Industry Report

2022 Trends in Health Advertising

Insights across DTC and HCP campaigns

Today’s pharma marketers are adapting their advertising strategies and investments in a world of digital choice. By embracing new online video and digital audio channels, advertisers are taking advantage of more precise targeting tactics, more efficiently reaching key patients and HCPs, and improving the overall ROI of their marketing investments.

To understand how DTC and HCP advertising campaigns are evolving in this changing media landscape, Veeva Crossix has aggregated media measurement and health data from hundreds of health brand campaigns. This analysis covers key learnings across more than 53 billion digital impressions and 115 billion linear TV impressions per year, representing more than $6 billion in media spend in 2021.

Across full-year 2021 campaign data, we are seeing three key trends — the changing media behavior of consumers, a corresponding diversification of campaign tactics to reach both patients and HCPs, and better connections between personal and non-personal promotion for more effective HCP marketing.

Pharma has embraced new digital channels

As users spend more time with different types of media, marketers have taken advantage of the opportunity to engage patients with richer messaging across more touchpoints. Across the board, time spent viewing connected TV (CTV), online video, and audio programming is up dramatically.

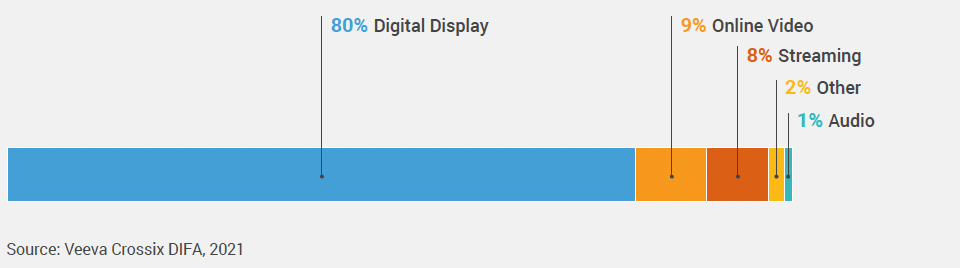

Pharma marketers have quickly adapted to this new environment, as their target patient audiences continue to embrace these emerging technologies. While digital display still represents the vast majority of digital impressions, online video, streaming and audio advertising have seen impressive year-over-year growth. Audio impressions have increased 61% year-over-year. Similarly, online video impressions are up 5% YoY, and streaming impressions have increased 18%.

SHARE OF 2021 DIGITAL IMPRESSIONS

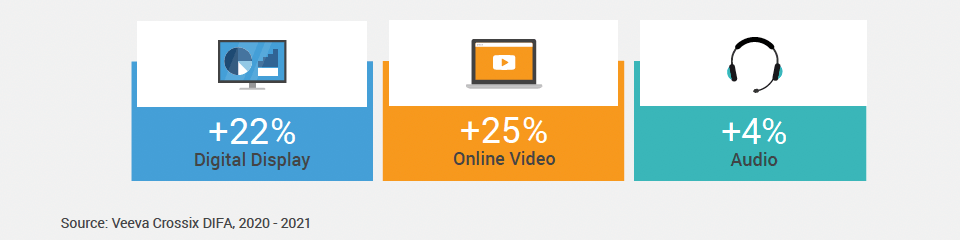

Despite the diversification of media plans, marketers have also improved the quality of the audience reached. New digital tactics provide opportunities to be more precise in ensuring media is reaching the right patients. For advertisers who have worked with Crossix in both 2020 and 2021, media diversification has led to an increase in overall audience quality. For example, in 2021, targeting improved more than 20% for digital display and online video campaigns, and an additional 4% in audio, compared to 2020.

