eBook

Pre-Launch Field Planning with Projected Data

A How-To Guide

Some of the largest biopharmas in the world spend between 27–33% of their overall revenue on sales and marketing, with a substantial amount focused on new product launches. Pre-launch field planning is vital for biopharmas to make the most of these early investments and can also have a significant impact on overall launch success.

However, traditional data sources for market and competitive intelligence for pre-launch activities are often too limited and rigid to support the complex, dynamic launch environment. According to Deloitte, while the average cost of bringing a pharmaceutical asset to market is $2 billion, more than a third of all product launches in the U.S. fail to meet expectations. Launches aren’t as straightforward as they used to be. Therefore, your approach to data needs to reflect this new reality.

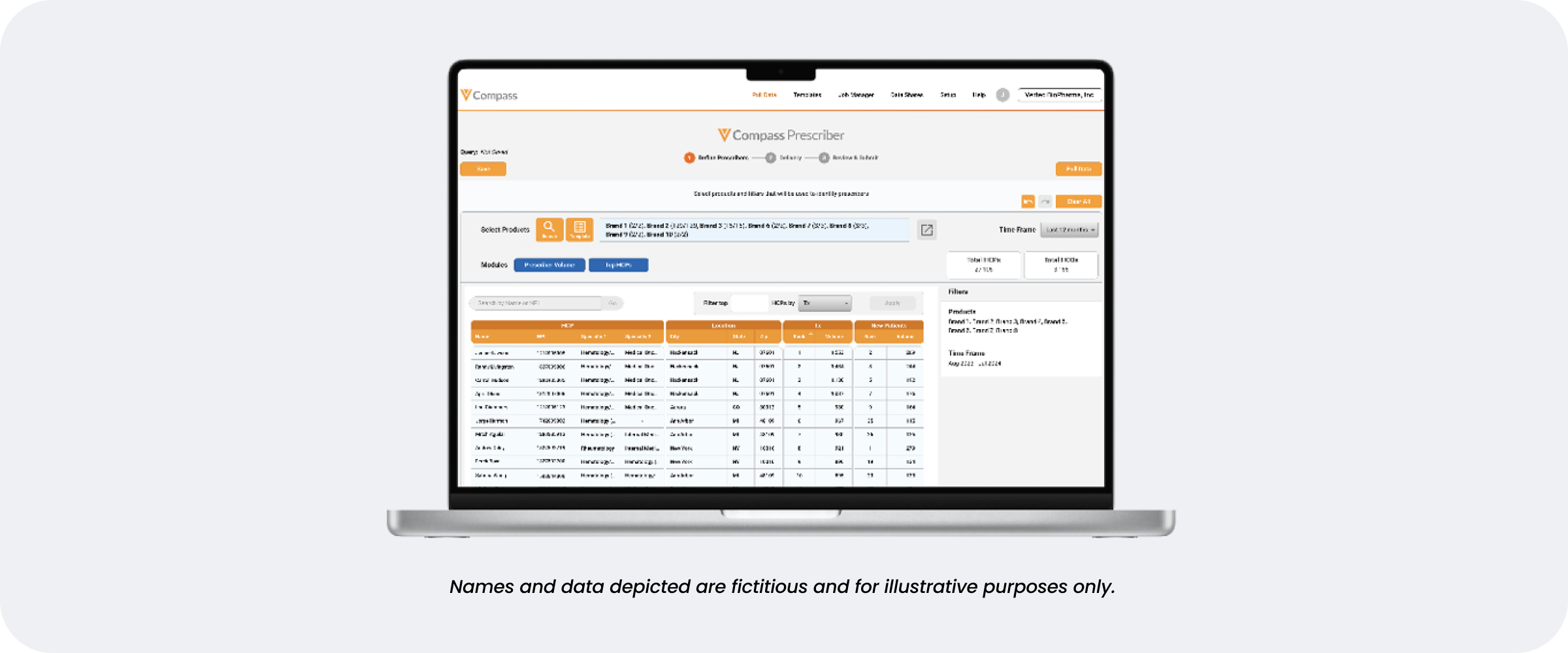

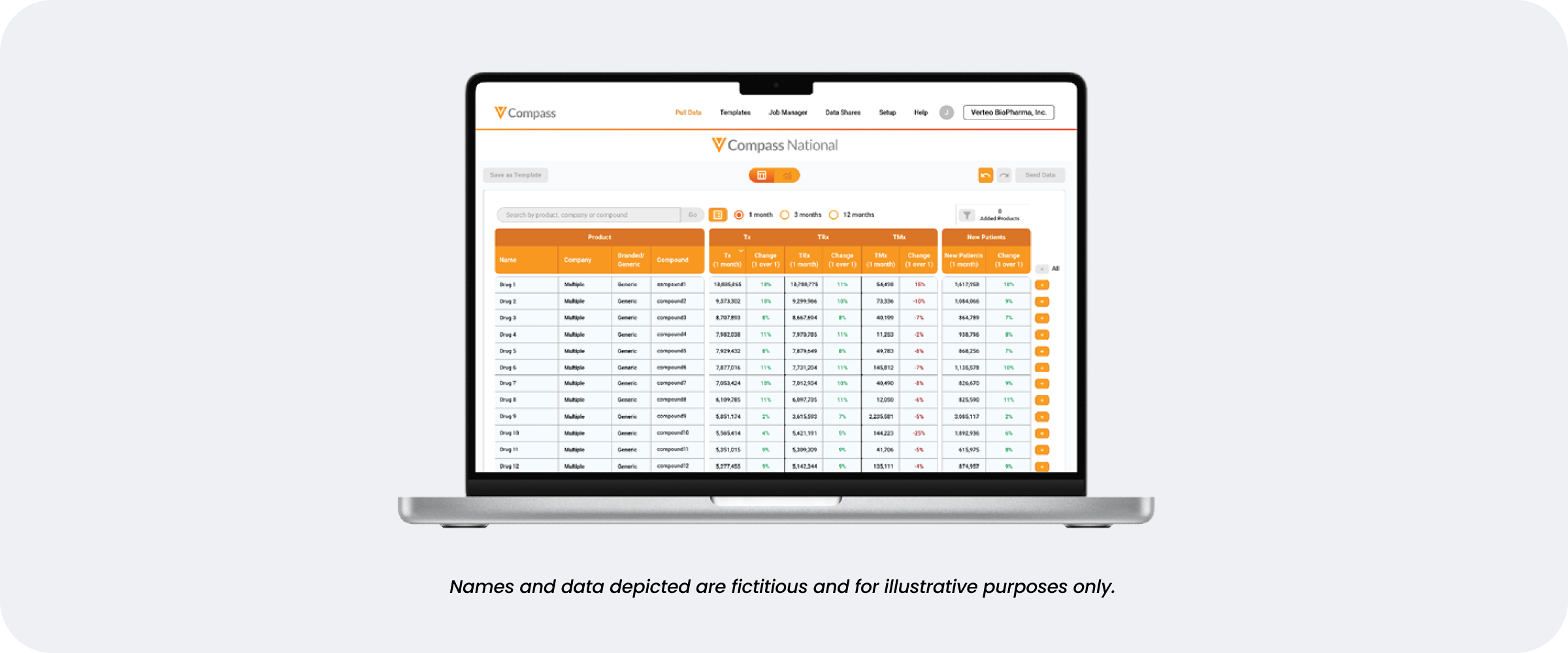

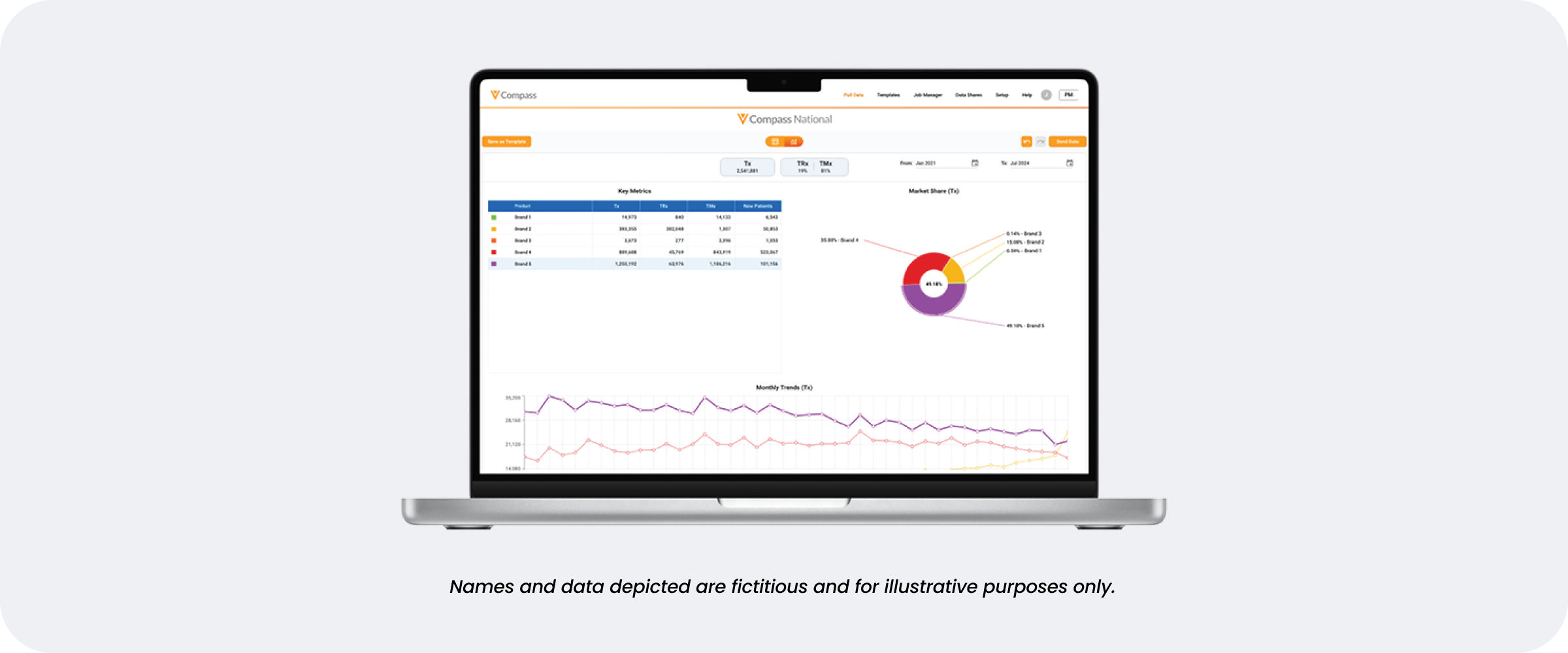

In this ebook, we’ll explain how Compass Prescriber and Compass National provide accurate and comprehensive projected data and review four distinct use cases that show how this projected data can support a successful launch.

