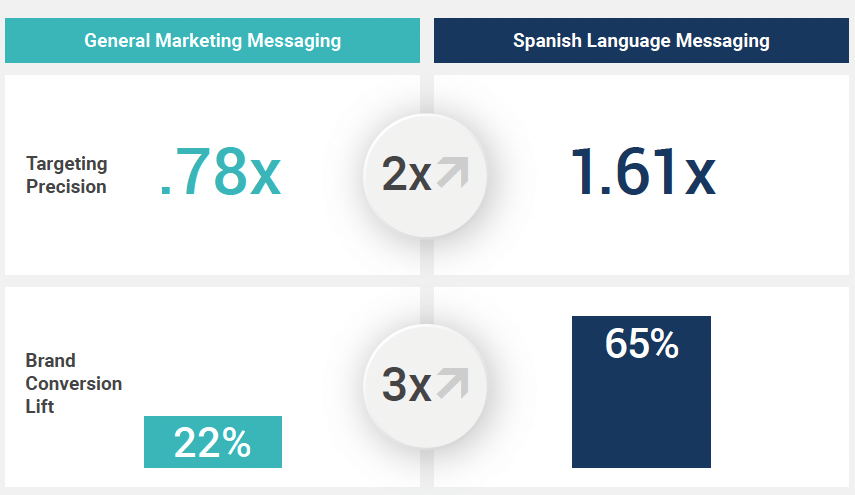

For example, an advertiser partnered with Crossix to measure the results of a Spanish-language campaign targeting U.S.-based Hispanic populations. The advertiser was able to confirm that the campaign reached its Spanish-speaking population with two times the precision and generated three times the conversion lift for the target population (Figure 2).

FIGURE 2: REACHING DIVERSE PATIENT POPULATIONS WHERE THEY ARE

3 keys to improve your advertising strategy

These trends underscore pharma advertisers’ need to constantly evolve strategy and tactics to reach patients effectively and efficiently. The correct information and insights using objective, third-party marketing measurement can help advertisers understand the impact of their campaigns across a wide range of channels, categories, and demographics.

Take these actions to achieve your strategic planning initiatives with a holistic, omnichannel approach:

- Evaluate digital audio channels as part of your media mix, ensuring the channel is effective for the target therapeutic area.

- Take advantage of the efficient ways you can buy streaming video, including programmatic buys.

- Reconsider multicultural campaigns’ evaluation and optimization framework to ensure they achieve the desired result.

Contact Crossix to learn more about trends specific to your therapeutic category.

About Veeva Crossix

This analysis focuses on new Veeva Crossix advertising data from January to June 2022. Crossix data represents more than $6 billion in annual direct-to-consumer (DTC) and HCP advertising spend and more than 230 life sciences brands, including 8 of the top 10 global pharmaceutical companies.