Industry Report

Trends Shaping Commercial Data & Analytics in 2025: East Coast Forum Highlights

Learn more about key insights and best practices from industry leaders who attended Veeva’s Commercial Data & Analytics Forums in Princeton, NJ and Boston, MA.

Veeva’s Commercial Data & Analytics Innovation Forums in Princeton, NJ and Boston, MA brought together industry leaders from early-stage biotechs to the top 20 biopharmas to discuss:

Here are some of the key insights and takeaways.

Data, analytics, and AI continue to evolve

Ensuring new product launch success is more complex than ever, with more data, computing power, and analytics capabilities available. However, as options increase, the importance of making the right decisions and solving challenges on the right timeline also increases.

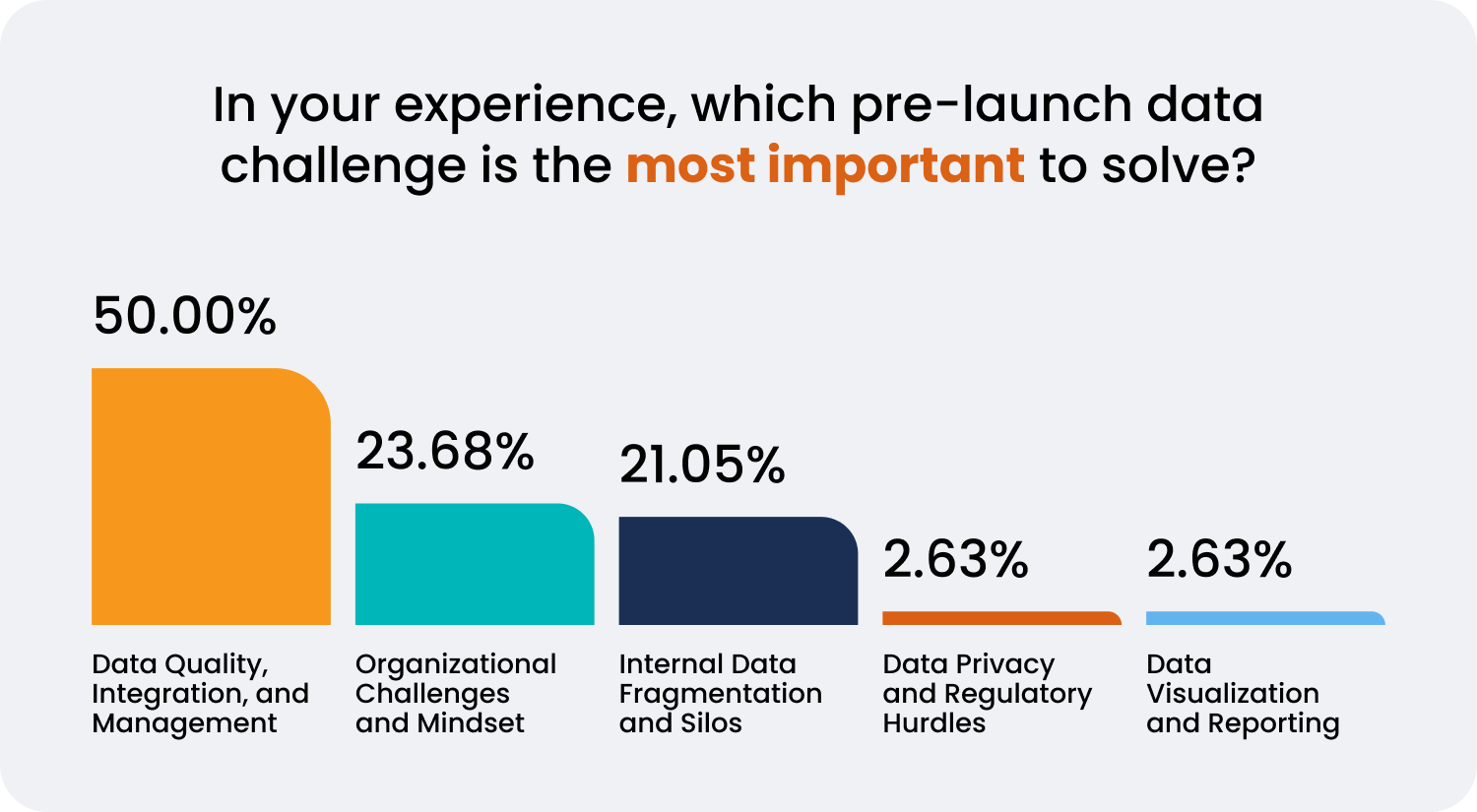

We asked attendees which pre-launch data challenges were most important to solve:

