Blog

The Challenges of Building Privacy-Safe DTC Analytics In-House

Feb 27, 2026 | Mike Ramadei

Feb 27, 2026 | Mike Ramadei

Across many applications, from enterprise resource planning to CRM, leading businesses have wondered if they can successfully duplicate, or DIY, the features and functions of external software. Over the past 10 years, matchback analytics — the use of health data to measure the impact of DTC advertising campaigns — has become ubiquitous in the life sciences industry. While most biopharmas partner with third parties, there is also a growing curiosity in replicating these capabilities in-house.

Building an internal marketing analytics function may appear feasible on the surface. But its complexity can increase rapidly due to the unique requirements of matchback analytics. To connect and use billions of data points while remaining HIPAA compliant, organizations must secure health and media exposure data, implement the right infrastructure, and ensure they have the internal expertise necessary to support long-term upkeep and innovation. Let’s explore how each of these areas can become challenging when attempting an in-house build.

The challenge of linkable health data

Biopharmas typically license de-identified patient-level claims data from aggregators who source information directly from healthcare entities. While this data begins as Protected Health Information (PHI), it must undergo de-identification — usually through tokenization via a HIPAA Expert Determination — before it can be utilized for commercial analysis.

For advertisers looking to conduct in-house analytics of DTC campaigns, the primary hurdle is linkability. To measure impact effectively, patient data must be connectable to other data sets. However, best-of-breed licensors are privacy conscious, and will often withhold sharing tokens and any downstream linking once the data has been provided.

To manage through these limitations, advertisers pivot to secondary sources of data that are less concerned with breadth, quality and privacy, but may permit downstream linking. With these secondary providers, and given appropriate concern for the privacy risks, the model can theoretically work, but the datasets are smaller, fragmented, unstable and costly, resulting in inferior health data.

The fragmentation of media data

Health data is only half the equation, media data is equally important. Advertisers are used to receiving media data, but in a much different format than required for matchback analytics. For DTC campaigns, advertisers typically receive impression volumes at zip level and GRPs at a DMA level for linear TV. None of these data sets represents log-level media exposure data, i.e., individual records akin to the patient data records discussed above. Most importantly, they do not have identity information so there’s nothing to match to.

Just as advertisers require patient data with a linkable token from a provider that allows for downstream linking, the same is required on the media side. Both data sets require the token content and the permissions to be connectable to each other.

However, this is even more challenging on the media side for many reasons.

- One-to-many media data problem: Large advertisers work with dozens of publishers. They must approach each publisher for data, which is often delivered in different formats and on different cadences. Stakeholder management then becomes a one-to-many problem.

- Publisher resistance: Publishers largely avoid providing data to advertisers, although there are exceptions by publisher and vertical. Major publishers — particularly in fast-growing markets like CTV and audio — have refused to share user data. Lack of access to media data makes in-house measurement of DTC campaigns non-viable.

Infrastructure with limits

Aside from the challenge of securing the two critical data sets — health and media — the obstacle of connecting and operationalizing them remains. The most common solutions are technologies known as clean rooms. These horizontal software solutions enable data collaboration between parties. With limited success, some biopharma advertisers have tried to stand up the IT infrastructure around clean rooms. They have then licensed additional health data from second- and third-tier providers and courted publishers, only to find large measurement gaps in their media plans. Rather than leaping ahead of peers, they find themselves at a competitive disadvantage with reduced coverage.

The reality of DIY

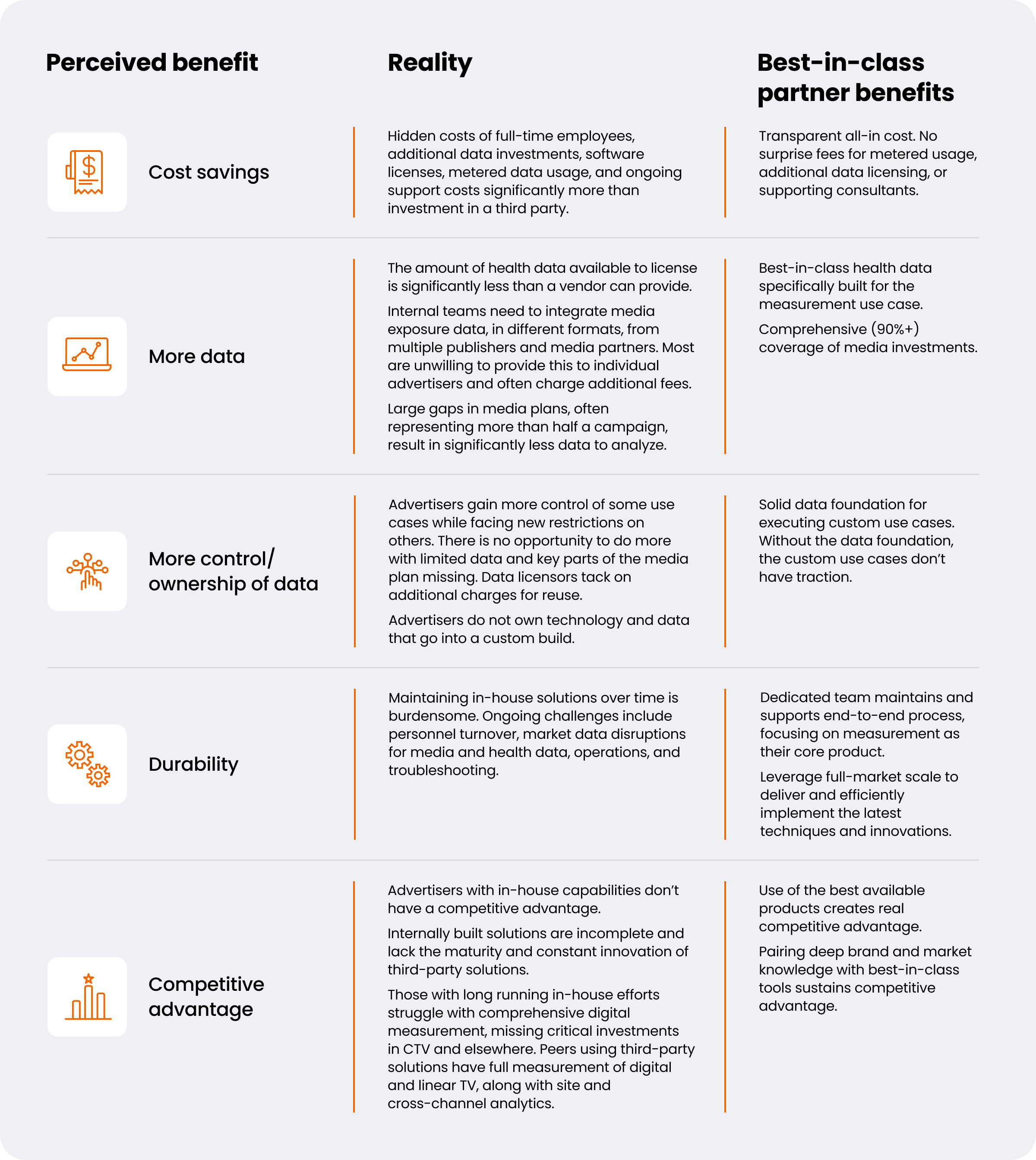

Perceived benefits — cost savings, more data, control or ownership of data, and competitive advantage — frequently drive the impetus for building capabilities in-house. However, these benefits have not come to fruition.

Don’t go it alone

When deciding to build any kind of functionality internally, it’s important to get all the facts and understand the full scope. Especially with technology, you need a long-term plan to support upkeep and innovation. Otherwise, you may find your organization using a bandaid approach to marketing measurement that is not sustainable nor producing the results needed to support your business.

Not all marketing analytics partners are created equal. Learn what to look for when vetting a partner.