Veeva Announces Fiscal 2016 Third Quarter Results

Total Revenues of $106.9M, up 28% Year-over-year;

Subscription Services Revenue of $81.7M, up 33% Year-over-year

PLEASANTON, CA — Nov. 24, 2015 — Veeva Systems Inc. (NYSE: VEEV), a leading provider of industry cloud solutions for life sciences, today announced results for its fiscal third quarter ended October 31, 2015.

“We had great execution in the third quarter, fueled by solid growth in our existing markets and significant traction in major new areas. We’re seeing the real benefit of an expanding solution set that addresses multiple large markets,” said CEO Peter Gassner. "Through customer success, product excellence, and strategic solutions spanning R&D to commercial, it’s clear Veeva is becoming the go- to vendor for the life sciences industry.”

Fiscal 2016 Third Quarter Results:

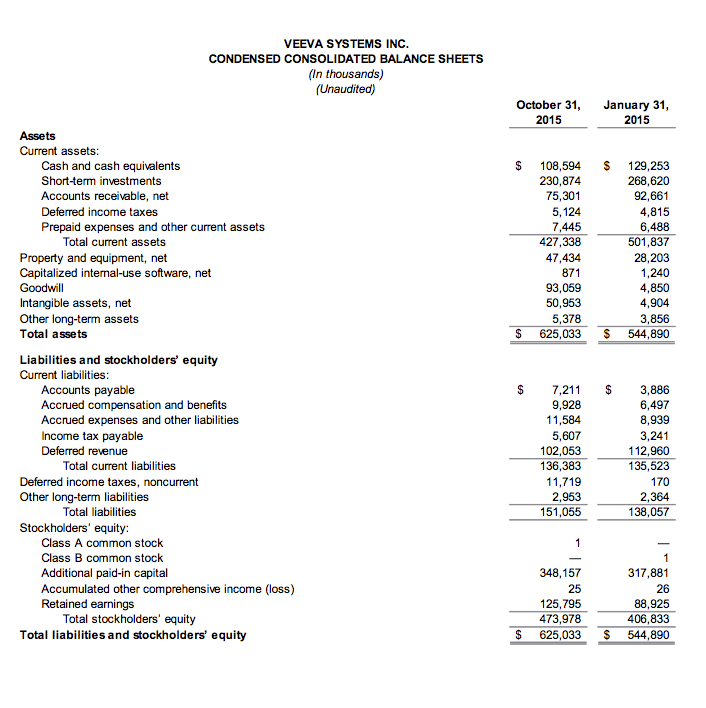

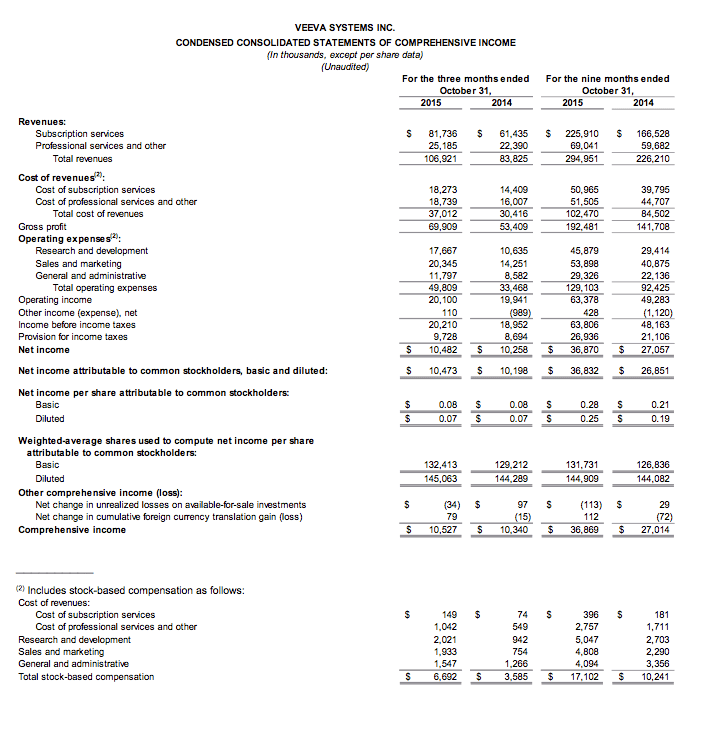

- Revenues: Total revenues for the third quarter were $106.9 million, up from $83.8 million one year ago, an increase of 28% year-over-year. Subscription services revenues for the third quarter were $81.7 million, up from $61.4 million one year ago, an increase of 33% year-over-year.