Modernizing the approach to pre-launch planning

Pre-launch field planning is a huge undertaking for any brand, requiring significant initial investment in resources, analytics, and data that will directly impact launch success. While traditional static Rx claims projections are still in use, they no longer meet the needs of modern field planning. Today, commercial operations teams need much broader data capabilities that deliver value in the moment and also adapt to changing market trends over time.

Three Common Field Planning Challenges

Complex markets

Personalized medicine, new types of therapy (e.g., gene editing), and small,difficult-to-reach patient populations are disrupting traditional field planning exercises, which relied heavily on retail Rx-based projections.

Fragmented data sources and software

Complex products and therapies drive complex data sets. Data for non-retail products, for example, is highly fragmented. Custom integrations and point solutions further block accuracy and advanced analytics.

Dynamic launch scenarios with fluid inputs

Rigid, one-time data pulls are an increasing liability to launch success, requiring massive amounts of rework and data reconciliation for even minor changes to the market basket.

See an in-depth look at the user interface for both Compass Prescriber and Compass National

The Veeva Compass Suite is a modern approach to commercial data that can accelerate and optimize pre-launch field planning. The Compass Suite includes Veeva Compass Patient – anonymous patient longitudinal data, including dispensed prescriptions and procedures, diagnoses, as well as two projected data products:

Veeva Compass Prescriber: Projected prescriptions and procedures at the healthcare professional (HCP), healthcare organization (HCO), and ZIP-code level for retail and non-retail products. Compass Prescriber supports segmentation, targeting, incentive compensation, and many other use cases.

Veeva Compass National: Projected prescriptions and procedures at the state and national level for retail and non-retail products. Compass National supports brand performance tracking, forecasting, and competitive analysis.