50% of respondents highlighted data quality, integration, and management as their top priority pre-launch.

Attendees noted that there is more to data quality than coverage. While “coverage is still king,” factors like completeness, longitudinality, analytics readiness, and the ease with which data sources can be integrated and connected have become increasingly important.

AI strategy also took a central role. While many organizations are still in the exploratory phase, clear initiatives with leadership support and well-defined success metrics can have significant uptake and impact.

The industry is still in the early stages of AI, but clear initiatives can make an impact

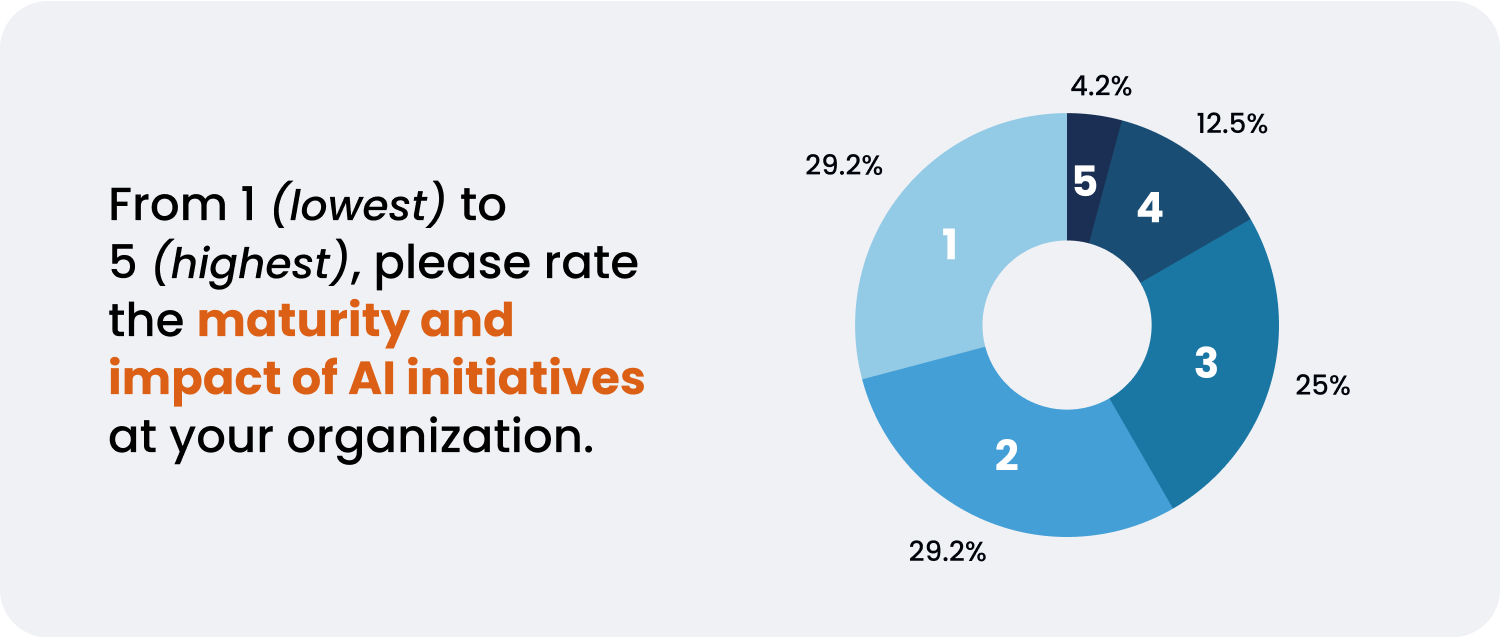

When asked to rate (1-5) their organization’s AI initiatives in terms of maturity and impact, attendees reported an average of 2.3. However, during roundtable discussions, those representing organizations who are further along the maturity curve presented key strategies that have enabled their success.