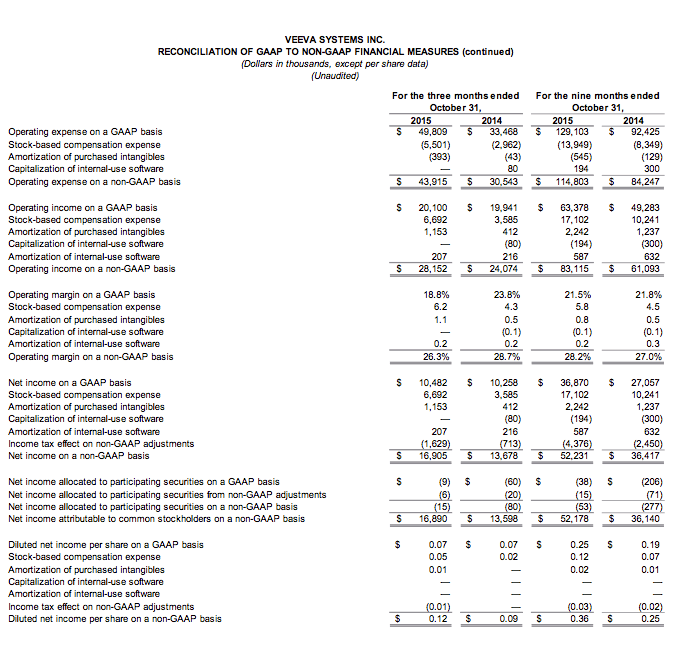

- Operating income and non-GAAP operating income(1): Third quarter operating income was $20.1 million, compared to $19.9 million one year ago, an increase of 1% year-over-year. Non-GAAP operating income for the third quarter was $28.2 million, compared to $24.1 million one year ago, an increase of 17% year-over-year.

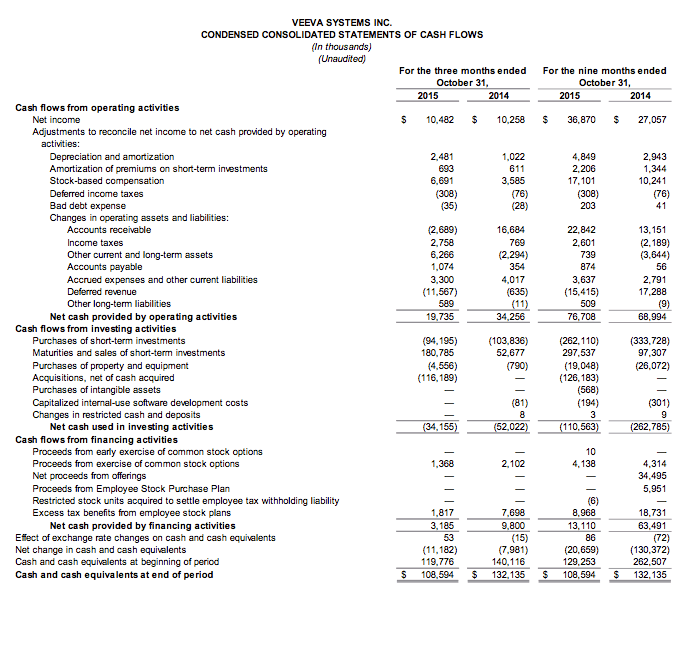

- Net income and non-GAAP net income(1): Third quarter net income was $10.5 million, compared to $10.3 million one year ago, an increase of 2% year-over-year. Non-GAAP net income for the third quarter was $16.9 million, compared to $13.7 million one year ago, an increase of 24% year-over-year.