Veeva Compass Prescriber and Veeva Compass National greatly improve the usability of the data in retail and non-retail markets. Non-retail data can help overcome gaps in legacy projected data and includes in-office administered medicines. Unlimited access to data reduces the time and resources spent analyzing specific cuts of data. Commercial teams can query data at their discretion to better learn, adapt to, and explore different markets, granularities, and time periods.

The data from Compass Prescriber and Compass National provides broad visibility into a given market. It ties together national, state, ZIP-code, and HCP-level projections, allowing for a united view of brand volume at all detail levels. For Compass National, coverage is delivered as a monthly metric, providing insight into the amount of data available and the projected percentage.

How Compass supports pre-launch planning for complex markets

Compass Prescriber and Compass National provide market data that commercial operations teams can use to investigate the market, evaluate competition, and build assumptions and insights across all stages of pre-launch field planning.

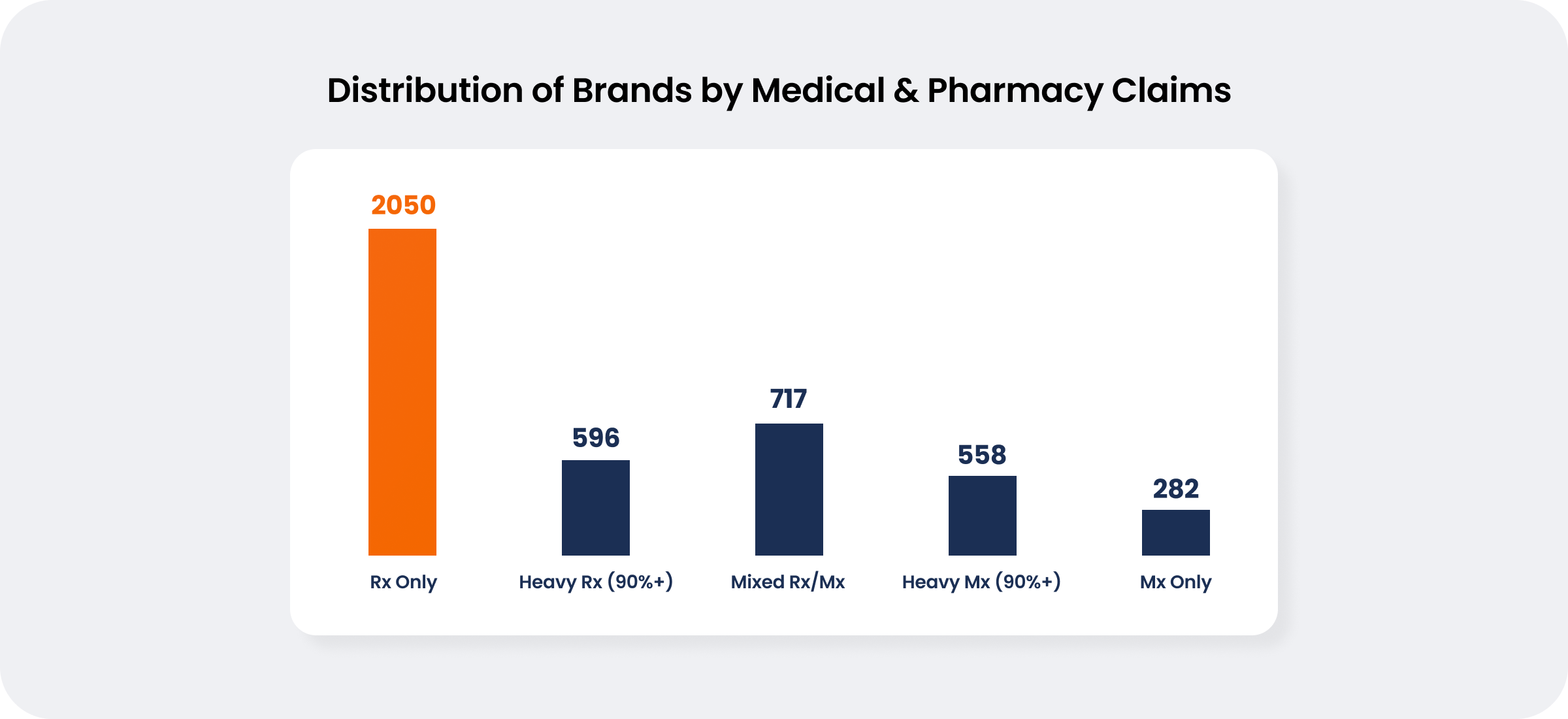

This coverage is important for a number of reasons, including:

- Rx-only based products comprise about half of the brands that Compass projects for.