Breakdown of AI ROI impact and maturity:

AI initiatives focused on a spread of user groups according to attendees, with field users slightly ahead of the rest:

Most successful AI initiatives according to roundtable discussions:

- Predictive analytics and modeling, especially around field alerts/triggers

- Targeting

- NBA prediction

- Customer engagement and personalization

- Pre-call planning for field teams

- Business development, including forecasting, market landscape, and assessing commercial attractiveness across a wide variety of therapeutic areas

- Non-analytics workflows including ideation, document summaries, and more.

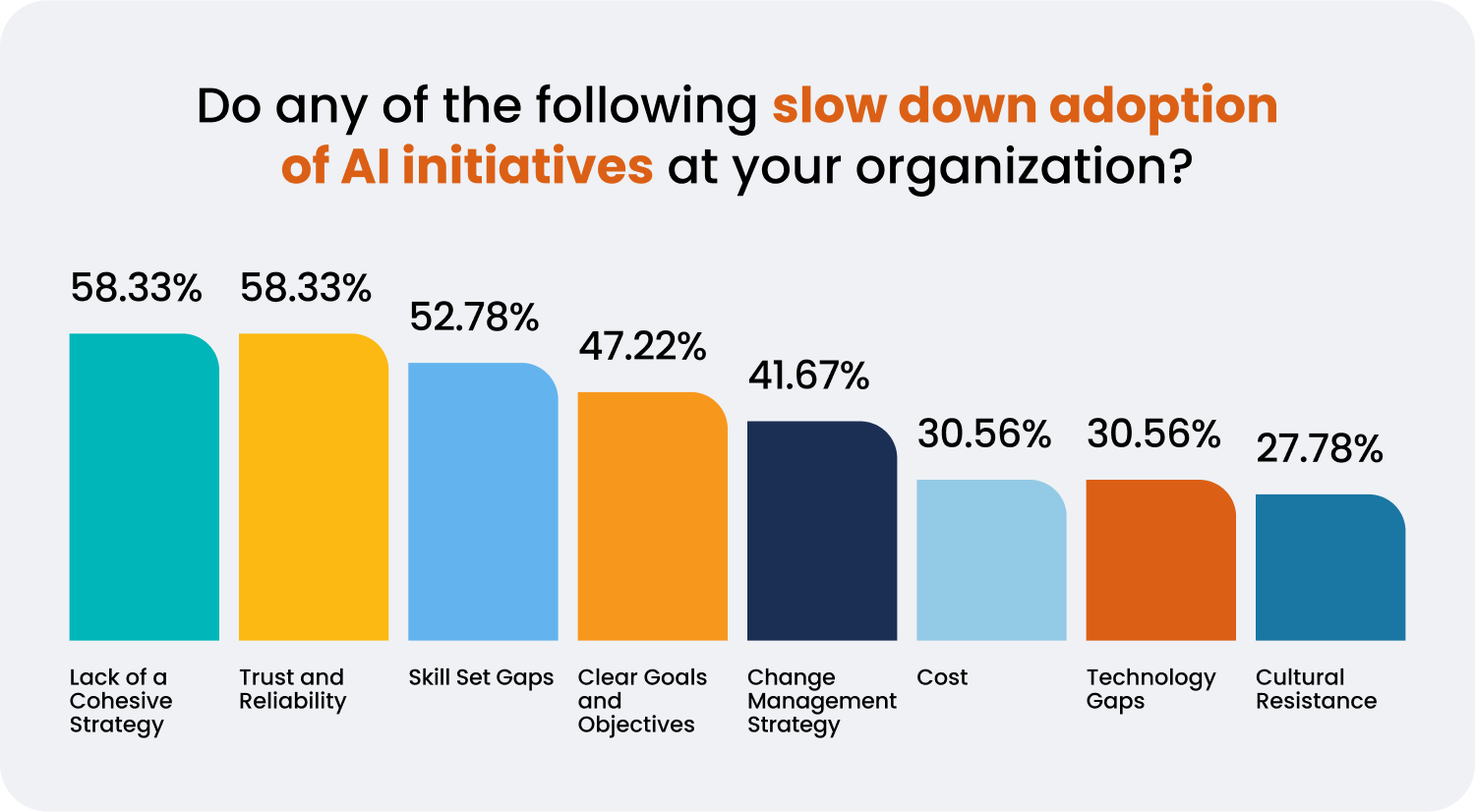

However, successful AI implementation requires a commitment to solving key challenges. Attendees were asked to select which challenges tend to slow down AI initiatives at their organizations:

Solving the top challenges — skill set gaps, decentralized strategies, and trust and reliability — is essential for enabling AI success.

How innovative biopharmas are enabling AI success

The fundamental line of thinking behind AI success is to leverage AI to augment and accelerate workflows rather than replacing or creating new workflows.

Across attendees representing AI outperformers, the following best practices proved most important:

- AI initiatives must start with a clearly defined need from a specific user group. Technology/IT-driven initiatives have not seen as much success.

- Training and change management are essential.

- Task-specific agents with the right context will outperform generalized solutions.

- ROI and success metrics must come from leadership.

- Understanding when not to use AI is as important as when to use it.

- Allowing employees to receive real-time feedback on AI use cases drives success.

- AI must be enabled with the right training data in a robust, privacy-safe environment.

- It is important to avoid being swept up in LLM hype. Other forms of AI including more mature ML use cases are better suited to a wide range of use cases.

To enable our customers to drive AI success across an integrated data ecosystem, Veeva offers agentic AI capabilities across Vault Platform and Veeva applications:

- We improve Veeva AI Agents and release new agents timed with product releases three times per year.

- Customers can also configure and extend Veeva AI Agents or create custom agents.

- Veeva is LLM-agnostic, supporting most major LLMs to provide flexibility.

- Veeva AI Agents are deep applications with specific prompts and safeguards.

- We ensure all AI capabilities are simple, secure, and compliant for life sciences companies.

See this press release from October 14, 2025 for the latest on Veeva AI.

Modern launches require a comprehensive data strategy

Building a pre-launch commercialization strategy involves many significant decisions.

As an attendee representing a mid-sized biotech put it:

“New data is out there. With cloud maturity, you can process billions of records much more easily than ever before. Unlimited compute, really, means data quality at scale — but launch is complex, with multiple stages and multiple uses of data.”