- Net income per share and non-GAAP net income per share(1): For the third quarter, fully diluted net income per share was $0.07, compared to $0.07 one year ago, while non-GAAP fully diluted net income per share was $0.12, compared to $0.09 one year ago.

- Zinc Ahead transaction: Our GAAP and non-GAAP results for the third quarter reflect a $1.6 million revenue reduction due to purchase accounting write-downs and $1.8 million in one-time transaction costs.

“For the first time, our non-CRM offerings accounted for more than 25% of total revenues in the quarter. Our success across the board stems from the reputation we've developed for exceptional quality and consistent delivery,” said CFO Tim Cabral. "We are executing well and setting up for the tremendous opportunity that lies ahead.”

Recent Highlights:

- Acquired Zinc Ahead – Veeva and Zinc bring together exceptional cloud software and the top domain experts to deliver the most complete commercial content management solution to the life sciences industry.

- Commercial Cloud momentum with Veeva Network and Veeva Data wins – Two top 20 pharmaceutical companies began rolling out Veeva Network concurrently with global Veeva CRM deployments. Additionally, Veeva won its first seven-figure deal for Veeva KOL Data as measured by annual contract value.

- Veeva R&D Summit – Veeva hosted more than 100 life sciences companies and drew 50% more attendees than last year for its second annual conference focused on the R&D side of life sciences.

- Launched new Vault products – Announced December 2015 availability of new Vault products and the first customers signed.

- Expansion in clinical with Vault Study Startup for the management of the content and the activities associated with activating sites for clinical trials.

- Expansion in regulatory with Vault Registrations for managing product registration data worldwide and Vault Submissions Archive for storing a complete history of regulatory submissions. Combined with Vault Submissions, the three solutions form a powerful suite for regulatory information management, Veeva Vault RIM.

Financial Outlook:

Veeva is providing guidance for its fiscal fourth quarter ending January 31, 2016 as follows:

- Total revenues between $109.0 and $111.0 million.

- Non-GAAP operating income between $25.5 and $26.5 million.

- Non-GAAP fully diluted net income per share of $0.11

This fourth quarter guidance implies the following results for Veeva’s fiscal year ending January 31, 2016:

- Total revenues between $404.0 and $406.0 million.

- Non-GAAP operating income between $108.7 and $109.7 million.

- Non-GAAP fully diluted net income per share between $0.46 and $0.47.

Conference Call Information:

What: Veeva’s Fiscal 2016 Third Quarter Results Conference Call

When: Tuesday, November 24, 2015

Time: 1:30 p.m. PT (4:30 p.m. ET)

Live Call: 1-877-201-0168, domestic 1-647-788-4901, international Conference ID 6506 7916