- The remaining brands have some form of meaningful medical claims volume, which is where traditional projected data sources create a blind spot. For example, in the above graph, brands in the “Mx-only” category wouldn’t be visible with legacy projected data products.

- The brands highlighted in the middle (Heavy Rx, Mixed Rx/Mx, and Heavy Mx) are brands with a hybrid of medical and Rx claims. These may represent hard-to-find prescribers who treat in a medical setting which limits visibility and also provides incorrect prioritization relative to the rest of the prescribers that are Rx only. Beyond the brand level, many therapeutic markets are not Rx-only or Mx-only.

In addition, as we continue to navigate complex diseases, we’re seeing trends like more therapeutic markets developing Mx-based products. Without medical claims data, you're generating an incorrect view of the market and adding unnecessary challenges to your upcoming launch. This can increase the chances of failure. Legacy projections also drop meaningful volume and HCPs, so whole brands may be missing which can also affect the success of your commercial team.

Key challenge: Manufacturer-blocked products

The Compass Data Network, as well as the projection models built into Compass Prescriber and Compass National, are purpose-built with a diverse and duplicate set of data source types. This network diversity provides greater visibility into manufacturer data blocks.

A manufacturer data block is often seen with products that have limited Rx distribution channels. The manufacturer of a specific drug contracts with an Rx to withhold the distribution of data regarding their product. This limits visibility into brand trends and customers (HCPs) to create a competitive advantage. If the pharmacy data provider is the only way to capture these transactions, the data block can significantly impact the available data and visibility.

The Compass Data Network leverages a combination of payer (closed) and non-payer (open) sources to navigate these challenging roadblocks. Data blocks have the largest impact on datasets limited to non-payer (open) sources which include pharmacies, practices, and switches. The Compass Data Network combines non-payer sources with payer sources (e.g., insurers, PBMs) – which mostly can’t be blocked – to gain visibility into brand trends and uses those transactions to generate accurate projections.

Projected data use cases for pre-launch field planning

Now that we’ve discussed how Compass Prescriber and Compass National provide a modern approach to projected data, we can explore how these products support four common pre-launch field planning needs:

- Forecasting — Establishing key financial inputs into the resourcing and strategy of the brand

- Segmentation — Translating the strategy to the customer universe and defining where you think your brand can win

- Targeting — Prioritizing where there is the most opportunity for your brand, often focused on opportunity or volume

- Territory design — Creating territories based on the location and distribution of targets

1. Forecasting

Forecasting is the first step in the pre-launch field planning process. The best forecasts are built on data-driven assumptions. These assumptions are often based on analog products and markets, which commercial teams then use to level-set and build expectations within a forecast.

When it comes to analog research, there are two important considerations to finding the right market: the breadth of brands available and unlimited data access. This allows teams to test a wider range of scenarios and understand how different market dynamics might impact forecasted performance.

How Compass helps

Once the team decides which brands to focus on, it can quickly generate key inputs to the forecast such as:

- Market share

- Launch and growth trends

- Key market events (e.g., order of entry or loss of exclusivity)

- Patient-to-prescription ratios

2. Segmentation

The segmentation phase hinges on establishing complete views of transaction volume at an HCP level. The completeness of the data set is a critical consideration because it directly impacts the value of projections. While longitudinal claims provide detailed insights at an HCP and patient level, the data shows just a subset of the market. Longitudinal claims provide a partial view by nature and can be biased toward where there is coverage. Projections can help commercial teams avoid that bias by filling in the voids from anonymized patient-level data (APLD) and longitudinal data to create a fully representative view of the market.

In addition, physician-administered products aren’t captured in Rx claims, therefore legacy approaches using only prescription claims will miss this. For both of these reasons, projections that use prescriptions and procedures are a superior option for segmentation and targeting.

How Compass helps

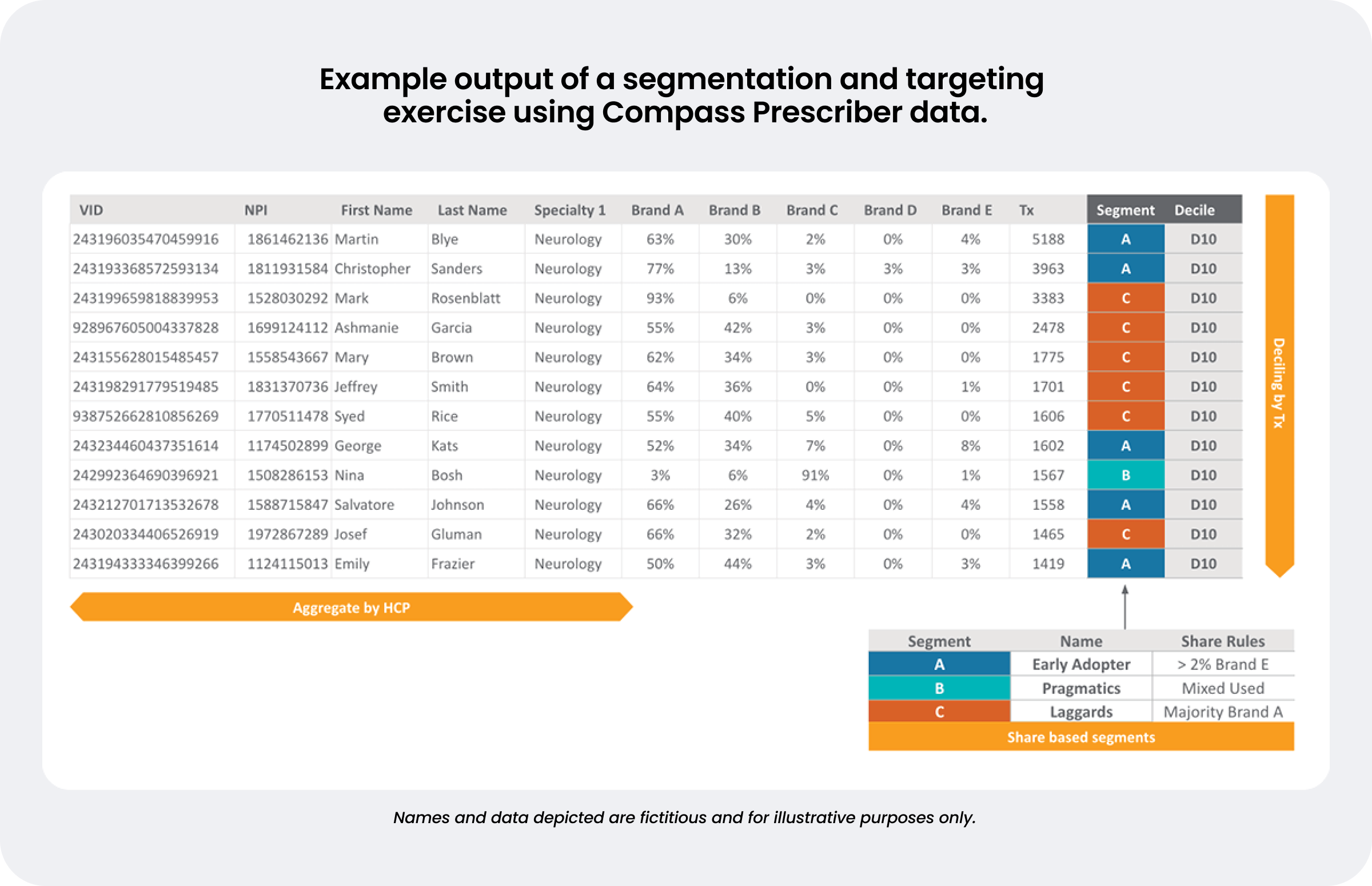

Segmentation translates brand strategy to customers and can be executed in the Compass Prescriber data. It also groups these customers based on how they might use a particular product. This enables segmentation by prescriber preference based on share of brands, types or classes of products, or even the care setting.

Data-driven segmentation is similar to using business rules to discern prescriber preference. It could be based on market share, branded versus generic utilization, or growth and decline rates that look at specific care settings.

These segmentations support a range of business cases, from simple to complex. A common approach is to use market share to create business rules that segment the customer by treating preference.

3. Targeting

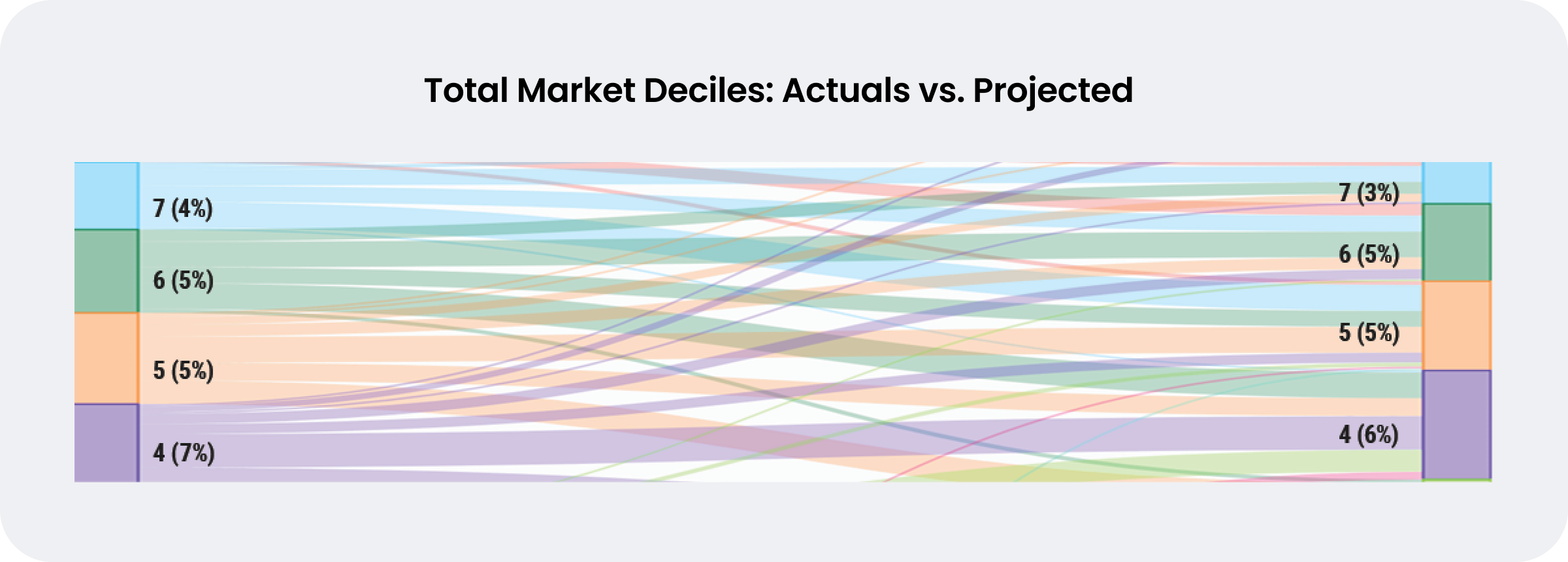

Effective targeting relies on prioritization and maximizing resources. Concentrating on volume and opportunity is the most important focus to optimize resources and identify high-potential customers. Traditionally, you don't have that complete visibility due to unprojected claims or facility-level sell-in data. Unprojected data only captures a subset of what's important, therefore limiting what you're optimizing against.

How Compass helps

Projected data can impact targeting in a number of ways:

- Compass Prescriber- and Compass National-specific metrics like TRx and TMx let teams isolate the volume and manipulate the data to achieve the right focus. This is particularly important when an account team on the targeting side needs to focus on opportunity prioritization.

- An overlap analysis might be necessary for existing field teams launching a new asset. Overlaying the expected specialties and HCPs on the existing target list can determine whether the product should be put in the existing bag.

- Finally, related to medically administered volume, teams can isolate TMx volume and use affiliations from Veeva OpenData to roll up to an account level.

All of these analyses rely on a fully representative volume. Using a subset of longitudinal claims exposes targeting and field execution to a given data network’s coverage biases, resulting in over- or under-indexed effort against HCPs.

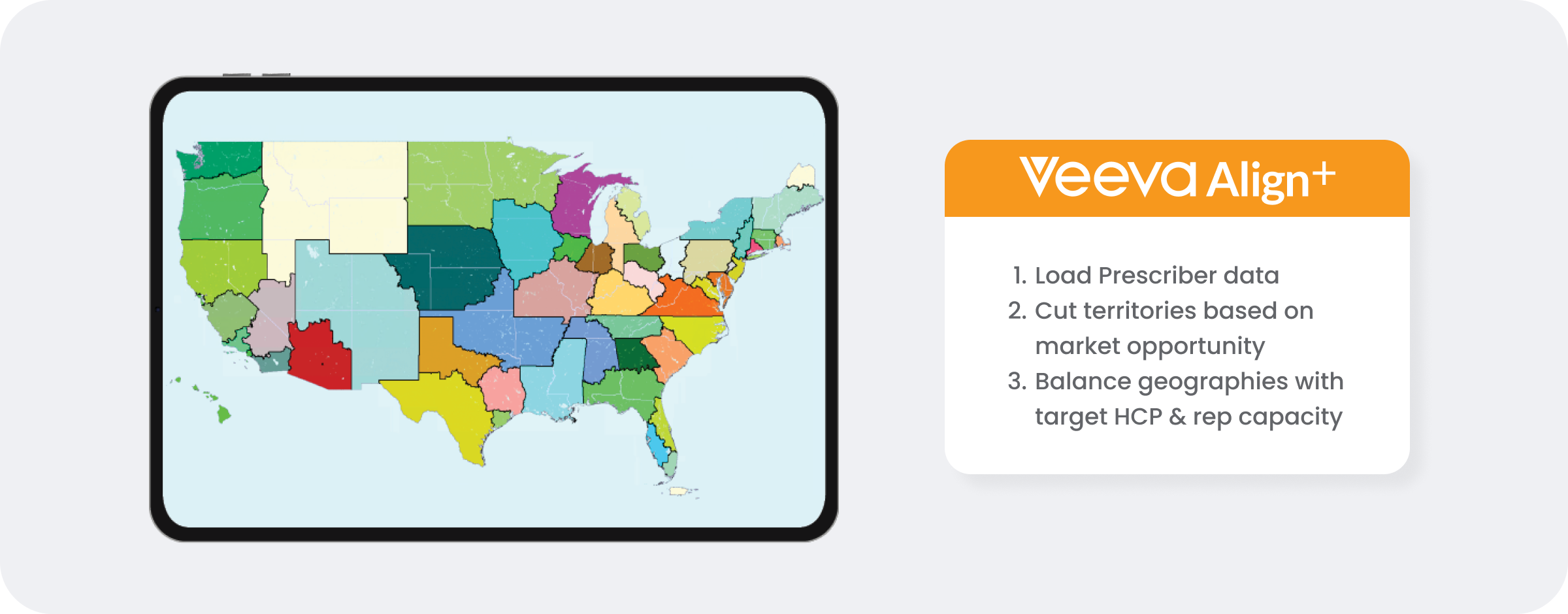

4. Territory design

Once the team creates the right segments and targets, it can use the financial and workload assumptions (calls per day) to determine field size. When designing a territory, it’s important to keep it as equitable as possible, balancing the number of targets and market volume in the geography. This ensures the right level of effort and opportunity for sales reps.

How Compass helps

Compass Prescriber provides geographic details by city, state, and ZIP code, which Veeva Align+ can ingest and analyze, as illustrated below.

Once complete, this process will yield a target list, alignment, segmentation, field team structure, and territory outlook. This isn’t a one-time exercise. Depending on the company's specific needs, it may happen as often as quarterly and is typically done months — if not years — in advance of the brand’s launch.

Beyond pre-commercial use cases

As the field team is hired, an incentive compensation (IC) plan will be necessary. Companies can use Compass Prescriber to support this in a variety of ways, from administering the plan and payout calculations to clarifying different market dynamics to use for goal setting. For example, market share can help illustrate the saturation point for a given territory and key players on a local level, or it can simulate a pre-launch IC plan with projected payouts.

Once the field team is in place, sharing the data is critical to execution. Compass Prescriber makes it easy to export the data and integrate it with the company’s CRM, which immediately pushes the data to sales reps. Reps can access the top HCPs and better understand local market trends.