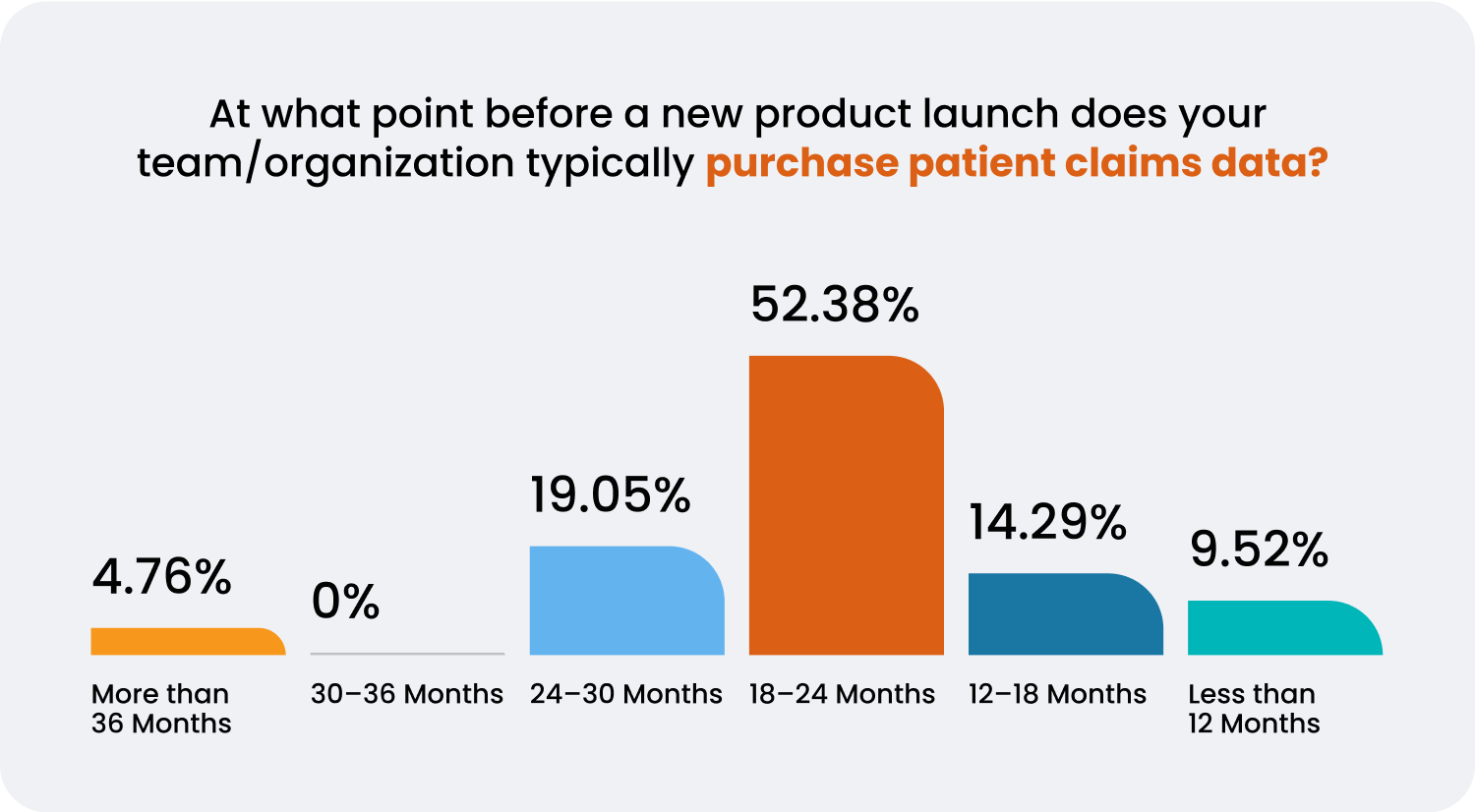

Timing is critical. Attendees were asked at what time period during pre-launch they would look to purchase claims data:

Patient claims data is foundational to understanding market size, targeting, segmentation, and forecasting pre-launch. However, claims data is not the only key piece.

Internal sources, medical data, and primary research such as patient population information are fundamental to understanding commercialization at the very earliest pre-launch stage. As launch approaches, claims data, EHR (electronic health records) data, labs and genomics, and reference data were discussed as key early sources.

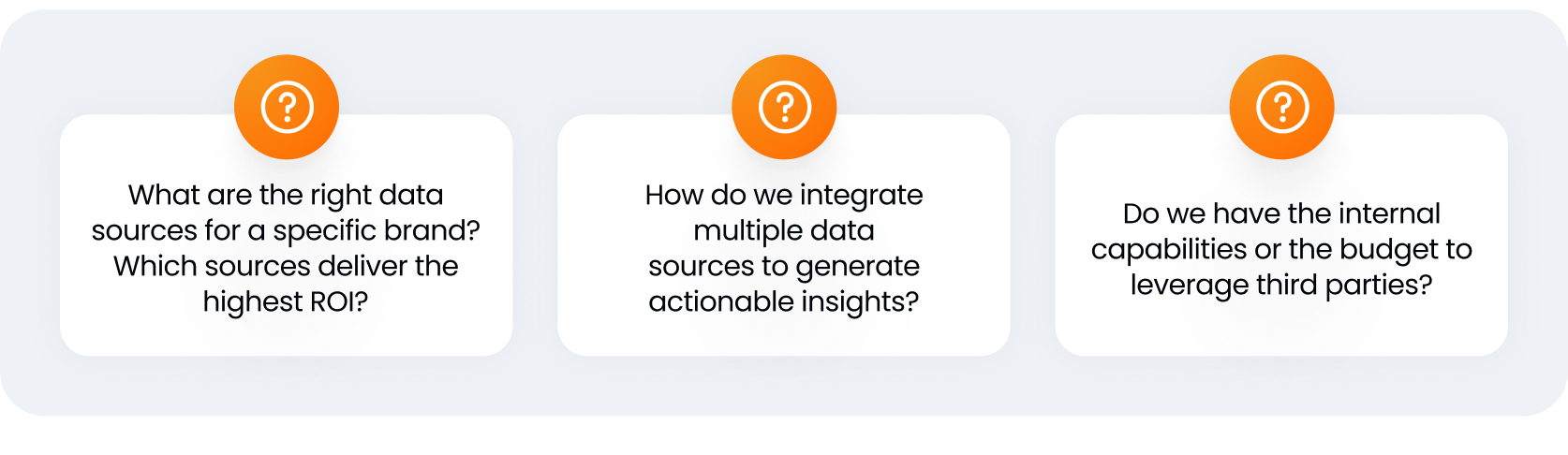

With so much data available, organizations face several key questions:

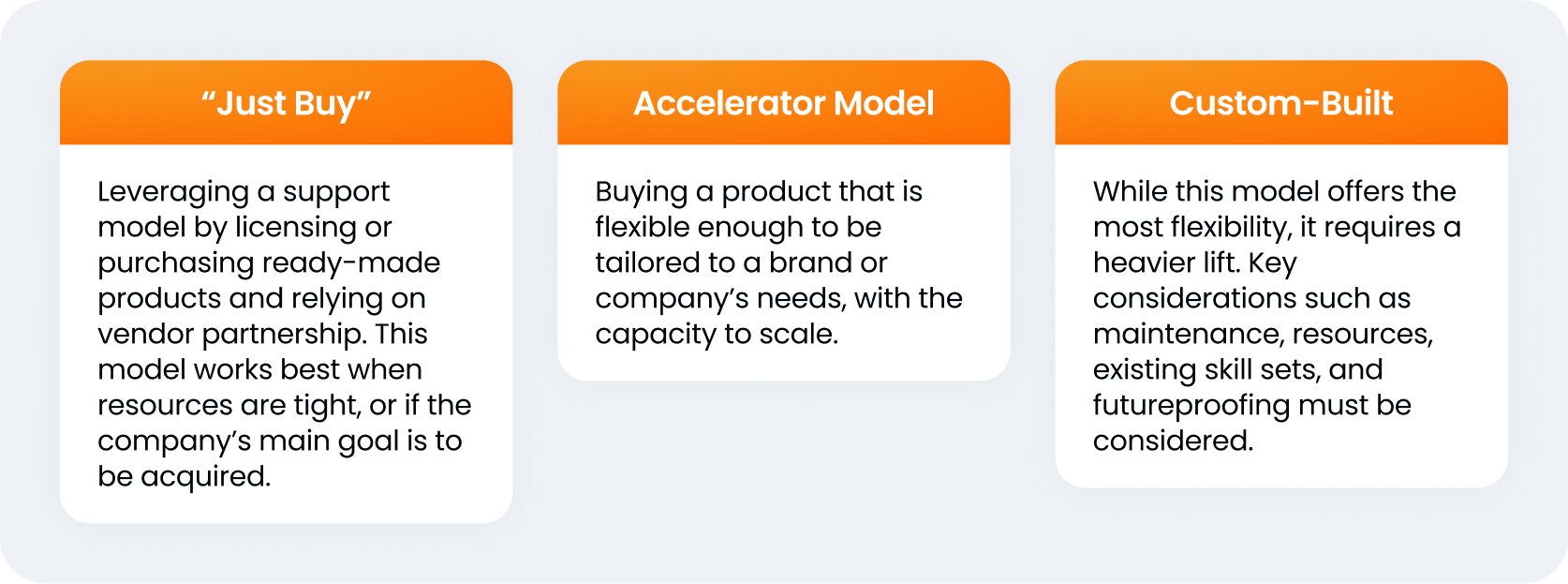

The question of build vs. buy is also important. Attendees discussed three main approaches:

Key pre-launch activities and evaluating data quality

Attendees were asked to rank pre-launch activities according to priority:

Following this question, attendees were asked to rank the purchase priority of key data sets:

Selecting the right data sources also means understanding which use cases are most important for your specific scenario: company size and budget, disease and therapeutic area, brand-specific dynamics, even indications.

Discussion groups at both events coalesced around the following criteria for evaluating data sources:

| Coverage | Evaluated by use cases, brand, therapeutic area, disease area, and indications. |

| Ease of Use | Does the data require analytics expertise to leverage? Are there limitations in terms of market baskets and access? How easily can this data source be linked to other data sources and analytics solutions? |

| Pricing | Does this data source fit within our budget and clearly make the case for its ROI? |

| Vendor Support | Can the vendor be trusted to be a partner? Do they have a commitment to privacy and compliance? What is the support model — how much is on us vs. the vendor? |

| Accuracy and Completeness | Multiple attendees discussed formalized quality assessment processes, where vendors show the quality and value of their data and are measured against well-defined metrics. |

See this recent research report for a deep dive into evaluating data for commercial success.

A commercial data strategy lead for a top 20 biopharma also made a key point around prioritization:

“At launch, we’re thinking about ‘what is absolutely critical?’ The question to ask yourself is, what do I need to do to compete in this market from today to 18 months from now? There really shouldn’t be more than a handful of key priorities you evaluate against for initial data sources.”

Data integration is a key priority from the beginning

With the variety of data sets available, speed to insight depends on integration across data sets and the ability to link multiple data sets to analytics solutions — in other words, connected data and connected software.

Attendees representing both emerging biotechs and top 20 biopharmas agreed: data integration must come early in the process. Waiting until launch or post-launch creates issues that are difficult to solve.

Veeva is committed to enabling an integrated data and analytics ecosystem for our customers. Key initiatives in this area include:

- A suite of connected data products under Veeva Data Cloud, designed to enable customers to immediately link key data sources for commercial analytics.

- A commitment to a common data architecture for the industry that is used across Veeva Data Cloud products, creating a global standard for fields such as entity IDs, entity relationships, and more. The CDA is available for no charge here for any data provider or aggregator to use.

- A connected software ecosystem including Vault CRM and Veeva Nitro, with native integrations between all data products and software products.

Seamlessly integrating data delivers commercialization efficiency and better outcomes

Attendees agreed that integrated, standardized data enables faster analytics, enhanced AI success, and increased ROI across pre-launch and post-launch activities. Natively connected ecosystems make integration as simple as a switch of a button.

To close both Forums, Veeva strategy leaders highlighted Veeva’s Data Cloud suite of connected data products, unified by a common data architecture. For a real-world use case where a customer saw an 8x increase to ROI activating field teams through daily alerts, see this webinar.

About Veeva Compass and Veeva Data Cloud

Veeva Compass is patient and prescriber data for segmentation and targeting. It supports biopharma commercialization by providing visibility into patient and provider activity within the U.S. healthcare ecosystem.

Veeva Data Cloud is the modern data platform for life sciences, bringing greater efficiency and precision across commercial operations. Designed for seamless integration with Veeva Commercial Cloud applications, Data Cloud fast-tracks your way to AI-driven engagement and intelligent workflows. Generate and act on insights faster with reference data, deep data, and transaction data built on a common data architecture.