Webcast: ir.veeva.com

__________

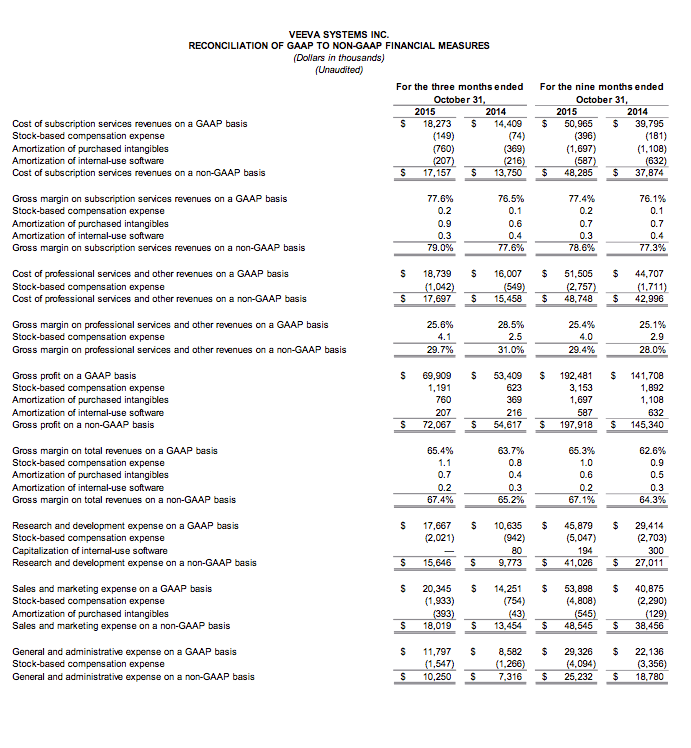

(1) This press release uses non-GAAP financial metrics that are adjusted for the impact of various GAAP items. See the sections titled “Non-GAAP Financial Measures” and the tables entitled “Reconciliation of GAAP to Non-GAAP Financial Measures” below for details.

About Veeva Systems

Veeva Systems Inc. is a leader in cloud-based software for the global life sciences industry. Committed to innovation, product excellence, and customer success, Veeva has more than 375 customers, ranging from the world's largest pharmaceutical companies to emerging biotechs. Veeva is headquartered in the San Francisco Bay Area, with offices in Europe, Asia, and Latin America. For more information, visit www.veeva.com.

Media Contact:

Veeva Systems, Inc.

pr@veeva.com

Forward-looking Statements

This release contains forward-looking statements, including statements regarding Veeva's future financial outlook and financial performance, market growth, the benefits from the use of Veeva's solutions, our strategies, and general business conditions. Any forward-looking statements contained in this press release are based upon Veeva's historical performance and its current plans, estimates and expectations and are not a representation that such plans, estimates, or expectations will be achieved. These forward- looking statements represent Veeva's expectations as of the date of this press announcement. Subsequent events may cause these expectations to change, and Veeva disclaims any obligation to update the forward-looking statements in the future. These forward-looking statements are subject to known and unknown risks and uncertainties that may cause actual results to differ materially, including (i) our limited operating history, which makes it difficult to predict future results;(ii) our expectation that the future growth rate of our revenues will decline, and that as our costs increase, we may not be able to generate sufficient revenues to sustain the level of profitability we have achieved in the past or achieve profitability in the future; (iii) breaches in our security measures, unauthorized access to our customers’ data, or system availability or performance problems associated with our data centers or computing infrastructure; (iv) dependence on revenues from our Veeva CRM solution, and the rate of adoption of our new products; (v) acceptance of our applications and services by customers, including renewals of existing subscriptions and purchases of subscriptions for additional users and solutions; (vi) our ability to integrate the Zinc Ahead business, retain Zinc Ahead customers and achieve the expected results from our acquisition of Zinc Ahead; (vii) loss of one or more key customers; (viii) adverse changes in general economic or market conditions, particularly in the life sciences industry; (ix) delays or reductions in information technology spending, particularly in the life sciences industry, including as a result of mergers in the life sciences industry; (x) the development of the market for enterprise cloud services, particularly in the life sciences industry; (xi) competitive factors, including but not limited to pricing pressures, industry consolidation, difficulty securing rights to access, host or integrate with complementary third party products or data used by our customers, entry of new competitors and new applications and marketing initiatives by our competitors; (xi) our ability to manage our growth effectively; and (xiii) changes in sales that may not be immediately reflected in our results due to the ratable recognition of our subscription revenue.

Additional risks and uncertainties that could affect Veeva’s financial results are included under the captions, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the company’s filing on Form 10-Q for the period ended July 31, 2015. This is available on the company’s website at http://www.veeva.com under the Investors section and on the SEC’s website at www.sec.gov. Further information on potential risks that could affect actual results will be included in other filings Veeva makes with the SEC from time to time.