CHANGE IN TARGETING QUALITY YEAR-OVER-YEAR

The impact of new digital tactics on patient behavior

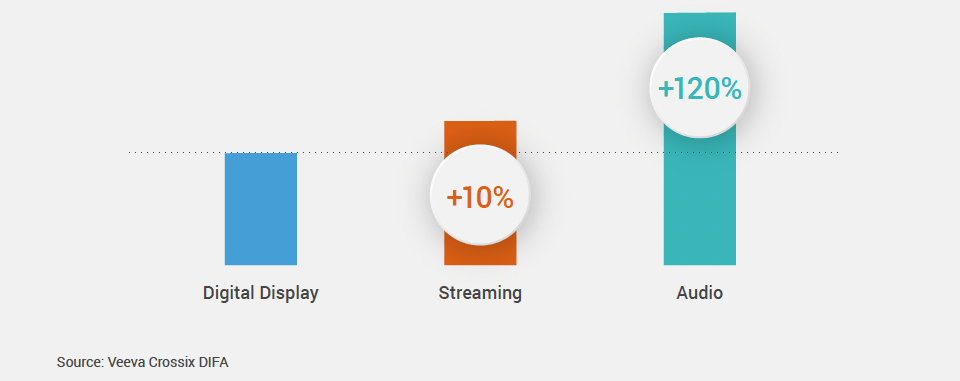

As shown in the chart below, new touch points across audio and streaming delivered results for pharma advertisers in 2021. While online video has similar conversion rates and costs as digital display, it can also be used effectively to supplement more static messaging.

CONVERSION-TO-BRAND RATES, RELATIVE TO DIGITAL DISPLAY

Across the board, Crossix has seen an uptick in the adoption of audio as a means of delivering rich messaging to patients, with more investments in streaming audio channels and an increase in audio inventory purchased programmatically. In 2021, Crossix measured 50% more campaigns that included digital audio tactics compared to the year before. Several condition categories drove growth in audio impressions, including Women’s Health (+77%) and Preventative Medicine (+103%). Audio investments also continue to see improvements in effectiveness, with conversion-to-brand rates stemming from audio rising 11% YoY.

The changing TV landscape

With more and more viewers cutting the cord, many marketers are asking “Should I make the switch to streaming TV?” Pharma advertisers are still betting big on traditional TV, with linear TV investment remaining 8x higher than streaming. However, streaming TV investment grew 34% year-over-year. Linear is often used to reach a large audience, while streaming enables more precision.

In addition to its traditional function driving broad awareness to spur patient acquisition, linear TV also supports improved adherence for health brands. After all, a commercial not only informs potential patients about a new therapy, it also reminds current patients to take their medication and refill their prescriptions.

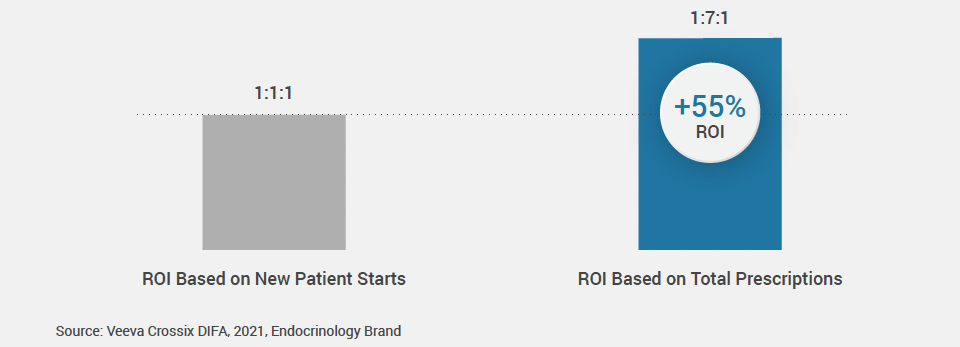

For example, for one endocrinology brand, the ROI for acquisition and adherence combined was 55% higher than when the brand connected the media to new patient starts alone. The campaign ROI increased from 1.1:1 to 1.7:1.

LINEAR TV ROI – 2021 CASE STUDY

Streaming video delivers precision

While non-linear video impressions are still dwarfed by national linear campaigns, marketers are increasing their use of targeted video. Streaming and online video campaigns share the targeting opportunities of digital, while providing a more engaging viewing experience for consumers and HCPs. Streaming is also easier to buy. Marketers no longer need to purchase directly with a network or full-episode-player (FEP) partner, but can purchase inventory programmatically. When considering the viability of various video channels in supporting brand success, marketers should take patient and category considerations into account.

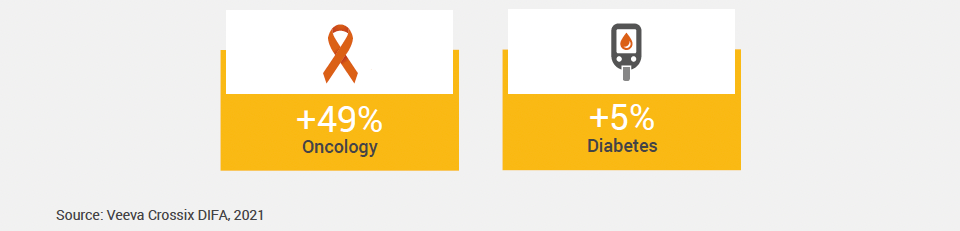

Marketers focused on rare diseases such as tumor-specific oncology therapies find that streaming is more effective at reaching small patient populations. For example, for oncology brands that aired media both on linear TV and streaming, streaming increased targeting effectiveness 49% compared to linear TV buys.

On the other hand, diabetes advertisers that are using both streaming and linear TV found that, on average, streaming increased targeting effectiveness by only 5%, suggesting that reaching patients with common or very common health conditions can be similarly effective with linear TV.

STREAMING VS LINEAR TV TARGETING PRECISION

Streaming delivered higher targeting effectivenesscompared to linear TV

Reaching HCPs and influencing prescribing behavior

Marketers continue to invest in digital advertising to HCPs and are using data to improve the efficacy of their campaigns. Although, on average, impressions delivered to HCPs per campaign remained flat, our customers reached 10% more priority list HCPs compared to the year before.

While direct buys remain a central component of many HCP digital campaigns, programmatic platforms generated the majority of HCP reach in 2021. Efficient delivery of ads through programmatic platforms has also enabled advertisers to reach larger HCP lists in a cost-effective way, expanding beyond typical priority segments. In 2021, 85% of new patient starts influenced by digital HCP campaigns were driven by target HCPs. This highlights the benefit of saturating messaging against this audience as extensively and efficiently as possible.

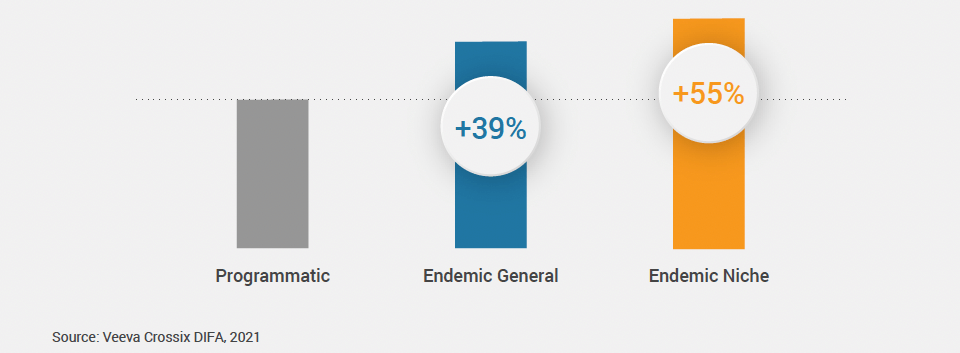

While programmatic delivery can build reach and frequency, endemic environments still play an important role in influencing HCP behavior. In 2021, Crossix observed that both general and niche endemic environments were able to deliver higher rates of new brand starts for digital HCP campaigns, compared to programmatic buys. These environments are still an important tool in an HCP marketer’s toolkit.

LIKELIHOOD OF BRAND CONVERSION, COMPARED TO PROGRAMMATIC MEDIA

Connecting field force engagement and marketing

Even as digital continues to educate and influence HCPs, pharma marketers are focused on the dynamics between what is happening in the field and how it might influence an effective omnichannel HCP engagement strategy. New measurement tools break down the barriers between these two touchpoints, as digital works to reinforce in-person messaging and offset white space.

Below is a 2021 case study that shows how sales and marketing synergy drives impact against key HCP target audiences.

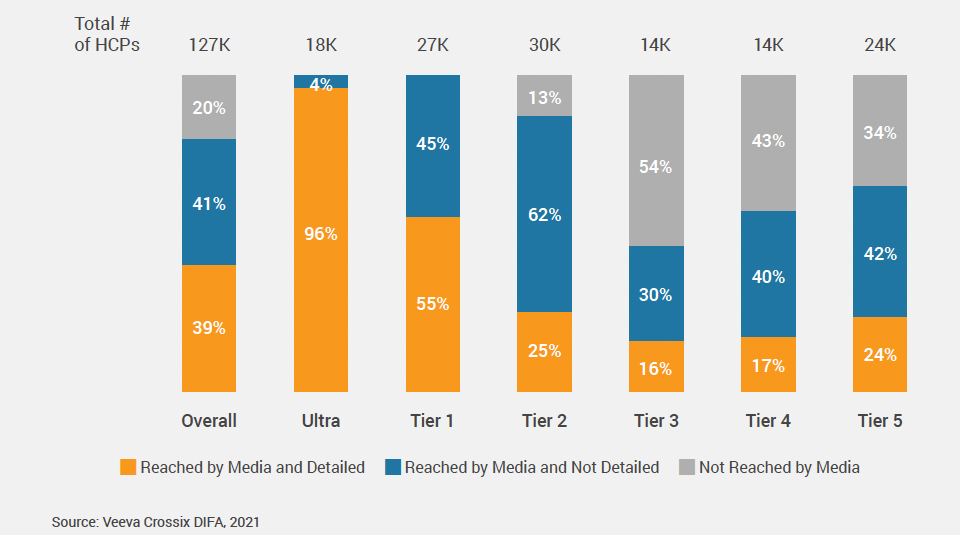

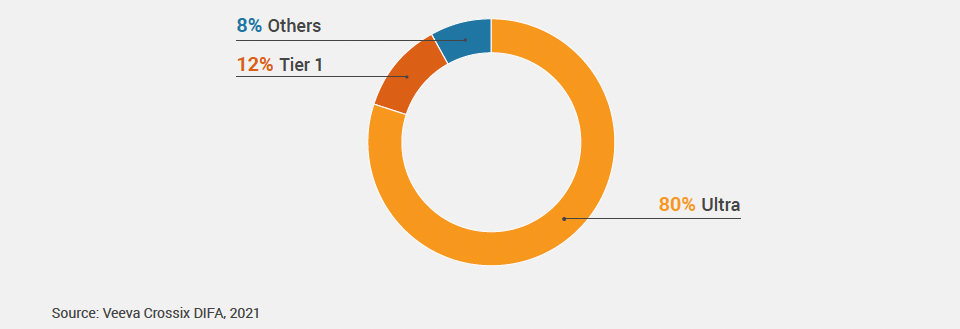

While 80% of HCP targets were reached with digital media, a smaller subset of that universe received sales detailing in addition to digital non personal promotion. Zeroing in on the specific targets who were receiving orchestrated messaging by both sales and digital, the brand marketing team was able to ensure the highest levels of saturation from both touchpoints for the highest priority HCPs (Ultra and Tier 1).

TARGET LIST REACH BY TIER

Effective omnichannel synergies — validated and refined with the right data — can drive real results, as evidenced by the share of new patient starts that were driven by these priority HCPs.

NEW BRAND STARTS POST-MEDIA EXPOSURE

BY HCP TARGET STATUS

Conclusion

The pace of change in advertising continues to accelerate, as audiences access content in new, innovative ways. The most effective marketers in this increasingly complex landscape are finding ways to cut through that noise and clear a path for brand success with the right information and insights.

Across categories, leveraging a common measurement currency, across channels and tactics, has led to more efficient DTC and HCP media campaigns. Marketers can continue to ensure this type of success in 2022 and beyond by tapping into the right type of insights with a holistic, omnichannel approach.

Implementing an omnichannel marketing plan? Hear best practices for omnichannel marketing from Sarah Caldwell, General Manager, Crossix, and Nick Lucente, Sr Director, Oncology Digital Marketing, Bayer.