###

Non-GAAP Financial Measures

Veeva has provided in this release financial information that has not been prepared in accordance

with generally accepted accounting principles in the United States, or GAAP. This information

primarily includes non-GAAP net income, non-GAAP fully diluted net income per share, non-GAAP

operating income, and non-GAAP operating margin. Veeva uses these non-GAAP financial measures

internally for budgeting and resource allocation purposes and in analyzing its financial results. Veeva

believes these measures are useful to investors, as a supplement to GAAP measures, as a means to

evaluate period-to-period comparisons, in evaluating Veeva's ongoing operating results and trends

and in comparing its financial measures with other companies in Veeva's industry, many of which

present similar non-GAAP financial measures to investors. These non-GAAP measures are adjusted

for the impact of expenses associated with stock-based compensation, amortization of purchased

intangibles, capitalization of expenses associated with development of internal-use software and the

subsequent amortization of the capitalized expenses, and the tax effect of all of these non-GAAP

adjustments.

As described above, Veeva may exclude the following items from its non-GAAP measures:

- Stock-based compensation expenses. Veeva excludes stock-based compensation expenses

from its non-GAAP measures primarily because they are non-cash expenses and

management finds it useful to exclude certain non-cash charges to assess the appropriate

level of various operating expenses to assist in budgeting, planning and forecasting future

periods. Moreover, because of varying available valuation methodologies, subjective

assumptions and the variety of award types that companies can use under FASB ASC Topic

718, Veeva believes excluding stock-based compensation expenses allows investors to make

meaningful comparisons between our recurring core business operating results and those of

other companies. - Amortization of purchased intangibles. Veeva incurs amortization expense for purchased

intangible assets in connection with acquisitions of certain businesses and technologies.

Amortization of intangible assets is inconsistent in amount and frequency and is significantly

affected by the timing and size of acquisitions. Management finds it useful to exclude these

variable charges to assess the appropriate level of various operating expenses to assist in

budgeting, planning and forecasting future periods. Investors should note that the use of

intangible assets contributed to our revenues earned during the periods presented and will

contribute to our future period revenues as well. Amortization of purchased intangible assets

will recur in future periods. - Capitalization of internal-use software development expenses and the subsequent

amortization of the capitalized expenses. Veeva capitalizes certain costs incurred for the

development of computer software for internal use and then amortizes those costs over the

estimated useful life. Capitalization and amortization of software development costs can vary

significantly depending on the timing of products reaching technological feasibility and being

made generally available. Moreover, because of the variety of approaches taken and the

subjective assumptions made by other companies in this area, Veeva believes that excluding

the effects of capitalized software costs allows investors to make more meaningful

comparisons between our operating results and those of other companies. - Income tax effects on the difference between GAAP and non-GAAP costs and expenses. The

income tax effects that are excluded from the non-GAAP measures relate to the tax impact on

the difference between GAAP and non-GAAP costs and expenses due to stock-based

compensation, purchased intangibles and capitalized internal-use software for GAAP and

non-GAAP measures.

There are limitations in using non-GAAP financial measures because non-GAAP financial measures

are not prepared in accordance with GAAP and may be different from non-GAAP financial measures

used by other companies. The non-GAAP financial measures are limited in value because they

exclude certain items that may have a material impact upon our reported financial results. In addition,

they are subject to inherent limitations as they reflect the exercise of judgments by management

about which items are adjusted to calculate our non-GAAP financial measures. Veeva compensates

for these limitations by analyzing current and future results on a GAAP basis as well as a non-GAAP

basis and also by providing GAAP measures in our public disclosures.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for,

financial information prepared in accordance with GAAP. Investors are encouraged to review the

reconciliation of these non-GAAP measures to their most directly comparable GAAP financial

measure and not to rely on any single financial measure to evaluate our business. A reconciliation of

GAAP to the non-GAAP financial measures has been provided in the tables below.

Veeva is not able, at this time, to provide GAAP targets for operating income and fully diluted net

income per share for the fourth quarter and full year of its fiscal year ending January 31, 2016

because of the difficulty of estimating certain items that are excluded from non-GAAP operating

income and non-GAAP fully diluted net income per share, such as charges related to stock-based

compensation expense, capitalization of internal-use software development expenses and the

subsequent amortization of the capitalized expenses and amortization of acquisition-related

intangibles, the effect of which may be significant.

The following table reconciles the specific items excluded from GAAP net income in the calculation of non-GAAP net income and non-GAAP net income per share for the periods shown below: